Table of Contents

Daniel Lacalle

Daniel Lacalle, PhD, economist and fund manager, is the author of the bestselling books Freedom or Equality (2020), Escape from the Central Bank Trap (2017), The Energy World Is Flat? (2015) and Life in the Financial Markets (2014).

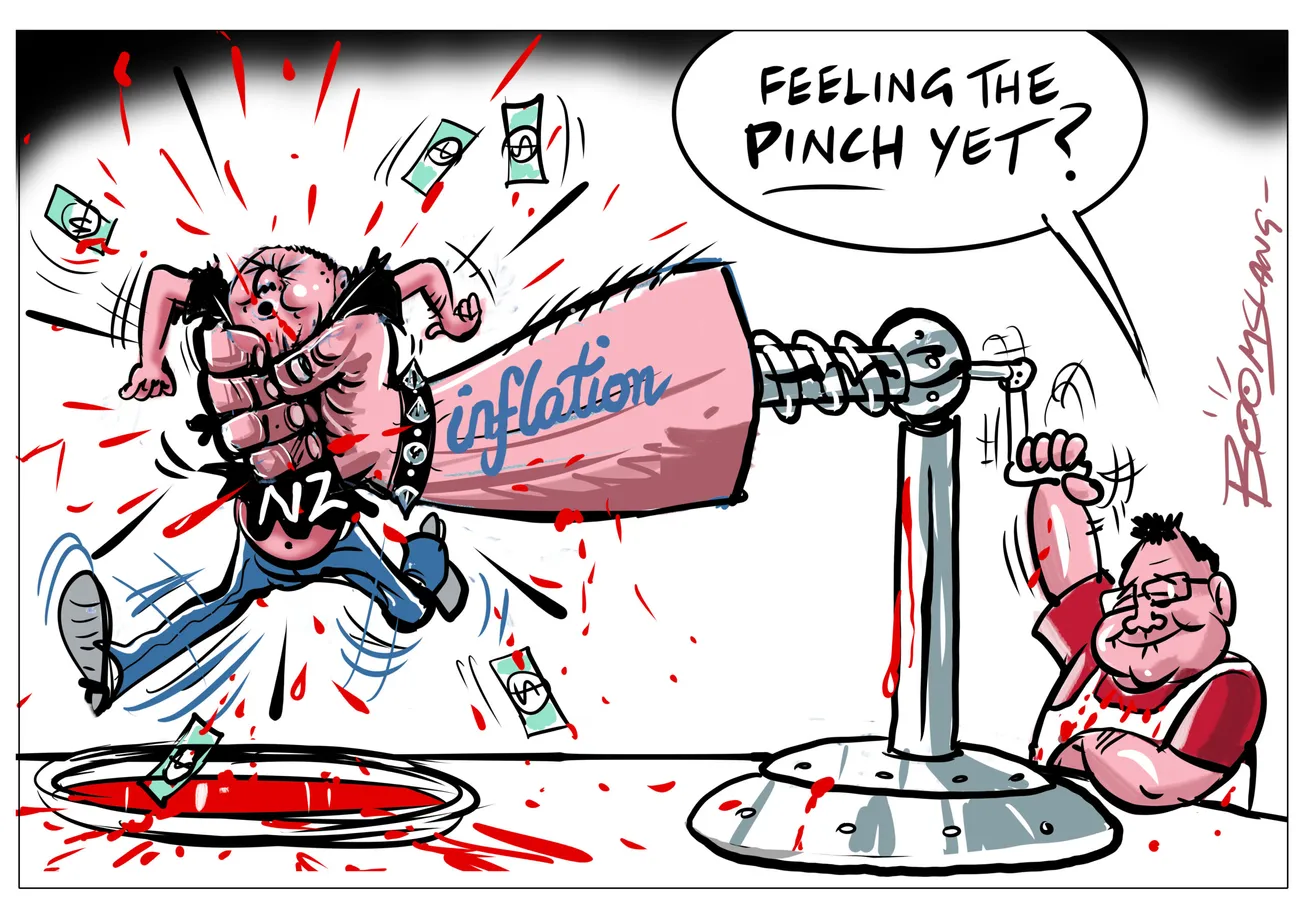

There are many excuses often used to explain inflation. However, the fact is that there is no such thing as “cost push inflation” or “commodity inflation.” Inflation is not an increase in prices, it is the destruction of the purchasing power of the currency.

Cost-push inflation is more units of currency going to relatively scarce real assets. The same can be said about all other[s], from commodities to demand and my favourite, “supply chain disruption”. More units of currency going to the same goods and services.

