Table of Contents

There was a time when large numbers of MPs went into politics after a career in the private sector. Many of us still think that it is a good idea; after all, there is nothing like a bit of real-world experience to teach a politician what is really needed for society in general. These days, however, we seem to have more and more career politicians… people who have done nothing other than politics for their entire career. Helen Clark was the first I can think of, although Winston must be close. I know he lays claim to having had a law career previously, but he entered parliament in 1979, so the law career cannot have been a lengthy one.

For those that choose politics as a lifelong career, you might expect that they would make sure that they understand a large number of issues that are considered important to politicians. While many of them have special areas of interest, some basic knowledge of economics and the local tax system would prove useful. If not, then the politician in question would be advised to keep quiet about those issues where they have no knowledge. Most politicians would normally observe such advice. Unfortunately, not all of them.

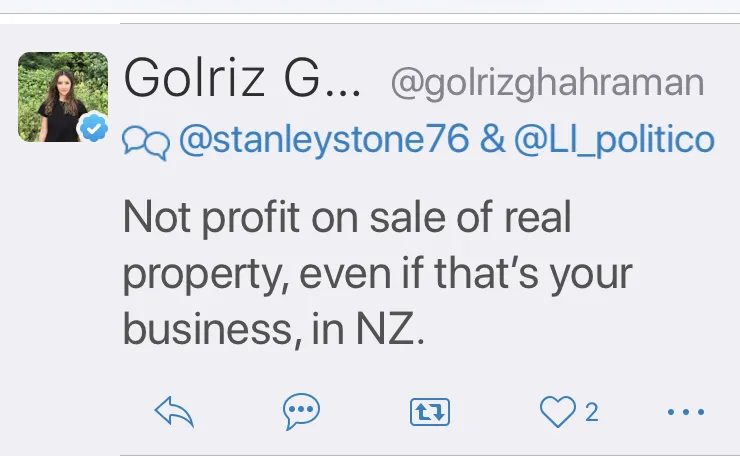

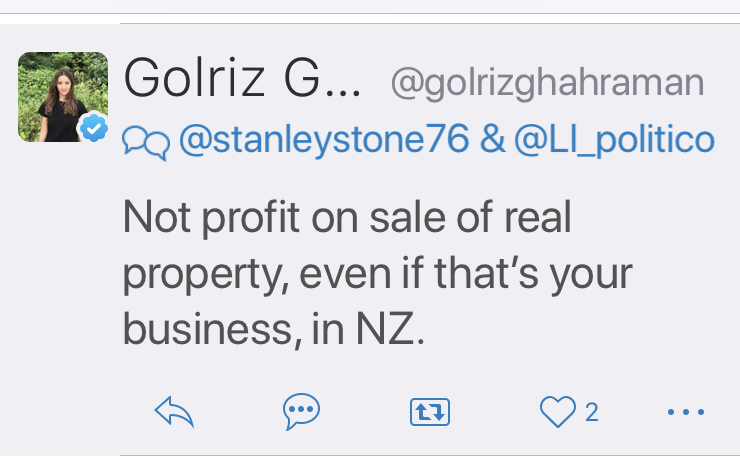

Here is a recent tweet from Golriz Ghahraman.

This is so wrong on so many levels, and because it has been tweeted by a member of parliament, some people will believe it.

First, I must tell my house builder clients that they no longer have to pay tax on their profits. They will be absolutely delirious.

(Delirious is probably an appropriate term here.)

Then I will tell everyone who has bought property since 2015 that the Bright Line Test was a hoax. No one has to pay tax on the proceeds of property sales ever.

If builders are exempt though, where does this leave the ancilliary trades? The architects, designers, draughtspeople? The plumbers, electricians, plasterers, painters? It wouldn’t be fair if the builders were exempt, but the plumbers were not.

The truth is that property owners are the most penalised class of taxpayers in this country. Builders do pay tax on their property sales (of course they do), but investment property owners are the only taxpayers that have to pay tax on the sale of an asset. No one else has to do that.

In case you were not aware, from April 1st, a new provision will apply, known as the ringfencing of tax losses. This means that rental property owners will not be able to offset their losses against other income, but will be forced to ‘ringfence’ them, and will only be allowed to use them against future rental profits. This provision has not actually been passed into law yet, but is intended to apply from April 1st, 2019. Once again, it is a specific provision, which applies to investment property owners only.

So sorry, Golriz, but investment property owners are the hardest hit group of business owners in our tax system. I guess you are hurting because of the failure of the previously proposed capital gains tax, but investment property owners are very hard hit anyway. This has already resulted in a large number of landlords selling their properties and taking their capital gains, but then again, if life hadn’t been made so hard for landlords, maybe this would not have happened. This is not going to be good news for people looking for rental properties, as we already know.

However, I do want to give credit where it is due. There has been a lot of comment about how so many world leaders, including Barack Obama and Jacinda Ardern, have been unable to acknowledge that the dreadful bombings in Sri Lanka were an attack on Christians, but Golriz has no such reservation.

Good on you for that, Golriz, but you might need to brush up on your understanding of the tax system in New Zealand as it stands today. Just a thought.