Table of Contents

Capitalist

After 30 years inflation has reared its ugly head once again, and – right on cue – the “experts”, the politicians, and others (all with no idea what they are talking about) have returned to misinform everybody about what has caused the inflation and how to deal with it.

This breathtaking ignorance was popular in the 1970s and 80s, by much the same sorts of people engaging in one failed anti-inflation measure after another. The end result was a poorer nation with a lower standard of living.

There are a couple of easy targets for these “experts” and politicians to take aim at; it’s already started and will no doubt intensify in the coming months.

One of these targets is to claim that pay rises cause inflation. So instead of simply parroting talking points, let us examine that claim for a moment and see where it leads.

I have never eaten McDonald’s hamburgers, nor shopped at Mitre10 Mega nor Supercheap Auto: three large employers in New Zealand with branches almost everywhere, but whose prices don’t affect me in the slightest. Let’s say all three of these companies give their employees a 15% pay rise tomorrow. Let’s say they increase their prices by a certain amount to cover this increase in their overhead.

Now let us look at what has happened: their staff are 15% better off; the rest of us are 0.000001% (or whatever) worse off. This is not inflationary folks! No amount of ignorance, no amount of stentorian lectures by politicians and other fools with no idea about the causes of inflation will make this scenario inflationary.

The other easy target is property prices. Your house rises in value 10%; as does your neighbour’s; and the house next to his, and so on down the street. Also not inflationary. My house rising in value is rather a good thing! (But feel free to sell yours for $200,000 to “be kind”.)

What actually causes inflation is quite simple. Let’s say the government spends $14. The government taxes you $10, your neighbour invests $3 in government bonds, and they simply create out of thin air the 14th dollar – as they have been doing for the last couple of years. It is having to spend $14 to buy $13 of ‘real’ things which is causing the inflation (i.e. your $10 was the result of a ‘real’ job, providing ‘real’ products and services to ‘real’ customers happy to purchase them; your neighbour’s savings were also the result of his ‘real’ job).

Another way to look at it is the funny money 14th dollar is 7.15% of the total, which is more or less the current inflation rate. Stop printing the funny money and inflation will disappear.

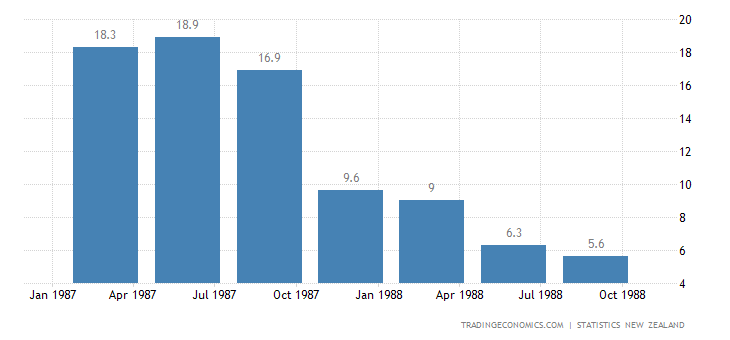

If you think I am exaggerating or being Pollyanna-ish then simply take a look at what happened last time. Our high inflation of the 1970s and 80s was cured not by “Rogernomics” or other government measures but by the 1987 sharemarket crash. Overnight $12 billion disappeared from the economy – the financial system – and 20 years of high inflation also disappeared; it collapsed from 18% in September 1987 to 6% in April 1988, en route to 1% (check the figures and you will see).