The monster inflation we have endured these years first arrived through asset inflation and then through consumer prices. Now, governments and statistical bodies are tweaking the calculation of CPI to disguise the loss of purchasing power of the currency and central banks had to hike rates after the disaster created in 2020, when the massive increase in money supply went to finance bloated government spending and created the mess we live today.

Central banks know that inflation is a monetary phenomenon and that is why they are hiking rates and tightening as fast as governments allow them. However, central banks have lost a significant amount of an already low credibility by first ignoring the inflation risk and later using the base effect and transitory excuse, only to react late and slowly.

This has happened in a world where the excess in money supply growth has a number of back-stops and limits that prevent a massive increase in consumer prices through the destruction of the artificially printed currency. With quantitative easing there are a number of limits that stop inflationary pressures: as the transmission mechanism of monetary policy is the banking channel, it is our demand for credit [that] puts a break on inflationary pressures.

The only thing that saves citizens from much higher prices is the fact that the transmission mechanism of monetary policy is independent and diversified. Now imagine for a second if that transmission mechanism was direct and had only one channel, the central bank itself.

A central bank digital currency would be issued directly to your account within the central bank. As such, it is surveillance disguised as money. The central bank would know exactly what you use the currency for, how much you save, borrow and spend, and where. It can make the currency fungible to avoid the ludicrous but often repeated “problem” of “excess savings”. Furthermore, with increasingly political central banks, they may even penalize those who spend in a way that they deem inappropriate or benefit those that do what they recommend. The entire privacy system and monetary limit mechanism would be eliminated. Even worse, when the central bank makes the mistake of printing way too much money as they did in 2020 the impact on consumer prices would be direct. With an increase in money supply that exceeded 20 per cent in a year, we would be suffering close to 20 per cent levels of inflation as the limits to the transmission mechanism are destroyed.

Now imagine if there was only one account, one central bank and the government. Guess what would happen? The complete monetary financing of all government spending driving the currency to hyperinflation in a few years and the obliteration of the private sector. A de facto nationalization. A digital version of the French assignats. Hyperinflation and full government control and financial repression.

Central bank digital currencies are an unnecessary and terrible idea. You cannot start an experiment of such caliber when the independence of central banks has been questioned for many years and there is ample evidence of policy actions that fail to recognize the risk of elevated inflation in asset prices and consumer goods. Central banks have never prevented a bubble, elevated levels of risk-taking and excess debt nor recognized inflationary pressures. With such a track record, no one should defend a measure that would allow them to take full control of the entire financial and monetary system.

The most important thing to remember is that central bank digital currencies are unnecessary. The benefits of technology, digitalization and ease of transactions are already there. There is no need to create a currency issued directly to an account at the central bank. They are unnecessary as well because there is absolutely no need to compete with a digital yuan. China is moving closer to sound monetary policy and its central bank is purchasing more gold, not the opposite. If you want to compete with other currencies or cryptocurrencies there is only one way: Make it absolutely clear that you will defend the reserve of value status of your currency. There is no need for the euro or the US dollar to compete with bitcoin or a digital yuan if the Fed and the ECB truly defend their reserve of value and purchasing power.

The argument of the need to compete with currencies that are used in less than one per cent of total transactions makes no sense, particularly when the transmission system and technology is already stronger for the world reserve currencies.

However, it looks like the only reason the Fed or the ECB want a digital currency is because they want to retain their market share without defending the purchasing power and reserve of value status of their currency. It looks like central banks want to behave like a monopoly that sells bad quality products but demands to remain the main supplier by eliminating the competition. The Fed and the ECB do not need to compete against cryptocurrencies if they show the world that they will defend the purchasing power of the US dollar and the euro.

The fact that the leaders in the monetary system fear currencies and assets that barely make a difference in terms of global use or market share shows that they know that their product – the currency – is not going to retain the confidence of citizens for a long period of time at this rate of monetary excess.

If the ECB and the Fed really want a digital currency [it] is because they know they will lose the confidence of citizens earlier than we think and they need to impose their market share, not gain it.

If the Fed or the ECB implemented a sound money policy and truly followed their mandate of price stability, they would destroy any competing currency, digital or not, in a second. If they do not win this race, it will be because the ultimate motive is to abandon the price stability and reserve of value mandate to continue bloating government size at the expense of real wages and deposits of the private sector.

Do the Fed and the ECB want a global and digital dollar or euro that is accepted and demanded by everyone? Simple: follow exactly the mandate and gain global share in currency utilization because people want it, not because they are forced to.