Table of Contents

Peter J Morgan

Peter J Morgan BE (Mech.), Dip. Teaching – professional forensic engineer, retired economics, mathematics and physics teacher

PART 9 of 18

It is notable, but unrelated of course, that in his book Mein Kampf, Adolf Hitler coined the term “Big Lie”, writing that “the broad masses” are more likely to “fall victims to the big lie than the small lie”, because “it would never come into their heads to fabricate colossal untruths, and they would not believe that others could have the impudence to distort the truth so infamously”. Adolf Hitler’s propaganda minister, Joseph Goebbels, followed the principle that when one lies, one should lie big, and stick to it.

Graeme Wheeler, the immediate-past governor of the RBNZ, is a graduate of The University of Auckland. (He retired on 26 September 2017.) So now you know why he had such trouble getting CPI inflation up to 2% – the middle of the target band he agreed with Bill English. If Graeme Wheeler was relying on what he was taught when an economics student at The University of Auckland, he believed that banks are financial intermediaries! What he should have practised, of course, was a little bit of Overt Monetary Financing, otherwise known as Sovereign Electronic Money Creation!

It is plainly evident that our universities, in their teaching of macroeconomics, have been letting us down really badly, and here’s one more example. On 1 November 2018, the New Zealand Treasury and the RBNZ jointly issued a public consultation paper entitled: “Safeguarding the future of our financial system – The role of the Reserve Bank and how it should be governed – Phase 2 of the Reserve Bank Act Review”.

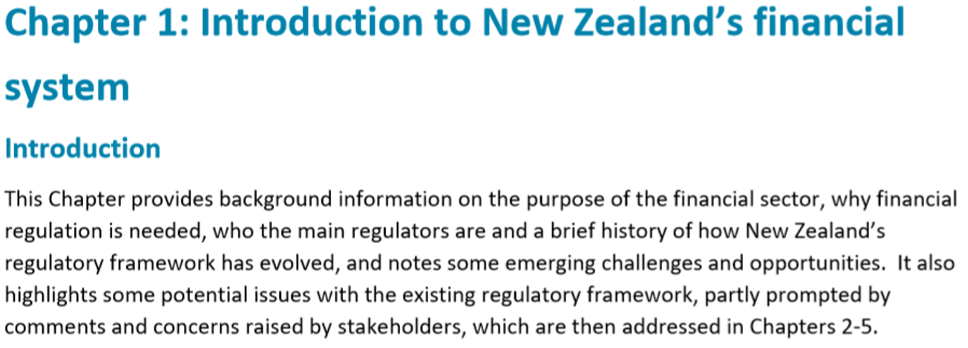

Below is an electronic scan of part of page 14:

Here is an electronic scan of the lower part of page 17:

The above two electronic scans show conclusively that the staff of the NZ Treasury and the RBNZ responsible for this paper, and those who vetted it and approved it for publication, are either woefully ignorant as to how the banking and monetary system actually works, or they are deliberately lying to the public. They are clearly not fit for purpose and should be summarily dismissed! But that won’t happen, most likely because the boss of the Treasury staff, the Secretary for the Treasury, is just as ignorant!

But wait, there’s more! Here is an electronic scan of part of page 28:

Rather than acting to “promote the prosperity and wellbeing of New Zealanders and contribute to a sustainable and productive economy” as it is supposed to do (as shown in the electronic scan above) the RBNZ enables and aids banks to make insanely obscene profits – far higher than would be possible if banks were merely financial intermediaries as both the Treasury and the RBNZ, by the above incontrovertible evidence, erroneously believe them to be.

Banks are not financial intermediaries. Banks are money creators, as shown by the unanimous Report of the 1956 NZ Royal Commission into Monetary, Banking and Credit Systems, previously mentioned in this series. That fact was again revealed in the two Bank of England papers: “Money creation in the modern economy” (2014), and “Banks are not financial intermediaries, and why this matters” (2015). In these papers, staff of the Bank of England describe how money is created out of nothing as debt to banks when they grant loans and when they purchase assets, and destroyed (i.e. sent back into the nothing whence it came) whenever any bank loan principal is repaid.

As shown in an article dated 1 November 2018 in the NZ Herald, bank profits are so insanely obscene that in the 2017-2018 financial year the $1.98 billion profit of ANZ Bank in New Zealand (equivalent to $416 of profit for every man, woman and child in New Zealand) was greater than the combined profits of the seven biggest public businesses in New Zealand – Fonterra ($745m), Spark ($418m), Air New Zealand ($382m), Fletcher Building ($105m), Woolworths, which owns the Countdown supermarket chain ($155.9m), and Foodstuffs (parent of Pak’nSave and New World) ($25.8m), and the Warehouse Group ($20.7m). New Zealanders ought to be asking themselves how it can be that one of the (nominally) Australian banks operating in New Zealand, which is simply a money-creator and creates no wealth itself, can garner more profit than the combined profits of the seven biggest public businesses in New Zealand.

Here is one more electronic scan, from page 48 of the Treasury/RBNZ document:

Nowhere in the Treasury/RBNZ document referred to above is there any mention of the fact that banks are money creators. Throughout, the NZ Treasury and the RBNZ present banks as being mere financial intermediaries.

The four electronic scans reproduced above show without a shadow of doubt that certain employees of the NZ Treasury and of the RBNZ – who should know better – either have a false understanding as to how the banking and monetary system actually works, or are deliberately lying. They, therefore, have no business advising a kindergarten – let alone our government – on anything to do with finance and banking!

The employees responsible for this outrageously misleading document should hang their heads in shame! The buck must stop with the Secretary for the Treasury, and Adrian Orr, the Governor of the RBNZ. They both deserve to be dismissed forthwith.

That the Treasury and RBNZ are advising governments on the regulation of the banking industry is, IMHO, farcical. The vice chancellors of every one of our universities should hang their heads in shame, for by and large it was their supposedly-learned employees in our universities’ departments of economics who taught the fake knowledge of neoliberal, mainstream macroeconomics to those misguided Treasury and RBNZ employees who produced the then-current public consultation document!