Table of Contents

Back in the day, I would console then-Whale Oil readers by pointing out that Kevin Rudd was once far more popular than Jacinda Ardern ever was. Once. Because, in just over year, Rudd went from record-high approval to being hated by even his own party. Lo and behold, the same downfall indeed awaited Ardern. Similarly, when Ardern’s Ten Cent Army was crowing about her supposedly ‘saving New Zealand from Covid’, I pointed to the similar lag in Australia that would eventually catch up to NZ, too. And behold…

Not all Kiwi politics is downstream from Australia, though. The political tide flows both ways across the Tasman. The human tide, of course, flows almost entirely one-way – and it’s only accelerating as the Luxon government fails to tackle the structural problems left in Ardern’s disastrous wake.

Joke’s on them, though: they’re jumping out of the frying-pan into a fire that is only slightly less raging than in NZ and getting hotter by the day.

New Zealand’s situation is not identical to Australia’s but there are important similarities that should make us worry. They should make New Zealanders worry too, because when their economy goes to heck, they usually just jump on a plane and find a job over here instead. If both countries go down the gurgler at once, that’s not possible.

We’re already getting a flood of them. It’s a trans-Tasman version of Californians, having voted to turn their state into a woke shithole, fleeing to Texas or Arizona and getting ready to rinse and repeat. Are we getting NZ’s best and brightest and hardest-working? Pfft.

Bookstore sales clerks from Wellington. Illustrators from Wellington. Samoan tattoists from Auckland.

One guess who and what they all voted for.

Stay right where you are, New Zealand wokies. We don’t want you coming over.

Not after what you voted to inflict on your own country.

As the next chart shows, the NZ economy shrank at a startling 0.9 per cent in the last quarter. That is quite a big fall. And it’s not the only bad quarter they’ve had recently. They put together two shrinking quarters in 2024 as well. That, technically, is what we call a recession. Now they need to pull their finger out to not have another one.

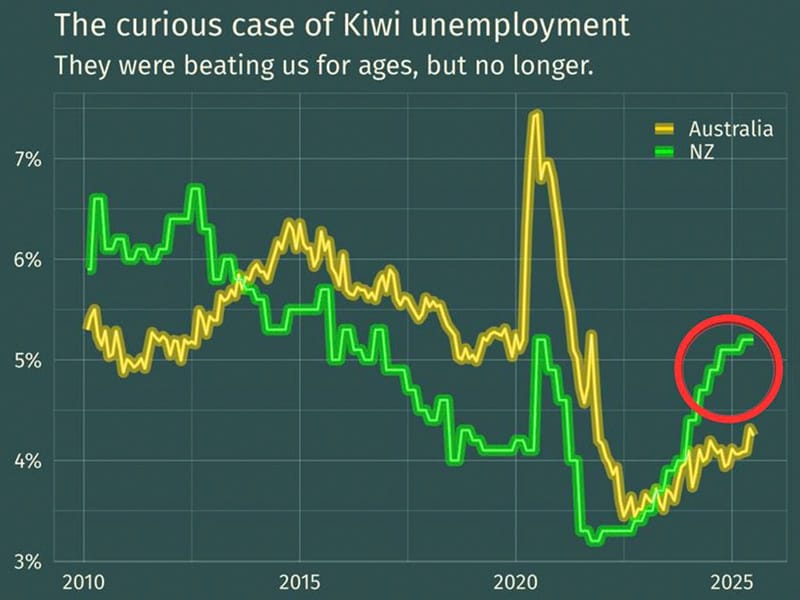

Australia’s economy has performed far better over this period. Our unemployment rate never got quite as low as theirs, but it also hasn’t snapped back. Kiwi unemployment has returned to levels well above their pre-pandemic situation […]

It’s not like NZ has sacrificed its economy to fix its budget, either. Their budget balance, is, in technical terms, cooked.

“The government’s books have taken a hammering over the past six years or so,” said the NZ Treasurer in her Budget speech earlier this year. “Spending has risen sharply. So has government debt.”

Oh, boy: you haven’t met Zippy the Pinhead, otherwise known as Treasurer Jim Chalmers. Spending and debt are his first and middle names.

The same is true in Australia. Although our recent fiscal trajectory is slightly better, with record high taxes helping pay for our very high spending, our debt load is still enormous.

So are we just NZ on delay? Will we be next to see the unemployment rate shoot up? Certainly recent signs are not good.

The only reason unemployment has stayed steady is because vast swathes of the Boomer generation are hitting retirement age.

And the Kiwi expats complaining about the cost of housing in New Zealand are about to get a rude shock.

In NZ the RBNZ is expected to drop the hammer, cutting rates by a whopping 0.5 per cent on Wednesday afternoon to try to give the economy a bit of breathing space. Their cash rate is already down to 3 per cent and falling. Ours is 3.6 per cent, and the RBA recently declared interest rates did not need to fall because the labour market was “stable”.

On the other hand, the government’s demented profligacy is driving inflation ever higher. Most forecasters are tipping interest rates to rise, rather than fall.

Maybe better make that AirNZ ticket a return one. Please.