Table of Contents

For years, while commentators have jerked themselves into a stupor over ‘China’s economic miracle’, the first thought that’s always occurred to me is: but is it? After all, all the giddy accounts of China’s ‘skyrocketing GDP’ are based solely on official Chinese government statistics.

You know: the same Chinese government that insists that just 250 people died in Tiananmen Square in 1989, that there are no concentration camps in Xinjiang and Tibet was always part of China. The same Chinese government that has ruthlessly purged all photographic evidence of the 45 million dead from the Great Leap Forward.

As former deputy prime minister John Anderson says, “We must never lose sight of the fact that a communist dictatorship will behave as a communist dictatorship.” In their eagerness to snatch up the crumbs from under Xi Jinping’s table, too many in the West chose to forget just that.

Or that a communist economy eventually collapses. The longer the economy is propped up by official lies, the harder it collapses.

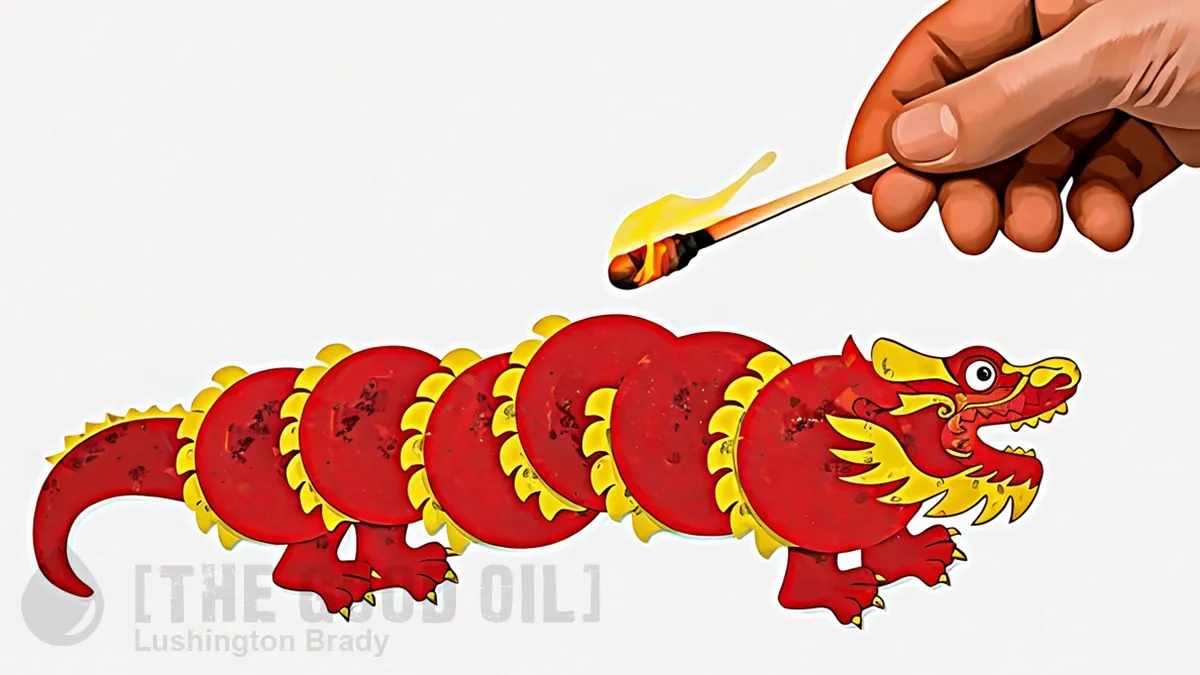

The same goes for those who try to hitch their prosperity to a communist paper dragon.

China’s debt levels, massive trade surplus and nonproductive investment binge are red flags that create significant risks for Australia’s over-reliance on real estate and commodities, world-renowned economist Michael Pettis has warned.

China’s biggest problem is the same with any command economy: the state can command all it want, but the market will follow its own inexorable logic. In this case, the commanded supply far exceeds a dwindling demand.

His rationale is that China’s consumption levels have not been enough to deliver goals of five per cent GDP growth, so the country has ramped up investment instead.

However, the investment is unproductive, pushing debt levels ahead of GDP.

Mr Pettis said China’s total debt-to-GDP ratio for 2025 is expected to hit 289 per cent, according to the IMF. That would be unsustainable and lead to an unwinding of investments in countries such as Australia.

As we all know, China has been buying up the country, whether by the shipload of iron ore, or farm by farm. Governments have been only too happy to sell the country away, relying on Chinese money to paper over the gaps of their own dismal economic management.

Sooner or later, though, the whole scam is bound to collapse.

“One consequence is that foreigners have been buying heavily into Australian markets, and that’s caused asset prices to go up, including, most notoriously, real estate.

“The other more important reason is commodity prices. Because Chinese growth is so heavily dependent on investment, particularly investment in infrastructure and property, China has been a huge buyer of industrial commodities.

“The problem is that China can no longer maintain these investment levels, and has to bring them down. Now, I’m sure in Australia, you’re hoping that as Chinese demand drops, Indian demand will replace it, but that’s very unlikely.

“Eventually, when this model ends, we should see demand for industrial commodities drop very sharply, and that will affect the Australian economy.”

And Anthony Albanese and Jim Chalmers, who could surely hardly believe their luck as they’ve spent like drunken sailors, are going to be up the creek when the flow of Chinese money suddenly evaporates.

A key part of Mr Pettis’s economic argument is that China’s massive trade surplus – the highest in the history of the world – is based on comparatively lower wages to other countries. But that crimps domestic demand and prevents consumption from becoming a bigger part of GDP.

Investment makes up an “astonishing” 40 per cent of China’s GDP, which Mr Pettis thinks is not sustainable.

It needs stronger consumption instead to achieve more sustainable GDP, but wants to maintain its trade surplus.

And this, with a collapsing population, is hardly likely to happen. Moreover, if China’s dwindling population starts demanding higher wages, the whole jig is up.

Still, there’s some silver lining, Pettis says. Greedy, lazy politicians and big businesses have been happy to sell off the farm and the factory at home and coast along on the Chinese Ponzi scheme. When it collapses, they’ll actually have to start doing the hard yards again.

That will be forcing Australia back into becoming a manufacturer, which he says will help lift productivity and the overall wealth of the nation. Currently, manufacturing in Australia as a percentage of GDP is in the single digits.

Maybe then we’ll be forced back into being a real country again. One that makes things – not a banana republic that sells off its resources on the cheap, for a quick buck.