Table of Contents

This is the COVID election. Let’s face it: there is nothing else. Labour has already stated that we should not expect any policy from them during the election campaign, as they are too busy stopping 80,000 of us from dying of the virus to worry about telling the voters what they will do if they form the next government. It also means they will not attempt to justify their abysmally poor record on everything else, from child poverty to housing to homelessness, to mental health… no. This election is about COVID and nothing else.

But it is imperative that voters are not taken for fools. We are all watching as eye-watering amounts of Government bonds are created out of nowhere and used as a vehicle to print money. It is the stuff of nightmares, and while all governments are doing it to try to hold up their economies while the virus ravages the world, there is no point in pretending that there will not be a significant price to pay. It would be a fair question to ask the government about their plan to stimulate the economy and start to repay the massive debts that have been incurred. But so far, no one is asking.

Britain has started the ball rolling with its taxation policy, but the government there doesn’t have to worry about an election for another four years. Inevitably though, taxes are going to have to increase in all countries that have funded a COVID response to the detriment of the economy. We are no different; but the government, in stating that this will be a COVID-only election, are conveniently avoiding the vexing question: what is their plan to stimulate the economy post-COVID and what will their taxation policy be for the next three years?

In other words, people deserve to know how much COVID is going to cost them, and compare the government’s proposals to those of the opposition.

New Zealand voters will get no such opportunity. In the absence of any actual policy, all we can do is guess what this government is likely to do. It has followed the Labour model fairly well so far, being a classic tax-and-spend government although, thanks to NZ First, the taxation side of that has been limited. The shackles are likely to come off if they make it back into power. Increased taxation will be justified on the grounds of what the fight against COVID has cost us, and in fact this is a reasonable argument. What is not reasonable is that we are not allowed that discussion now, when we are deciding who we will vote for.

I am frequently asked what I think will happen, and I am as much in the dark as anyone, but I do have a few predictions. First, bear in mind that introducing an entirely new class of taxation, such as a Capital Gains Tax, is a time-consuming matter, because the law has to be drafted, sent through select committee, go through the House and, after that, the systems have to be set up within IRD. All of that will take months, if not longer, but the financial shortfall is here already and is destined only to get worse as time goes on.

My prediction is for something that can be done more quickly, which means increases in existing taxation. Personal tax rates are the most likely to be increased; it can be done at the stroke of a pen and the adjustments to systems are incremental rather than far-reaching. Expect the introduction of two new top tax rates, as proposed by the Greens, of 37% and of 42%. The current proposal is for income over $100,000 to be taxed at 37%, and income over $150,000 to be taxed at 42%. I think the government will introduce something along those lines, effective from April 2021.

It is entirely possible that increases in personal taxation will be introduced quickly, but that new taxes are still introduced, admittedly taking some time before they can be rolled out.

I do not expect increases in company tax or GST. Business is struggling enough at the moment, and it will only get worse, and a Labour government may not be able to stomach increasing the cost of living for poor families.

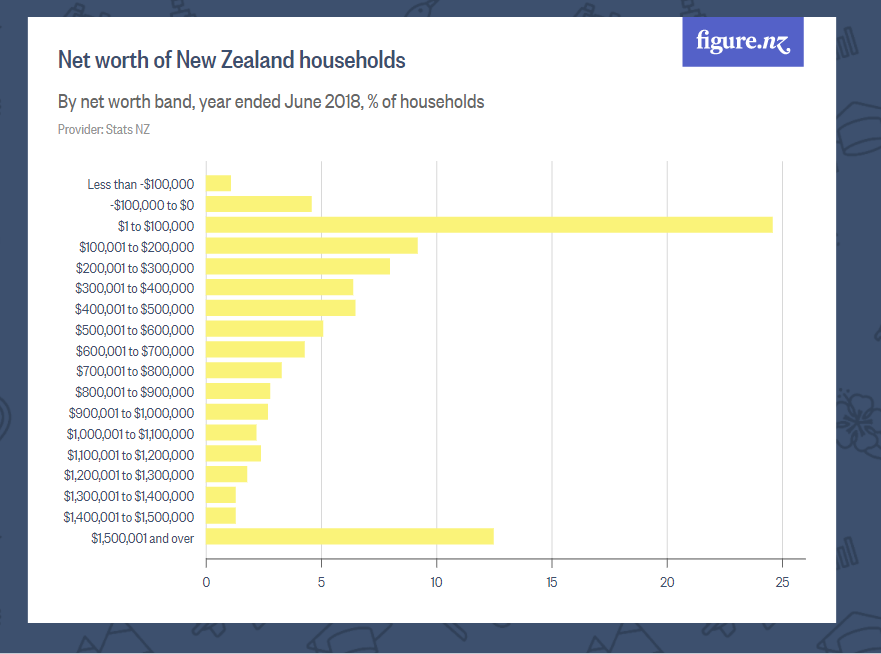

There is one other possibility, particularly if the Greens get back in. Their taxation policy also included a wealth tax. Initially, I dismissed this as political suicide, typical of a party that knows it will never be the governing party in a coalition, but now, I am not so sure. The reason I have changed my mind is because I looked at the net worth of New Zealand families recently. Have a look at the graph below.

The bottom 7 levels of this graph identify households with an asset base of $1 million or more, and I estimate that this equates to approximately 20% of households in the country. I now see why the Greens are so keen to introduce a wealth tax, as a significant portion of taxpayers would find themselves liable for it. With over 1.5 million households in the country, this means over 300,000 families may find themselves liable for wealth tax, at least to some extent.

We all know that much of this ‘wealth’ is the result of inflated house values, created by a chronic housing shortage, but this would not necessarily make any difference, as the Greens have not exempted the family home from the liability for wealth tax.

I am speculating of course, but it seems convenient that the Greens have come out with a fairly comprehensive tax policy and Labour has not produced any tax policy at all, thus it is reasonable to say that Labour’s policy would not be significantly different from that of the Greens. Labour is less likely to go for a wealth tax, but these are unprecedented times. They might justify the extra taxation on the grounds of COVID.

It doesn’t really matter. Until Labour announces its actual tax policy, they will have to suffer the extent of the speculation that will ensue. It is time they showed some honesty and let voters know what the next 3 years are going to look like, particularly when it comes to tax. But they won’t. Because, this is a COVID election.

If you enjoyed this BFD article please consider sharing it with your friends.