Table of Contents

Ronni Stoeferle

Ronni is the managing partner of Incrementum AG in Liechtenstein. He studied business administration and finance in the USA and Austria.

The reshaping of the world economy and the global (political) order is in full swing. It is a long process, the concrete outcome of which is uncertain in advance and associated with numerous imponderables. Nevertheless, there are powerful factors, such as the shift in economic, demographic and military weight, that are driving the readjustment in the (geo)political arena. And this readjustment is also reflected in the change in gold flows. They are increasingly shifting from West to East, since “Gold goes where the money is,” as James Steel pointedly put it.

The central banks of the states of the East are among the strongest buyers of gold – also within the West

This is also reflected in the continuing enthusiasm of central banks for gold, especially in non-Western countries. 2022 saw the largest purchases of gold by central banks since records began more than 70 years ago, at 1,136 tons. The first half of 2023 saw a continuation of this trend. Despite a weaker second quarter, central bank purchases in the first half of the year set a new half-year record. Central banks increased their gold reserves by a total of 378 tons from January to June. The previous half-year record from 2019 was thus slightly exceeded. China made the largest purchases, followed by Singapore, Poland, India and the Czech Republic. So even in the West, it was countries in the East that made additional purchases.

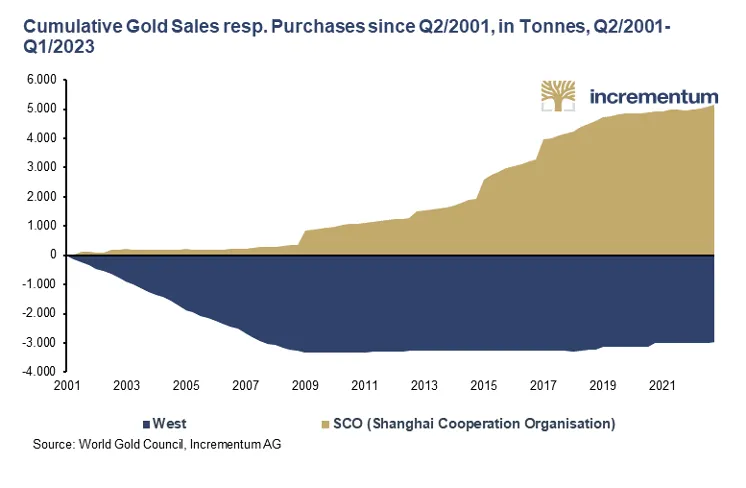

The following chart shows the extent to which institutional demand for gold has shifted to the East. It compares the cumulative gold sales of Western central banks with the cumulative gold purchases of the Shanghai Cooperation Organization (SCO or SOC) since 2001.

Looking at the BRICS, we also see a striking overlap, with central banks from four of the five BRICS countries – Brazil, Russia, India and China – buying a cumulative 2,932 tonnes of gold over 2010–2022.

Holdings of US Treasuries are reduced

In turn, the BRICS continue to reduce their share of the soaring US government debt. In other words, gold is becoming more and more interesting as a reserve asset because US Treasuries have been becoming less and less interesting as a currency reserve for more than a decade. The militarization of money by freezing Russia’s foreign exchange reserves just days after Russia’s invasion of Ukraine in late February 2022 added emphasis to this process, but did not kick it off.

The BRICS now hold only 4.1 per cent of all US government debt, compared with 10.4 per cent in January 2012. That is a decline of more than 60 per cent. The rest of the world has reduced its exposure to US government debt by much less. In January 2012, the rest of the world held 22.0 per cent of all US government debt on their books; currently, they hold 19.3 per cent. That is a decrease of more than 12 per cent.

The East is expanding its infrastructure for gold trading

However, the East is not only stocking up on gold and mining gold itself on a large scale. China and Russia have ranked among the top three gold producing nations for years.

Countries such as China, the United Arab Emirates and even Russia are expanding their gold trading infrastructure. This is to establish a permanent infrastructure for the detour of gold trading from gold trading centers in the West such as London, New York and Zurich. This testifies to the changing understanding of roles: The East increasingly no longer sees itself as a customer of Western infrastructures, but offers the infrastructure itself.

