Table of Contents

J d’Anconia

A central banker walks into a pizzeria and orders a pizza. When the pizza is done, he goes up to the counter. There, an assistant asks him, “Should I cut it into six pieces or eight pieces?” The central banker replies, “I’m feeling rather hungry right now. You’d better cut it into eight pieces.”

It is said that a joke is a truth wrapped in a smile. And this joke about central bankers reflects an absurdity which to us is instinctively obvious. But, as the joke implies, it’s an absurdity which reflects that our day-to-day realities are often lost on the grey suits with impressive looking letters after their names.

You see, for years we have been told by the Reserve Bank, Statistics New Zealand, politicians of all stripes, and most economists, that inflation in New Zealand was low. Sometimes 2% a year. Sometimes closer to 3%. And inflation expectations, we were told, were also low. Nothing to worry about. The boffins at 2 The Terrace in Wellington knew what they were doing.

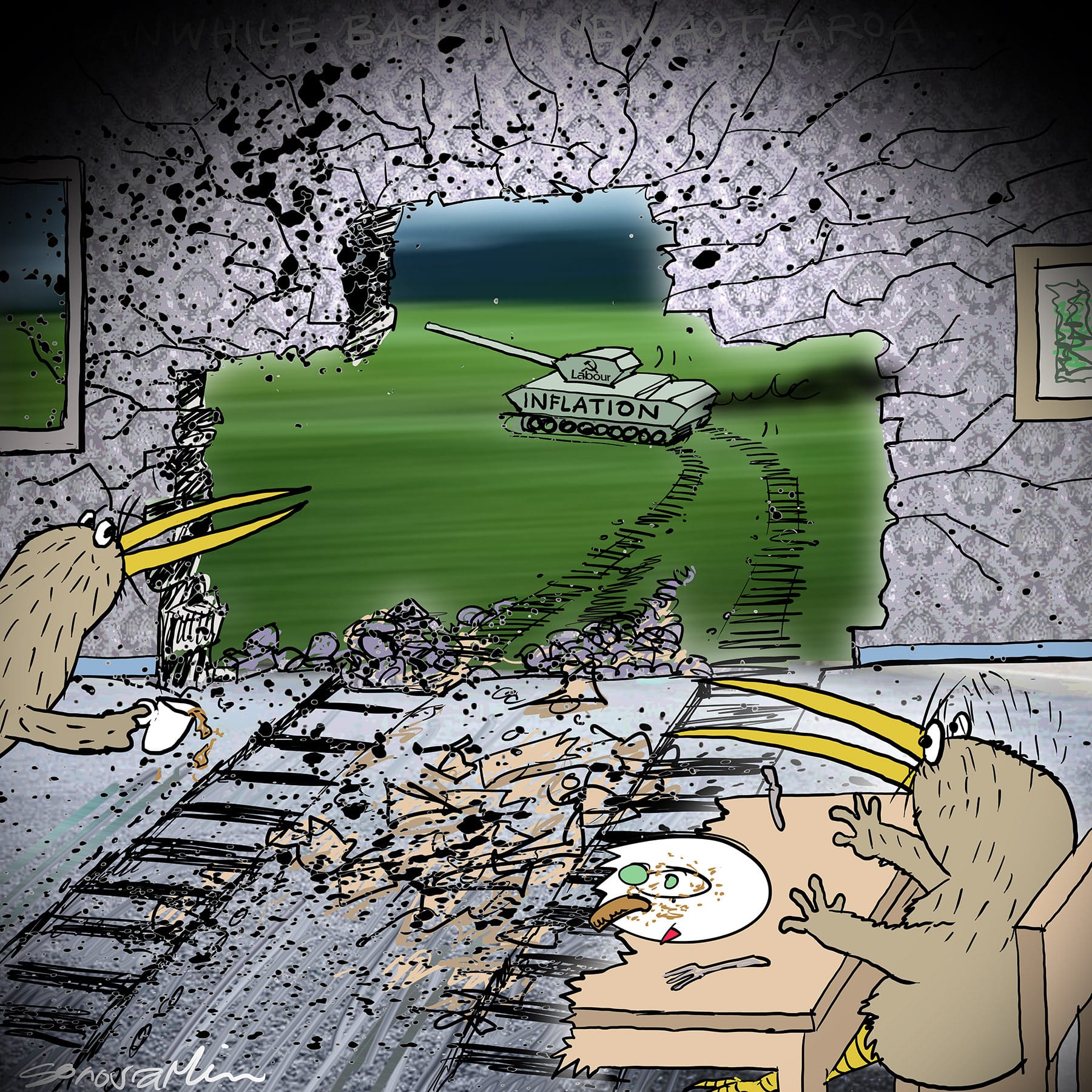

Yet we knew instinctively that the numbers we were being fed were absurd. Over the last 20 years, and even longer, we watched house prices rise dramatically. Sometimes double digit rises each year. We saw the price of food at the supermarket rise significantly. And we saw that with each passing year we had less to save or spend out of our weekly income (or we had to borrow more and more).

The average Kiwi was getting poorer. We knew it. We felt it. But we couldn’t understand why.

It was the Spanish Scholastics teaching morals and theology at the University of Salamanca in the 1500s who first articulated the root of the problem facing us today. Juan de Mariana wrote that inflation is a tax that “taxes those who had money before and, as a consequence thereof, are forced to buy things more dearly”.

