Table of Contents

Eliora

Dr Brash, who led the Reserve Bank between 1988 and 2002 before going into politics, said it’s not the Reserve Bank’s job to fix the housing crisis.

Newshub 29 April 21

Fixing a housing crisis is not part of the Reserve Bank’s remit. Kiwis have recently become aware that, astonishingly, Grant Robertson, Minister of Finance, is about to use the Reserve Bank in precisely this way.

It was with disbelief that New Zealanders found out that Robertson has planned to outfox this constraint since 2018 by giving himself more powers. He set in process a proposal for a new law to give him authority to exert more control over monetary policy.

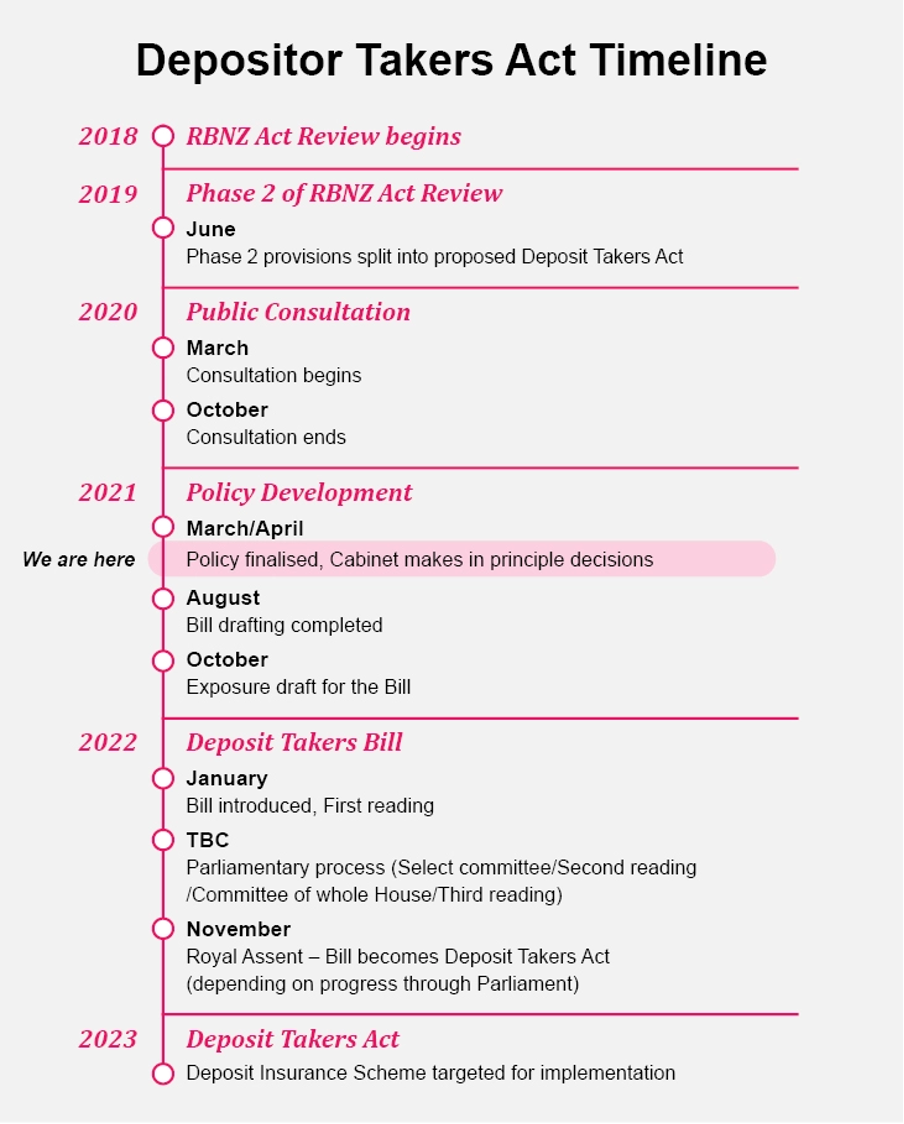

Last week Robertson announced a Deposit Takers Act (DTA) was finalised in principle, with full cabinet approval. Drafting the bill for this new legislation is to be completed by August.

