Table of Contents

Don Brash

bassettbrashandhide.com

Don Brash was Reserve Bank Governor from 1988 to 2002, and National Party Leader from 2003 to 2006

I suspect that most New Zealanders don’t give a lot of thought to the size of the government debt. But every now and then the media reports that the Government is spending vastly more than it takes in in revenue, with the result that the amount the Government has to borrow goes up by billions more. Surely this is mortgaging our future, and the future of our children and grandchildren?

Actually, thanks to a piece of legislation passed at Ruth Richardson’s initiative in 1994 – legislation which required future governments to be honest about the longer-term implications of their spending plans – and by the restraint of subsequent Finance Ministers, in particular Sir William Birch, Sir Michael Cullen and Sir Bill English, New Zealand got to early 2020 with very little government debt. Indeed, taking into account the assets built up in the New Zealand Superannuation Fund, the net government debt was very low indeed, despite the impact of the Christchurch earthquake and the Global Financial Crisis.

In 2018, not long after the formation of the Labour-New Zealand First Government, the Minister of Finance made a commitment to have net “core Crown debt” at no more than 20% of Gross Domestic Product (a measure of the size of the whole economy).

But in early 2020 Covid-19 came along and, as it became clear that this would have a serious effect on economic activity, the Government abandoned that objective and announced its intention to borrow $50 billion to ensure that support could be provided to those people most adversely affected by the pandemic and the related lockdowns. Without necessarily agreeing with the precise scale of the proposed borrowing, most economists thought that a large measure of government borrowing made good sense in the circumstances.

Serious doubts have begun to emerge about whether some of the spending undertaken from that Covid Recovery Fund could really be regarded as related to helping the economy recover – such as the $515 million allocated to improve the school lunch programme, or the $26.6 million to introduce cameras on fishing boats – and doubts have even emerged about whether the Government really needs to be spending on such a scale, given that in much of the country the problem facing employers appears to be to find staff.

Be that as it may – and on current projections net government debt will climb from little more than 20% in relation to GDP just prior to the pandemic to a currently projected 48% in 2023 – this is not yet a serious situation relative to the position in many other developed countries.

Australia’s government debt is lower, relative to GDP, than New Zealand’s, and countries like Norway and Singapore actually have large amounts of “cash in the bank”, with no net government debt at all.

But what the OECD calls “general government debt” already exceeds 100% of GDP in both the United Kingdom and the United States, and exceeds 200% in Japan.

And all the indications are that this situation will get markedly worse if present demographic and political trends continue. Nearly a decade ago, Lawrence Kotlikoff, Professor Economics at Boston University, visited New Zealand and talked about government debt in the US. At that time, the US federal debt was about US$16 trillion, or about the same size as US GDP at that time. But he argued that that was not the real problem, nor the real measure of US federal debt. He argued that US federal debt was not US$16 trillion but rather the difference between the present value of what the US government had promised to pay out in the future (in pensions, medical benefits, and so on) and the present value of what the US government could expect to take in in tax revenue in the future on the basis of current tax rates.

That difference was not US$16 trillion but in excess of US$200 trillion, an amount many times the size of the US economy. He concluded that the US government would not be bankrupt in 50 years’ time, or ten years’ time, but is bankrupt now! That is, of course, unless the US government reneges on its commitment to provide pensions and healthcare to the elderly, or radically increases tax rates – both seem to be totally unrealistic whether Congress is controlled by the Democrats or the Republicans.

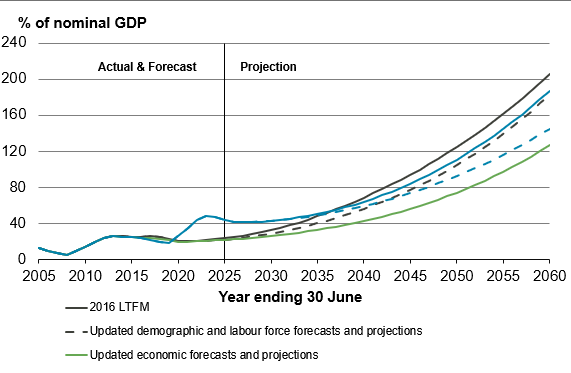

Our own Treasury regularly does long-term projections of what government debt would look like if current trends continue – with a steadily ageing population demanding both income support and steadily higher levels of healthcare, and the birth rate now well below the replacement rate. Their latest project, released in September, suggests that on current policies and demographic trends, net government debt will rise from 34% of GDP this year, to 43% by the end of this decade, to 84% by 2045 and to 197% by 2060.

Raghuram Rajan, currently at the University of Chicago but previously Governor of the Reserve Bank of India, argues that there are in principle only four ways out of a government debt trap.

First, it may be possible to grow out of it – but the problem is that many government payments rise in proportion to higher income (think many superannuation schemes) or at an even faster rate than income growth (think healthcare). To the extent that that is the case, growing the economy doesn’t solve the problem.

Second, in principle government can drastically cut down on government spending – easy to say, but hellish difficult to do in practice, as many a politician will attest.

Third, the debt might be inflated away, but that is not only politically unpopular it also only works to the extent that the government debt has fairly short maturity – otherwise, the interest rate on the debt begins to escalate sharply, and the real burden of the debt isn’t reduced much at all.

Or finally, there is the option of “defaulting” on the debt, simply refusing to pay it. And for countries like Argentina or Venezuela, that may be an option. But no country which aspires to be regarded as creditworthy in the long-term wants to take that solution.

No, the time to behave prudently is now, recognizing that responsible restraint on government spending now, or some increase in taxation, difficult though both may be politically, is vastly to be preferred to any of the other options.

This article was first published at Elocal

Please share this article so that others can discover The BFD.