While de Mariana identified the destructive nature of inflation, he also made an observation that 500 years later is proving crucial. He realised that the reduction of the precious metal content in the coins which was then used to increase the number of coins in circulation was simply a form of inflation (although he didn’t use that word at the time) and that this inevitably led to a rise in prices.

While we no longer have precious metal in our coins you may have noticed that the definition of inflation used by today’s central bankers and economists has changed from that used by de Mariana. In his 1951 essay, Austrian economist Ludwig von Mises addressed this change and its inevitable implications.

“Inflation, as this term was always used everywhere and especially in this country, means increasing the quantity of money and bank notes in circulation and the quantity of bank deposits subject to check. But people today use the term ‘inflation’ to refer to the phenomenon that is an inevitable consequence of inflation, that is the tendency of all prices and wage rates to rise. The result of this deplorable confusion is that there is no term left to signify the cause of this rise in prices and wages. There is no longer any word available to signify the phenomenon that has been, up to now, called inflation…

“As you cannot talk about something that has no name, you cannot fight it. Those who pretend to fight inflation are in fact only fighting what is the inevitable consequence of inflation, rising prices. Their ventures are doomed to failure because they do not attack the root of the evil. They try to keep prices low while firmly committed to a policy of increasing the quantity of money that must necessarily make them soar. As long as this terminological confusion is not entirely wiped out, there cannot be any question of stopping inflation.”

