Table of Contents

John G Malcolm

John G Malcolm is the vice president of the Institute for Constitutional Government and director of the Edwin Meese III Center for Legal and Judicial Studies at The Heritage Foundation . http://www.heritage.org/ overseeing The Heritage Foundation’s work to increase understanding of the Constitution and the rule of law.

Cully Stimson

Charles “Cully” Stimson is a leading expert in national security, homeland security, crime control, immigration and drug policy at The Center for Legal and Judicial Studies at The Heritage Foundation . http://www.heritage.org/

PA Pundits – International

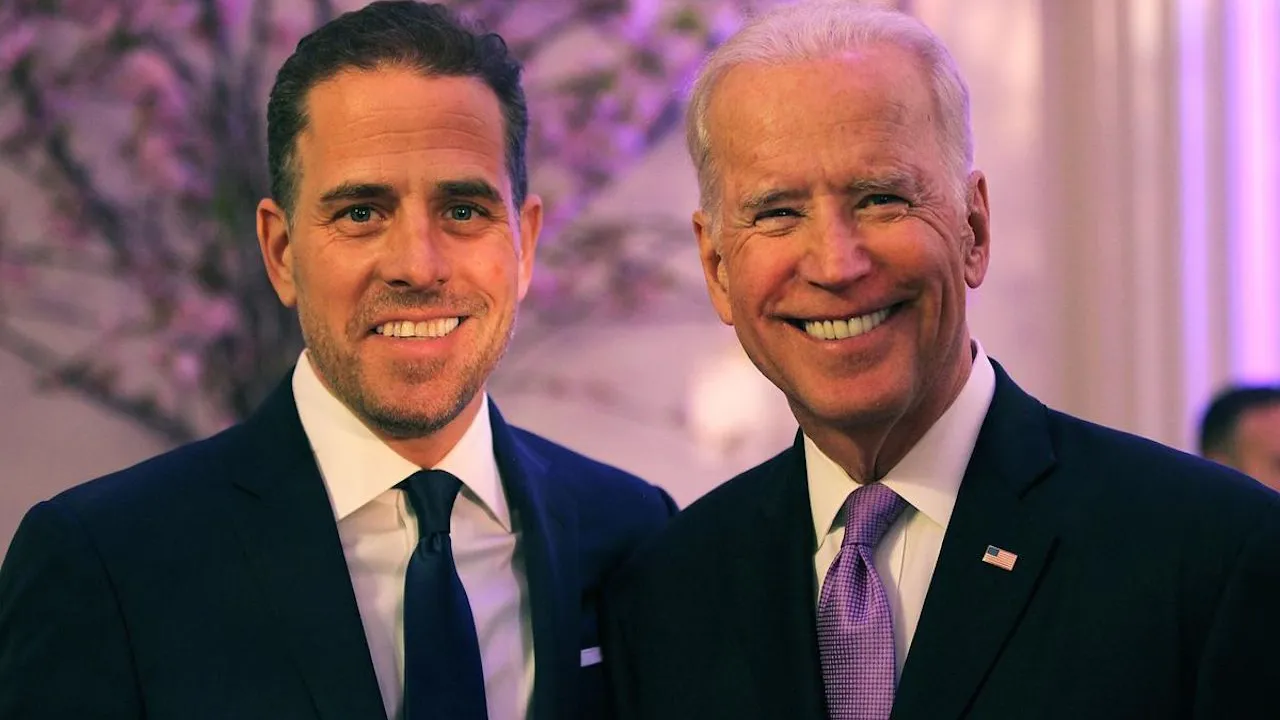

In what only can be described as a bizarre and disturbing turn of events, after a five-year investigation, the Justice Department this week announced a plea agreement with Hunter Biden, the troubled son of President Joe Biden.

Under the deal, the president’s son would plead guilty to two misdemeanor counts of willful failure to pay income taxes (in which the government would recommend a sentence of probation). He also would be permitted to enter a pretrial diversion program for a serious gun charge (with charges dismissed if he successfully completes the program).

Talk about a sweetheart deal!

But the closer you look, the worse the plea deal gets.

It is not just that Hunter Biden failed to pay his federal income taxes, he did so for two years in which he earned over $1.5 million and owed over $100,000 in taxes.

This easily could have been prosecuted as a five-year felony. Does anyone think that other rich businessmen would have gotten such a deal for tax evasion? As two former federal prosecutors, we doubt it.

And what of the gun charge? The crime of possession of a firearm by an individual who is an unlawful user of or addicted to a controlled substance – and there is ample proof that Hunter Biden fit into that category – is sufficiently serious that President Biden signed into law a measure called the Bipartisan Safer Communities Act, which increased the potential penalty from 10 years to 15 years in prison.

Granted, drug users with no criminal history don’t pose the same level of danger as a violent felon who possesses a firearm. But a pretrial diversion program?

On its face, the plea deal announced Tuesday for Hunter Biden seems suspect, or at least overly lenient.

And what about all the allegations of shady business dealings in Ukraine [and] China, and who knows where else? What about the allegations of a $10 million pay-to-play bribery scheme involving both Hunter and his then-vice president father – the “big guy”, according to Hunter’s former business partner, Tony Bobulinski?

Were those allegations thoroughly investigated?

The House Ways and Means Committee released transcripts Thursday of two key investigators whose testimony, under oath, suggests that the answer to this last question is “no” and paints the Hunter Biden plea deal in a whole new light.

