Table of Contents

Sir Bob Jones

nopunchespulled.com

The acronym, “FOMO”, or “Fear Of Missing Out”, accurately describes the current irrationality by so-called “little people”, buying into the likes of Tesla, Afterpay and Bitcoin, all entities without a scintilla of justification for their booming share-prices. FOMOists are today’s equivalent to the 1929 fabled shoe-shine boys.

New floats of sometimes questionable merit, are characterised by their creators cashing in large chunks, but that doesn’t stop the mug public buying in.

For example, respected share analyst Brian Gaynor, writing in his Businessweek website of the My Food Bag flotation currently being flogged, asked the all-important questions.

Specifically, if the company’s prospects are so good, why are the existing shareholders selling 75% of their shareholding into this float? And of the $342 million being raised, only $38m will actually go to the company after flotation costs and the rest into the selling directors’ pockets.

If that’s not alarming enough Gaynor also raises the critical point why the circa $17m flotation costs are being met 100% by MFB when three quarters of the proceeds are going to the directors?

A final valid Gaynor concern is departure of all the long standing directors with but one exception, and their replacement by new chums.

All of these factors says volumes about the company’s prospects. But I have no doubt the float will succeed and the share price will temporarily soar before ultimately reality strikes. Why? FOMO again.

In the case of Elon Musk buying into Bitcoin, given his form I suspect he’s having a laugh. He went public about buying in but it’s odds on he’ll only go public about jumping out after the event, and jumping out in due course will be inevitable.

As with all speculative fevers there will be winners and losers, the winners on the way up and the losers when the inevitable happens and the music stops as it always does and sanity is restored.

The amusing Game Stop saga which captured the news as a David and Goliath tale of how the little blokes killed off the short sellers “big boys” is a telling story.

For the little blokes could only win when they realised on their punt. They learnt this the hard way for by all piling in and achieving a massively over-valued U.S.$483 share-price, then all trying to capture this gain, in the space of a week they drove the price down to a 10th of that with considerable losses for them.

There’s one golden rule applying to this situation.

That’s the age-old adage arising with every irrational sharemarket boom, namely that this time, contrary to the faithful’s trusting belief, it isn’t different. In other words, sensible rules of earnings, risk and return etc. etc. remain valid. Speculative booms ignore those and are based on the bigger fool principle, namely the religious like faith of others climbing on board behind and continue driving up the price.

Whenever anything is based solely on faith, in other words with no rational justification, then ultimate failure is inevitable. The single exception is religion but that offers no tangible outcome, rather it’s selling an unprovable product you will supposedly only find out about when you’re dead.

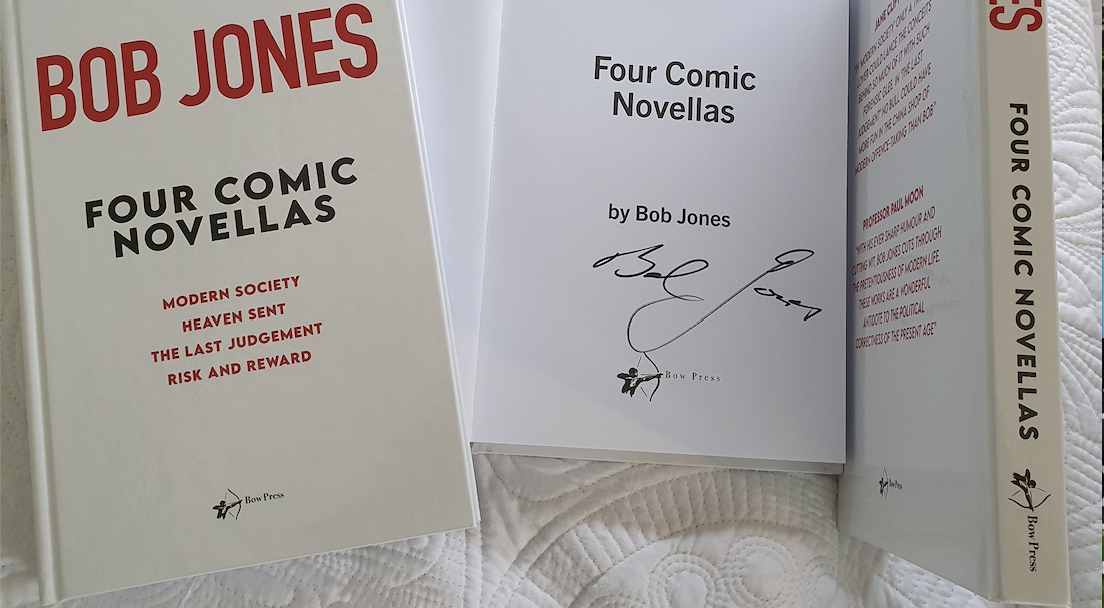

BUY Your Own First Edition Hardcover Signed Copy of Sir Bob’s Latest Book Today.

Please share so others can discover The BFD.