Table of Contents

Ani O’Brien

Like good faith disagreements and principled people. Dislike disingenuousness and Foucault. Care especially about women’s rights, justice, and democracy.

The New Zealand Climate Infrastructure Fund was born at a moment of visible political scrambling rather than strategic confidence. By mid-2023, the Labour government was under pressure on multiple fronts, including rising energy costs, slowing growth, public fatigue with climate rhetoric unaccompanied by delivery, and an approaching election with an air of change about it. Against that backdrop, the BlackRock partnership functioned less as the culmination of a coherent energy strategy and more as a high-impact signalling exercise: a way to demonstrate urgency, scale, and international validation without committing public capital or confronting domestic delivery failures.

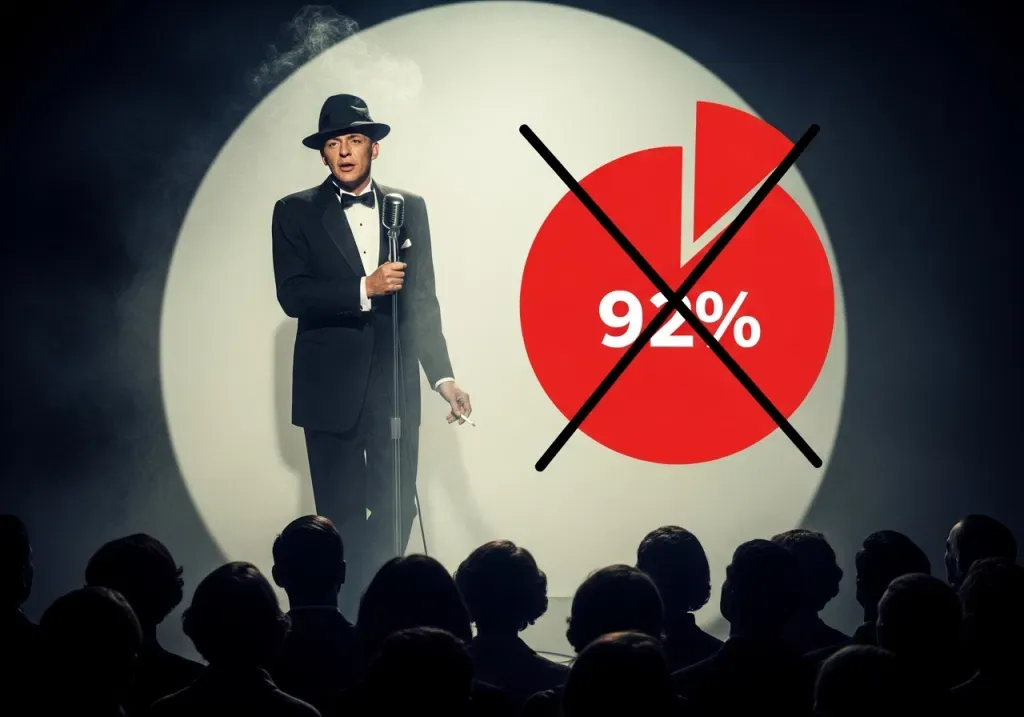

In short, it was theatrics. It was announced before any capital was raised, before Crown investors were secured, and even before any projects were identified. The language used like “first of its kind”, “watershed moment”, and “game changer” was that of political spin, not genuine transformative policy. In that sense, the New Zealand Climate Infrastructure Fund was a last attempt to reclaim the mantle of climate leadership through scale and association, rather than through delivery.

Announced in August 2023, by then-Prime Minister Chris Hipkins, the partnership with BlackRock, the world’s largest asset manager, was to establish a dedicated $2 billion fund aimed at accelerating renewable energy and low-carbon infrastructure. The initiative was heralded as a transformational climate vehicle, purpose-built for New Zealand, and a template for public-private (yes, Labour was pro-public/private for this) cooperation the rest of the world could follow.

At its core, the BlackRock climate fund was a naive and unsophisticated Hail Mary by Labour, launched at precisely the moment its government was running out of economic credibility and political time. As the 2017–2023 Labour governments had become famous for, it was an announcement acting as a facade for an absence of substance and it was heavy on superlatives. Labour was seeking to outsource its energy-climate legitimacy to BlackRock, rather than doing the unglamorous work of fixing consenting, energy storage, grid resilience, and long-term supply security.

Hipkins mistook a press conference and a billionaire CEO’s flattering words for a locked-in investment outcome, and in doing so revealed a shallow understanding of how global capital actually behaves. Serious investors do not move on vibes, ambition speeches, or political deadlines. They require regulatory certainty and returns commensurate with risk. That this was not secured before the fanfare is why the fund never deployed a dollar and why it has ultimately fallen over before it began. What was sold as a “watershed moment” has ended as an administrative deregistration and an unanswered letter.

Naturally, despite the song and dance he put on when he announced the deal, Hipkins has been very quiet on its demise. As has the media who frothed all over the deal at the time. A single Newsroom article has reported on the embarrassing abandonment of an idea that was never brought close to fruition. The rest of the media are apparently not interested in covering it, though they will surely cover the next load of ideas and promises from Hipkins as he campaigns for the election. He will, no doubt, continue to prefer symbolism over substance and to confuse press conferences with policy without fear of scrutiny.

