Table of Contents

Unless you’ve been living under a rock for the past month or so, you’ll have been deafened by the outraged screeching of women. Well, not all women: just the tiny coven of permanently-outraged frightbats. Despite being amongst the wealthiest, most privileged people in the land, these shrieking fishwives would have us believe that they are victims.

Endless bleating about women’s tough lives, whining about women being badly done by, mistreated and deprived. Our captured institutions are busy trotting out dubious research reports and cherry-picked statistics claiming that the women in our pampered country are missing out and in need of urgent funding to address their disadvantage.

Despite being repeatedly debunked, the “gender wage gap” is an article of faith for the frightbat left. They’re pursuing the absurd argument even further, though, whining now about a “gender superannuation gap”.

It’s no more real than the gender wage gap, dangerous climate change, systemic racism, unicorns or Hannah Gadsby’s comedic talent.

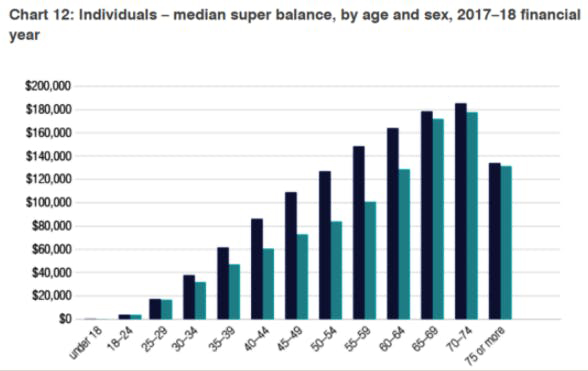

Take a look at this neat little graph buried on the ATO website:

As women grow older the gender gap in super miraculously evens out, with men and women ending up pretty much level. This means that one way or another, older women end up with more of the men’s loot.

It’s highly unlikely that these older women are suddenly earning much more to account for their increase in super balances. Most of them must be losing their partners and ending up on their own. Many of these women outlive their men – the current gap in life expectancy is about five years and with most women partnering slightly older men, they enjoy the financial benefits for long after his passing. As named beneficiaries for the man’s super what was his is now hers.

Given that the loudest squallers in the collective feminist tantrum are drawn from the ranks of the public service, it might be interesting to take a gander at the astonishingly generous manner in which Commonwealth superannuation keeps its women.

Commonwealth defined benefit super schemes pay the beneficiary for life 67% of the pension the contributor was receiving. You can simultaneously collect three of these pensions if you choose your deceased spouses carefully – the limit of three apparently came in when the relevant authority noticed they had a woman who had lodged her third death of a spouse beneficiary claim!

[…]Many older men also transfer super to their partners. People aged over 60 can access a “condition of release” to take up to $300,000 out of super tax-free. Husbands often put it in the name of a partner with a lower super balance which can help with managing taxable balances, reducing tax on death benefits, and sometimes allowing access to Centrelink payments[…]

It’s nonsense to suggest that older men live high on the hog due to tax concessions. There’s usually a grey-haired wife luxuriating right next to him on that fancy retirement cruise.

The big lie of the “gender wage gap” and its associated arguments is that when women choose – choose – to take time out to raise children and then restructure their working hours around family, they are somehow losing out to harder-working, higher-earning men.

In fact, they’re benefitting.

Right through their time together, partnered women are beneficiaries of men’s higher earnings – it’s long been the case that women control the purse strings in most marriages. That’s where the feminist argument is so duplicitous, carrying on about women’s lower super and lower earnings without taking into account the fact that most women’s economic security actually comes from living with higher-earning men.

Women have always sought out men who can provide that security (and low-income women often reject the dubious male prospects on offer, preferring more stable and lucrative government largess in the form of sole parent pensions). Most men’s economic security relies on them working full time for decades, often marking time in unfulfilling jobs.

Women also benefit from the largesse of the public purse – again, mostly paid for by men.

On average, as a group, women pay considerably less tax and receive substantially more benefits. Have a look at this Centrelink payment data – showing that in almost every category there are more female recipients than male. For instance, there are 23% more female aged pensioners than male.

That’s where significant amounts of the tax paid by these high earning men ends up – providing benefits for women.

Spectator Australia

In fact, welfare is one of the biggest costs in public expenditure: one-third of every tax dollar goes to social security and welfare. Ten cents alone goes to an aged pension dominated by women.

Maybe men should start calculating the Gender Benefits Gap – and ask for a refund.

Somehow I don’t think the feministas will like being hit with their own arguments.

Please share this article so that others can discover The BFD