Ludwig von Mises

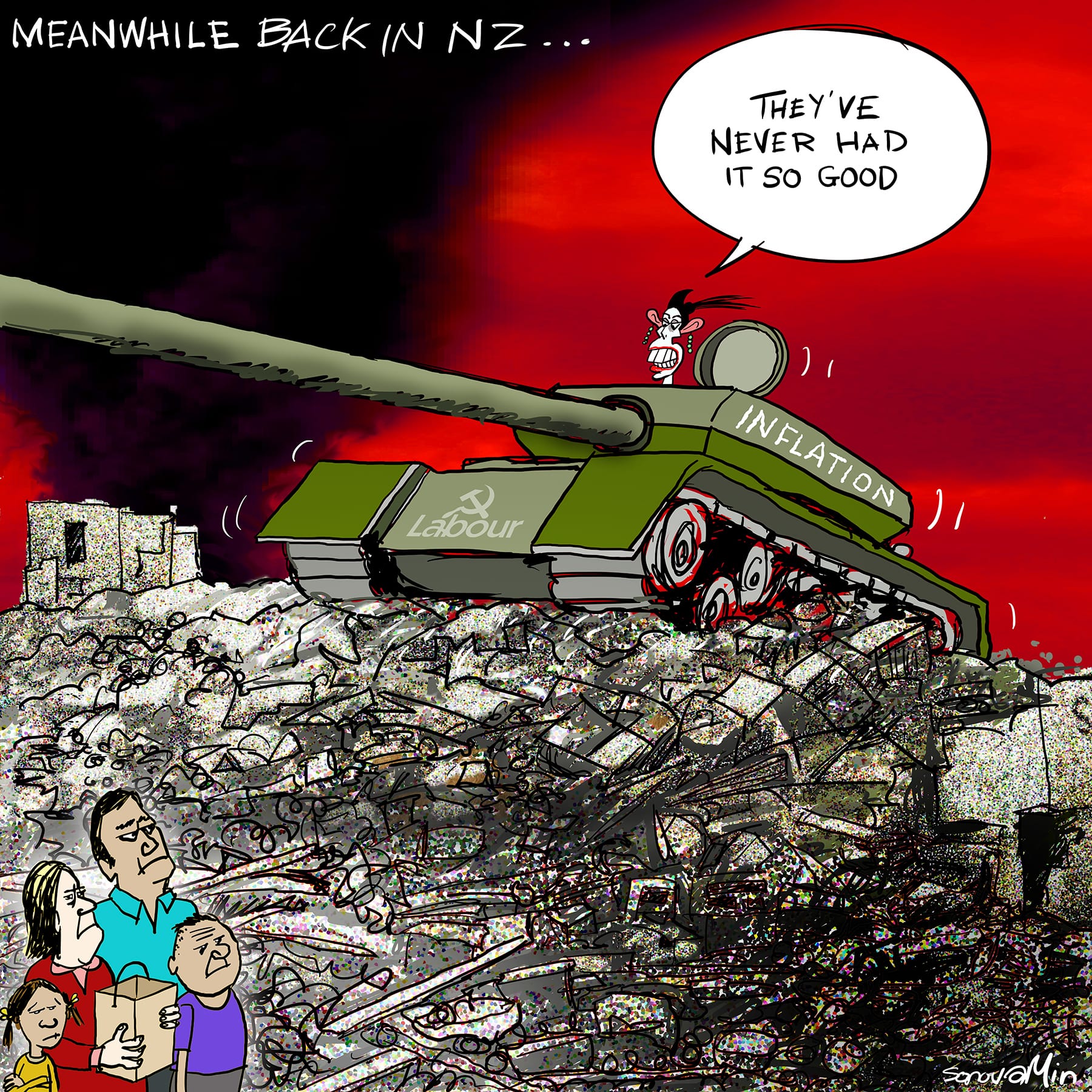

This brings us to 2022. In May the Reserve Bank raised the Official Cash Rate as it tried to address the “ongoing inflation pressures” while in the Budget the Minister of Finance announced a $350 payment for the middle class in a bid to help families cope with a 30-year high inflation rate.

What is instinctively obvious to those who recognise that inflation is monetary in nature and that rising prices are merely a consequence of inflation (which now includes you, dear reader), is that their proposed solutions are not addressing the root cause of the problem. They are merely fighting the consequences of the inflation which they themselves created and continue to create by expanding the money supply. That is, they are fighting the consequences of inflation all while they continue to create more inflation.

And that is as absurd as putting pyromaniacs in charge of the fire station.

However, while the grey suits may be unaware of what has led to this devastation, if we have learned anything over the last few years it is that many Kiwis are beginning to realise that something is not right. One by one Kiwis are beginning to lose faith in so-called experts, and that includes those who manage our financial institutions. Some are even losing faith in the fiat money system. In our currency.

And the first step to exposing what our central bank and politicians are doing to us and our country is to define inflation correctly using the centuries-old definition.

However, while this misunderstanding and confusion about the true nature of inflation continue, then, like a thief in the night, our wealth and the prosperity of our society will continue to be robbed from us.

And that, sadly, is no joke.