Key developments include:

- SGE & SFO NRA: Cooperation between the Chinese and Russian gold markets

For some time now, China and Russia have been working hard to link their gold markets through cooperation between the Shanghai Gold Exchange (SGE) and the Russian financial authority, the National Financial Association (NFA). The NFA is a Russian professional association representing the entire Russian financial sector, including the Russian precious metals market.

In the face of Western sanctions, Russian gold exports to China have already surged since mid-2022. As three Russian banks – VTB, Sberbank and Otkritie – are already members of the SGE International Board of the SGE, which was founded in 2014, this cooperation between the gold markets of Russia and China is likely to intensify in the future.

- Memberships in gold-related institutions

As gold flows from west to east and the importance of eastern gold markets increases, these markets will also have greater representation and influence in the global institutions that represent the gold market, such as the LBMA and the World Gold Council (WGC).

In 2009, only six Chinese refineries were on the LBMA’s Good Delivery List, but now there are 13. While just 15 years ago there was only one regular (full) member of the LBMA from China, the Bank of China, there are now seven. China’s growing influence is also reflected in the World Gold Council. In February 2009, only one Chinese gold producer was a member of the WGC; now there are four.

- India International Bullion Exchange (IIBX)

In addition to its sophisticated OTC gold trading market, India has also established a trading infrastructure for gold futures contracts on the Multi Commodity Exchange of India Limited (MCX). In July 2022, the India International Bullion Exchange (IIBX), supported by the Indian government, was officially opened for trading spot gold contracts backed by physical metal. IIBX is located in a special economic zone in GIFT City in the Indian state of Gujarat, and the gold underlying the contracts is stored there. One goal of IIBX is to allow qualified buyers to import gold directly into India without the need for banks or authorized agencies. So far, however, trading volumes have been minimal.

- Establishment of a Moscow World Standard

At the end of February 2022, when sanctions against Russia were imposed by the West immediately after the start of the Ukraine war, the London Bullion Market Association (LBMA) excluded the three Russian banks VTB, Sovkombank and Otkritie. A few days later, the LBMA removed all six Russian precious metals refiners from the LBMA Good Delivery List and the CME Group followed suit, removing the same refiners from the list of approved COMEX refiners.

As a result, Moscow announced in July 2022 that a new infrastructure for precious metals trading independent of the LBMA and COMEX would be established. According to Moscow, this is intended to break the supremacy of London and New York in global precious metals pricing. This proposal calls for the introduction of a Moscow World Standard (MWS) for precious metals trading, similar to the LBMA’s Good Delivery List, the establishment of a new international precious metals exchange in Moscow based on the MWS, the Moscow International Precious Metals Exchange, and the creation of a new gold price fixing based on the MWS so as to establish gold prices and reference prices different from those of the LBMA and COMEX.

Private gold demand shifts to the east

East’s increased interest in gold is also evident in the non-governmental sector. Chinese consumer demand, for example, increased from 292.6 tons to 824.9 tons (2022) since the turn of the millennium. This is an increase of 181 per cent. Annual consumer demand in India has also increased since the turn of the millennium, albeit from an already high level in 2000. China and India, which together accounted for only 28.7 per cent of consumer demand in 2000, account for almost half of global consumer demand (48.4%) in 2022 and together acquired 1,600 tons of gold last year.

Consumer Demand for Gold – 2000 vs. 2022

| 2000 | % of Global Demand | 2022 | % of Global Demand | 2022 vs. 2000 in Tonnes | 2022 vs. 2000 in % | |