The Reserve Bank and the Treasury websites both indicate the DTA will be up and running by 2023, although there is some confusion as Robertson wants this legislation hurried up and in place by the end of 2021. He wants to have free rein to make decisions that have previously been made by the Reserve Bank.

NEWS New Deposit Takers Act a step closer

A Cabinet decision to adopt the final measures resulting from the Reserve Bank Act Review will see drafting commence for new legislation to be known as the Deposit Takers Act.

Reserve Bank Website 22 Apr 21

New Zealanders have understood the Reserve Bank to be largely independent of government since the passing of the Reserve Bank Act in 1989. The Reserve Bank of New Zealand manages monetary policy to maintain price stability, promotes the maintenance of a sound and efficient financial system, and supplies banknotes and coins. Thinking Kiwis do not support transferring fiscal and monetary decisions from the politically independent Reserve Bank to any government, especially to an inexperienced Marxist Labour MP and cabinet.

It is a political shakeup when a NZ Deputy Prime Minister wants to override the Governor of the Reserve Bank and his role.

This term the Labour government have unilaterally made far-reaching decisions. The left-leaning Labour government are determined to centralise whatever they choose in New Zealand. As young socialists, they think they have the chance to ‘build back better’ than they were before. New Zealand is being subjected to a radical new plan or ‘reset’. Unopposed, they can bring organisations such as education, polytechs and the health system into a single central entity. Now they are intending to run the economy from the Finance Minister’s office in the Beehive.

This Deposit Takers Act policy to fix housing problems is wrong on many levels:

- Robertson overrules the Reserve Bank desire to remain the decision maker

- Robertson went against the advice of the Treasury

- It is not the job of the Reserve Bank

- It will not lower prices of houses

- The Reserve Bank needs to retain statutory independence.

The role of the Governor (or chief executive) of the Reserve Bank has changed and grown since the Bank’s establishment in 1934. Today, the Governor is accountable for the Bank’s performance in maintaining price stability, promoting a sound and efficient financial system, and meeting the currency needs of the public but retains statutory independence as to how these key outcomes are achieved.

RB Govt. website

Ashley Church, business executive, commentator and former politician thinks the Reserve Bank is going to make it worse for first home buyers.

This started in 2018 with the addition of an ‘employment target’ to the Bank’s mandate. It continued, late last year, when the Finance Minister wrote to the Governor of the Reserve Bank instructing him to include house prices in his decision-making process and to pursue policies to intervene in the housing market. This move was popular with the Government’s supporters but signalled a huge departure from the intentions of the 1989 Act.

Yet another attack on the independence of the Reserve Bank came in February of this year in the form of a directive to introduce measures to “support more sustainable house prices, including by dampening investor demand for existing housing stock, which would improve affordability for first-home buyers”. Putting aside the fact that ‘dampening investor demand for existing housing’ will have absolutely no impact on affordability for first home buyers, the new requirement further confuses social policy and monetary policy and requires the Reserve Bank to do the Government’s heavy lifting on both.

Ashley Church – OneRoof 27 April 21

In 2008 Ardern was elected as President of the International Union of Socialist Youth. She told New Zealand that the role was her proudest moment, and she still agrees with socialist principles.

The aim of the Union is to, “defend and spread our core socialists’ principles.”

The World Council Annual Meeting (2008)

Jacinda Ardern, New Zealand’s Prime Minister, has approved Robertson’s policy. It is compatible with her ideology. Socialism includes a system of a centralised government that plans and controls the economy and much more. Ardern and Robertson are spreading these core principles widely.

Please share so others can discover The BFD.