These two whistleblowers, both IRS agents, have come forward to state that federal prosecutors and others within the Justice Department stymied the investigation and nixed recommendations to charge the younger Biden with multiple felonies. The IRS agents also say that they suffered retaliation for raising concerns about such interference.

US Attorney for Delaware David Weiss, a holdover appointed by President Donald Trump, claims the investigation is ongoing. However, Biden’s attorneys have stated that with this plea deal, they believe the matter is now over.

And although Weiss maintains that he had “ultimate authority” over the Biden investigation, the whistleblowers claim that their probe was stifled by people at Main Justice and by Lesley Wolf, the assistant US attorney on the case.

The identity of one IRS whistleblower remains undisclosed, but the other is Gary Shapley, the supervisory agent who until recently was in charge of the Biden investigation. Shapley has stated that the investigation was replete with irregularities and was unlike any other investigation he was involved in over the course of his 14-year career.

Shapley appears to be a model career civil servant, with no ax to grind. He testified that he was taught as a child to “always do the right thing”, and that there was “no reward for me for becoming a whistleblower”.

A highly decorated IRS agent since 2009, Shapley testified under oath that he investigated and managed “some of the largest cases in U.S. history and of the history of the agency, recovering over $3.5 billion”. He said that he never has given money to any political campaign, never attended a campaign event, never had a candidate sticker on his car and voted for both Democrats and Republicans for president.

In January 2020, Shapley became the supervisor of the IRS’ Hunter Biden case, code name Sportsman. By March of that year, he had sent reports up his chain of command that the IRS would be ready to “seek approval for physical search warrants in California, Arkansas, New York and Washington, DC”.

On April 1, 2020, an IRS colleague drafted an affidavit establishing probable cause for those searches and also noted he need to conduct 15 interviews at the same time.

But once Joe Biden became the Democrats’ presumptive nominee for president in early April 2020, according to Shapley, “career DOJ officials dragged their feet on the IRS taking these investigative steps”.

Over the course of the next two years, Shapley testified, he and his team were hamstrung by superiors and not allowed to follow the facts in this case.

Shapley also stated under oath that he was abruptly removed from the investigation a month ago “after providing protected disclosures concerning prosecutors’ mishandling of the investigation of Hunter Biden, to include conflicts of interest, preferential treatment, deviations from normal investigative procedures and conflicting information provided by Attorney General Merrick Garland to Congress related to the independence of the US Attorney of Delaware [Weiss]”.

During his testimony, Shapley recalled a meeting that he attended Oct 7, 2022, at Weiss’ offices along with senior-level managers from the IRS, FBI and Weiss himself.

Weiss told the group that he was “not the deciding official on whether charges are filed” against Hunter Biden and that US Attorney for the District of Columbia Matthew Graves “would not allow him to charge” Hunter Biden in Washington, DC (where Biden’s taxes should have been filed). Weiss also said that he had asked “Main Justice” for the authority of special counsel to charge Biden in DC and that the request was denied.

Shapley also said he learned that the US attorney for the Central District of California (where the younger Biden lived) declined Weiss’ attempt to bring charges in his district.

“Some of these decisions seem to be influenced by politics,” Shapley added.

Shapley was asked about Garland’s sworn Senate testimony March 1, in which the attorney general said: “I promise to leave the matter of Hunter Biden in the hands of the US attorney for the District of Delaware. … I have pledged not to interfere with that investigation, and I have carried through on my pledge.”

House investigators asked Shapley whether Garland’s statement, under oath, was true.

He answered, “It’s not accurate.”

Garland testified during the same hearing about Weiss’s latitude to bring cases in other federal districts.

Weiss “has full authority to make those kinds of referrals that you are talking about or bring cases in other jurisdictions if he feels that it’s necessary”, the attorney general said. “And I will assure that if he does, he will be able to do that.”

Shapley testified that Garland’s statement was not true, and that it came a year after Weiss was rebuffed by fellow US attorneys in both DC and California.

According to the newly released (albeit redacted) transcripts of testimony by Shapley and the other whistleblower, search warrants (including a search warrant of Joe Biden’s guest house where Hunter was living) and other investigative requests were blocked. They said charges were downgraded and critical related information was leaked to the younger Biden’s legal team, thereby stifling investigators’ ability to obtain evidence.

The IRS whistleblowers also claim that investigating agents were prohibited from asking any questions of witnesses about the president or delving into potential campaign finance violations or financial transactions involving his son’s children.

The unnamed whistleblower said investigators recommended charging Hunter Biden with felony tax charges covering six years and over $8.3 million in income – not just the two years covered by the misdemeanor charges to which he will plead guilty. But, the whistleblower said, that recommendation was blocked by the president’s political appointees.

Shapley alleges that Hunter Biden engaged in this conduct, at least in part, to hide payments that he received from Burisma Holdings, the Ukrainian energy company that hired him as a consultant and placed him on its board of directors.

Others have asserted that, as vice president, Joe Biden orchestrated the firing of Ukraine’s chief prosecutor, Viktor Shokin, because he was investigating Burisma.

If these allegations are true – and Garland has denied that they are – that would be shocking, not only because of the favorable treatment accorded to the president’s son but because agents were prevented from investigating potential criminal wrongdoing by the president himself.

So, we thought earlier this week that the Justice Department’s plea deal with Hunter Biden was overly lenient, and now it looks like the story behind that plea deal might be much more rotten.

It is of the utmost importance that the truth and facts come to light. A thorough investigation is warranted. Let the chips fall where they may.

Read more informative articles at The Daily Signal http://dailysignal.com/

Reprinted from PA Pundits – International