Table of Contents

Summarised by Centrist

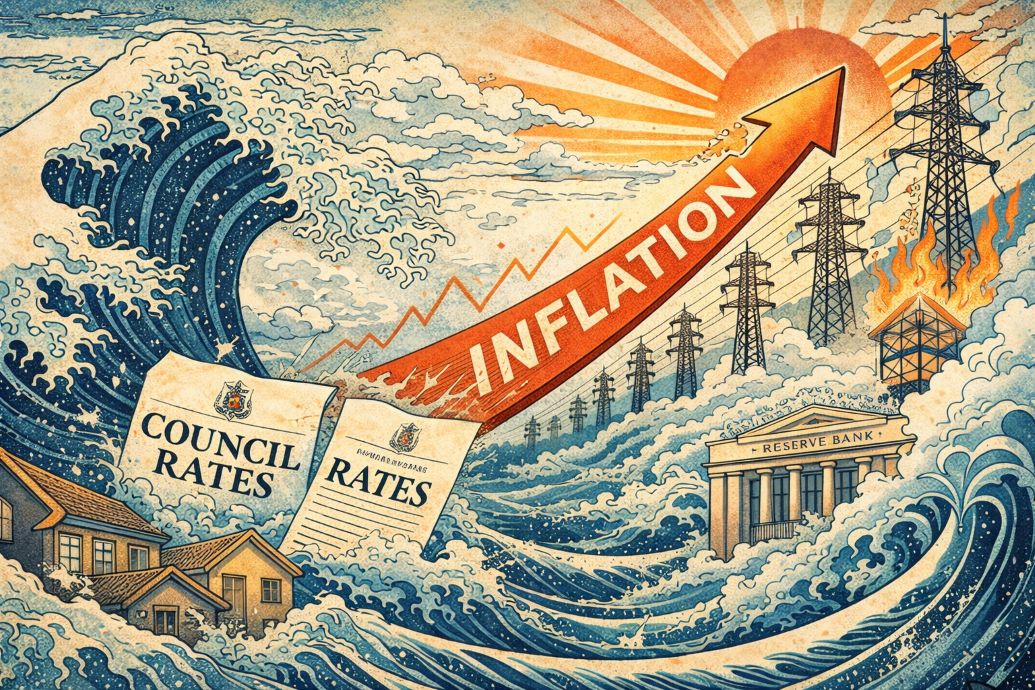

Inflation has moved back above the Reserve Bank’s target range, driven less by discretionary spending than by unavoidable household bills. Council rates and electricity costs are now biting hardest, pushing inflation higher even as families cut back elsewhere.

Statistics New Zealand figures show the consumer price index rose 0.6 per cent in the December quarter.

This has lifted annual inflation to 3.1 per cent. That places inflation above the Reserve Bank’s 1 to 3 per cent target band and marks the third consecutive quarterly increase since December 2024, when inflation stood at 2.2 per cent.

More than 80 per cent of items in the CPI basket rose over the past year, the highest proportion recorded in 18 months.

Education and insurance rose fastest, but electricity and council rates drove inflation higher because they are essential, government-influenced costs that households cannot avoid. Electricity prices increased by more than 12 per cent over the year, making them the single largest contributor to annual inflation. Local authority rates and payments rose almost 9 per cent, while rents increased nearly 2 per cent.

Other major increases included tertiary and post-school education, up nearly 23 per cent, and health insurance, more than 20 per cent. While these categories recorded the steepest percentage rises, they carry less weight in the CPI than power and rates, which affect almost every household.

Domestically set prices, such as power and council charges, rose 3.5 per cent over the year, showing inflation is being generated at home.

Although the official cash rate was cut to 2.25 per cent late last year, markets are now pricing in a growing risk that rates could rise later in 2026 if inflation remains stuck near the top of the target band.

Finance Minister Nicola Willis said the figures supported restrained government spending, warning that higher public outlays would have added further pressure.