| India | 723.0 | 20.4% | 774.0 | 23.4% | 50.0 | 7.0% |

| China | 292.6 | 8.3% | 824.9 | 25% | 532.3 | 181.9% |

| Japan | 105.1 | 3.0% | 4.3 | 0.1% | -100.8 | -95.9% |

| Middle East | 457.9 | 12.9% | 268.2 | 8.1% | -189.7 | -41.4% |

| Türkiye | 177.4 | 5.0% | 121.5 | 3.7% | -55.9 | -31.5% |

| United States | 368.5 | 10.4% | 256.6 | 7.8% | -111.9 | -30.4% |

| France | 19.0 | 0.5% | 19.9 | 0.6% | 0.9 | 4.5% |

| Germany | 15.6 | 0.4% | 196.4 | 5.9% | 180.8 | 1,159% |

| Italy | 92.1 | 2.6% | 17.8 | 0.5% | -74.3 | -80.6% |

| UK | 75.0 | 2.1% | 35.6 | 1.1% | -39.4 | -52.5% |

| Rest of Europe | 142.4 | 4.0% | 115.1 | 3.5% | -27.3 | -19.2% |

| Other | 1,076.0 | 30.4% | 669.1 | 20.3% | -406.9 | -37.8% |

| Global Demand | 3,544.6 | 100.0% | 3,303.3 | 100.0% | -241.3 | -6.8% |

Source: World Gold Council, Incrementum AG

Recent developments point in the same direction. In the first eight months of the current year, Asian gold ETFs increased their holdings by 7.7 per cent, while North America and Europe recorded outflows of 2.3 per cent and 6.1 per cent, respectively. Significantly, in the bars and coins demand segment, Turkey and Iran replaced Germany and Switzerland in the top five in the first half of the year. China now leads this sub-segment of gold demand – in the first half of 2022, Germany was still in the lead – followed by Turkey, the US, India and Iran. This is because while demand for bars and coins in Turkey shot up from 9.5 tons to 47.6 tons in the second quarter of 2023, it fell by around three quarters in Germany.

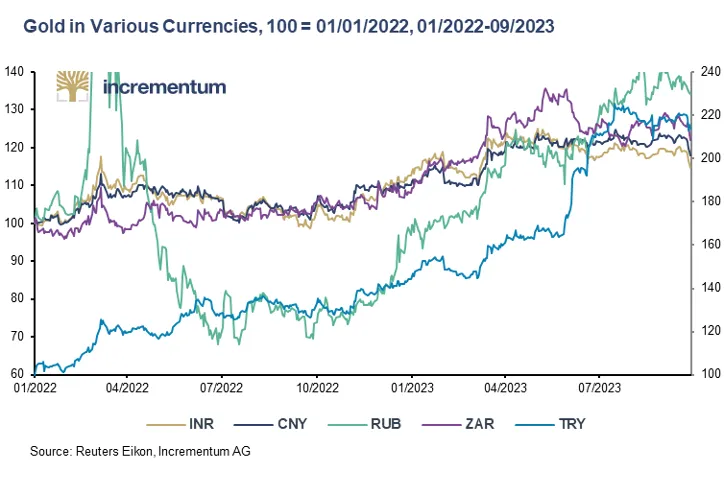

The price of gold in currencies of the East has increased significantly

As of the end of September, gold was 14.6 per cent higher in Indian rupees than at the beginning of 2022, 18.0 per cent higher in Chinese renminbi, 34.3 per cent higher in Russian rubles, 22.1 per cent higher in South African rand (all left-hand side) and 114.0 per cent higher in Turkish lira (right-hand side). Gold thus impressively demonstrates its value-preserving properties in difficult (geo)political and macroeconomic situations in these countries.

The significantly increased premium on the gold price in China since July is an unmistakable sign that there is a structural shortage of gold in the Chinese market and thus an expression of the strong demand for gold in the Middle Kingdom, which is struggling with profound economic problems.

Conclusion

This shift in demand from West to East can be observed not only among governments or government-related entities, but also among institutional and private investors. Gold is flowing to where it is most valued and where economic prosperity and savings rates have increased. In the medium term, the shift in demand should therefore find support from the higher growth prospects in Asia and the Middle East. “Ohne Geld, ka Musi” (“Without money, no music”) – this is how the vernacular formulates this economic truism in German. And as the IMF’s most recent economic growth forecast indicates, the sub-region of emerging and developing Asia will grow at a projected 5.2 per cent this year and 4.8 per cent next year, while the West will grow much less strongly. This will also lead to a shift in influence on pricing from West to East.