Returning to the deal itself, it is important to understand that this was not a public investment. The Crown did not commit any capital. Instead, Labour worked with BlackRock to establish a stand-alone, country-specific, private fund that would then be “crowded into” by Crown entities, KiwiSaver funds, and offshore institutional investors. The political appeal was obvious: Labour could claim transformational climate action without adding to national debt or direct fiscal exposure.

At the announcement in August 2023, Energy Minister Megan Woods explicitly linked the fund to Labour’s most controversial climate decisions, including the ban on offshore oil and gas exploration and the 2030 target of 100 per cent renewable electricity. BlackRock executives cheered on this framing. Larry Fink called it the firm’s largest single-country low-carbon transition initiative. Australasia head Andrew Landman and Asia-Pacific climate infrastructure co-head Charlie Reid spoke of New Zealand as uniquely innovative, well-governed, and positioned to be first in the world. Flattering words that proved to be empty.

Yet even at the moment of celebration, warning signs were visible. Political economist Brett Christophers publicly cautioned that BlackRock rarely invests in renewables unless risk has already been absorbed elsewhere, usually by the state. Financial commentators noted the conceptual ambiguity asking if this was a classic infrastructure fund, or venture-style clean-tech investment? The answer was never clearly resolved. Even Greenpeace welcomed the ambition but warned that relying on overseas private capital risked backlash and poor outcomes.

Then the election later that year changed the underlying conditions entirely. The incoming National-led government quickly signalled a different approach to climate and energy. Prime Minister Christopher Luxon argued Labour’s 100 per cent renewables target threatened energy security and electricity affordability. While National did not repudiate foreign investment or renewable generation, it removed the sense of inevitability that had underpinned the BlackRock pitch. The coalition government appeared aware of the meaninglessness of a fund with nothing but a press conference in August 2023 to prove it existed at all. The fund had been sold as aligned with a specific (and lite) political vision and that vision no longer governed.

“This is a game changer for the clean tech sector and another example of the pragmatic and practical steps the government is taking to accelerate climate action while growing our economy,” said then-Prime Minister Chris Hipkins.

By mid-2024, it became even clearer that the fund existed largely on paper. Reporting revealed that BlackRock had made no investments at all through the New Zealand Climate Infrastructure Fund. It is true BlackRock was shopping the vehicle to some domestic co-investors. Both NZ Green Investment Finance and the NZ Superannuation Fund considered participation, but eventually declined. NZGIF went as far as full due diligence before formally rejecting the proposal in June 2024. The refusal undercut the central premise of the fund, as communicated by Hipkins and Labour, that public capital would help anchor and legitimise it.

The situation deteriorated further with the collapse of SolarZero, a separate but politically entangled BlackRock investment. SolarZero had received substantial backing not only from BlackRock funds but also from NZGIF lending facilities. When BlackRock declined to inject further capital in late 2024, the company was placed into liquidation, leaving workers, contractors, and suppliers owed more than $40 million. The fallout was reputationally devastating. Former staff protested and contractors sold assets to pay wages. But most humiliatingly of all, opposition leader Chris Hipkins wrote directly to his so-called partners at BlackRock seeking assistance for unpaid workers. His letter went unanswered.

Labour had held up BlackRock as a model climate partner and now the global giant was demonstrating just how indifferent it is to local social consequences. The climate fund and SolarZero were technically separate, but the distinction meant little politically. BlackRock had swatted New Zealand’s interests away like a pesky fly.

It is not possible to put this down to bad luck. The collapse of the deal was not an unforeseeable quirk of fate. It was poor judgement, plain and simple. You cannot crown a foreign investor as a climate saviour and then act surprised when they behave like a foreign investor.

And they certainly were behaving to stereotype! Behind the scenes, BlackRock itself was changing. From 2024 onward, the firm steadily retreated from high-profile climate alliances. It slashed support for climate-related shareholder resolutions, rebranded or dropped ‘sustainable’ labels on funds following greenwashing complaints, and in early 2025 formally exited the Net Zero Asset Managers initiative. CEO Larry Fink removed climate and ESG almost entirely from his annual letter, replacing them with a language of “energy pragmatism”, security, and deregulation. Apparently there was no longer social capital in overt climate evangelism: it was now a liability rather than an asset.

Against that backdrop, the fate of the New Zealand fund is hardly surprising. In November 2024, BlackRock quietly applied to deregister the limited partnership underpinning it, stating it had ceased to carry on business. In January 2026, the firm confirmed the fund would not proceed, citing “client feedback” and internal restructuring following its acquisition of Global Infrastructure Partners. No public announcement. No ministerial briefing. They did not have to pack up their desks because they had never set any up in the first place.

The BlackRock climate fund was not simply a victim of a change of government, nor merely collateral damage from America’s ESG culture war. It was a political construction first, barely an investment vehicle second, and it was announced before capital was secured, reliant on policy stability it did not control, and sold with a degree of rhetorical inflation that execution could never match. When the politics shifted, the substance was not there to carry it through.

Global capital does not invest in narratives. It invests in durable incentives and risk-adjusted returns. And governments that mistake announcement theatre for structural reform should not be surprised when the applause fades and the money never arrives.

This article was originally published by Thought Crimes.