Table of Contents

The Doctor

I have disagreed with many commentators in the last few days here on The BFD about the cause of inflation here in New Zealand. Many believe that if government spending were constrained and if the government stopped borrowing money, then inflation would reduce.

But for Austrian economists such as myself, inflation is solely a monetary phenomenon rather than the result of imbalances between supply and demand such as overspending. In our view, the commentators are confusing the cause with the effect. The cause is the increase of the money supply. The effect is price increases and overspending.

This confusion continues over at the Reserve Bank. Because they mistakenly think that money being too cheap is the cause of inflation then they think that by bureaucratically increasing the price of money, they will reduce inflation.

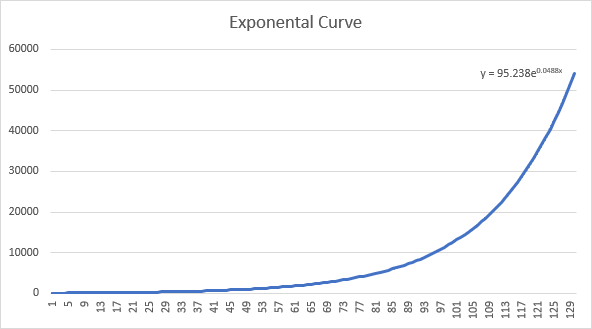

But it is worse than that. The way that the current “fiat” money system is set up means that an increase in money supply is inevitable. And inflation is inevitable. Moreover, this increase is exponential. It starts off flat for many, many years. But ultimately ends up very steep as we follow the curve over time.

Let me explain. In 1933 New Zealand left the gold standard[i]. Instead of money being gold or at least backed by gold, money was created by borrowing it into existence.

Suppose that we needed $100 money in circulation for the economy in 1934. The government would issue bonds to the value of $100 and in exchange, the Reserve bank would print $100 to be used as currency. The government takes the $100 and spends it into circulation.

Now let’s say at the end of 1934 those $100 are held by companies and private men so that the government has nothing in the coffers[ii]. How will it pay the $5 interest coupon that is due on the bond it issued at the beginning of the year? You guessed it. It will at the very least, issue another bond to the value of $5 so that the Reserve Bank can create another $5 that can be used to pay the coupon.

Imagine this process happening repeatedly. Year after year. Decade after decade. The money supply would not just happen to increase; it must increase. And the government debt must increase. And (according to us Austrians) there must be inflation as a result.

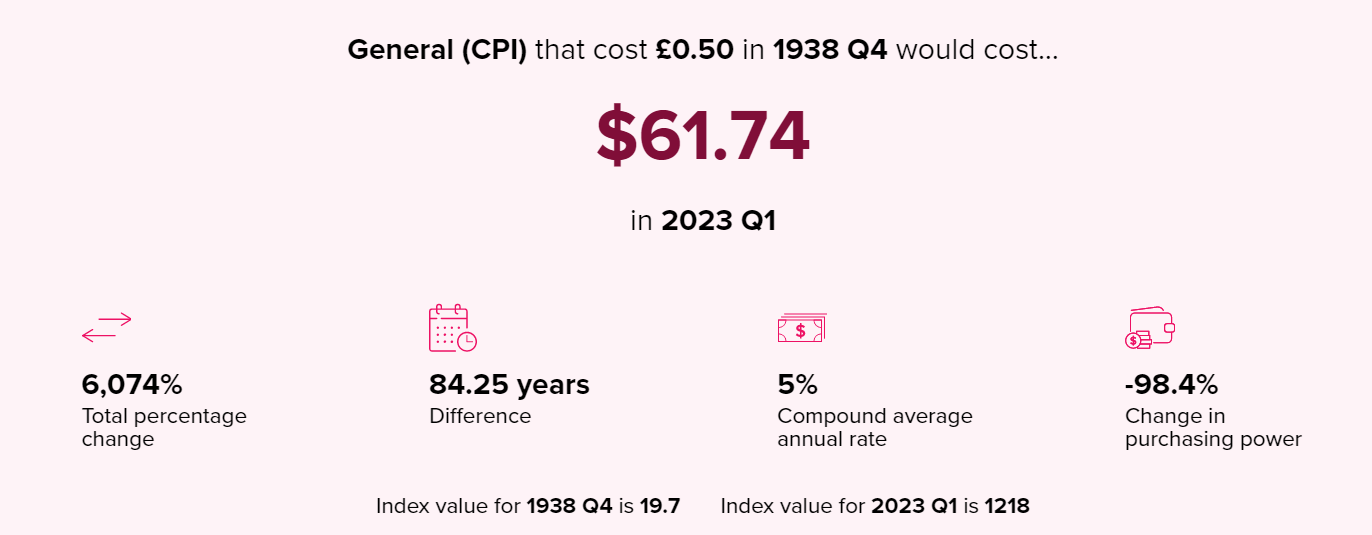

Inflation is simply more money chasing the same amount of goods and services. The economy in our example is still only worth $100 at the end of 1934 but the money supply has increased to $105. Thus each “thing” in the economy is “worth” 1.05x what it was “worth” before. All things remaining equal, the thing that cost $1, will have to be repriced to $1.05.

Figure 1 You can see that the compound average rate of inflation is 5%. The same as the typical bond coupon.

So you can see that even absent supply chain shocks or government overspending or wars in Ukraine, inflation causes an increase in price, but it is not that increase in price. You can see it from the name. Inflation makes the tyre bigger, but it is still the same tyre. It has simply been stretched bigger by additional worthless air.

This system works great up until the curve of the exponential function changes from a flat ramp to a more and more vertical slope. The government still issues that 5% extra bond each year, but the overall money supply has grown quite large. Thus 5% of it is quite a lot more money in absolute terms.

And that is where we are now. The government must issue more and more bonds. It must spend more and more money into circulation. Otherwise, there is not enough to pay the coupons on the existing debt. The government will have to default.

Thus, Covid is just an excuse. Giving money to more and more consultants, and steel works and electric cars and all manner of hare-brained schemes, are all just excuses to cover up for the inherently unstable nature of the monetary system we use.

Overspending, government debt and inflation are not bugs in the system. They are features of the system. And it is a mathematical certainty that the government must ultimately either hyper-inflate or default.

“But don’t worry,” they say. “Here is a Central Bank Digital Currency (CBDC) we prepared earlier.”

[i] Strictly speaking, NZ left the gold standard in 1914 but after the war British currency used in NZ was redeemable for gold in Britain even if it was not redeemable here. In 1933 NZ introduced its own currency and the Reserve Bank. In 1938 the NZ currency was unpegged from the British pound.

[ii] This state of affairs is encouraged in government. If you don’t spend the money this year, you will lose it in next year’s budget.