Table of Contents

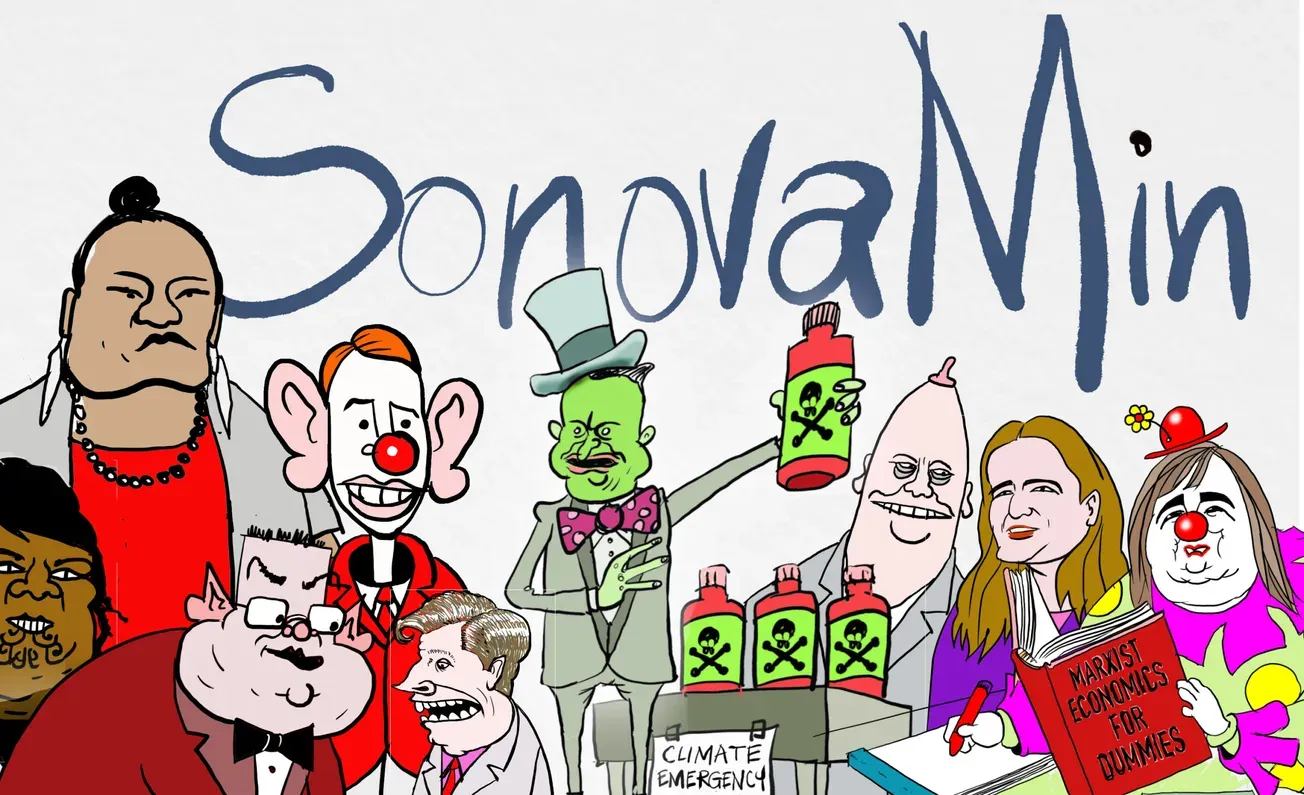

Joe Spencer

This week it came to light that the New Zealand Government is going to airdrop some free money to those of us struggling to keep up with the consequences of Reserve Bank-driven inflation. This is definitely accepted by many as great news; a respite at a time when people are struggling to keep up with power bills and other skyrocketing consumer prices as the “cost of living crisis” begins to take hold in New Zealand.

Of course, like all government interventions in the economy, it will have unintended consequences. And chances are, the problems that our dear leaders are claiming to fix, will in fact be exacerbated by this new influx of cash into the hands of consumers.

The important question is: What will everyone spend their newfound coin on? More than likely, we will see it go directly into things like fuel or food. It doesn’t take a rocket scientist to realise that this is going to have a measurable effect on the demand for these commodities. With a little more money in our pockets, when we slip on our mask and head to the supermarket, we will feel just that little bit more empowered to buy that expensive cucumber or that block of cheese that so often now feels strangely out of reach to those of us in the working class.

What does one suspect happens when demand for a scarce commodity like cheese, for example, increases without warning? Without increased production to match the increased demand, the price will tend to rise. Shocking, right?

Now comes the question of where the money came from in the first place. But does that even matter at this point? Consumer price inflation (the problem the Government is so generously fixing for us), was driven by many decades of central banks printing money. Printing mainly to keep up the illusion of growing economies. “Look our GDP is going up….” is wonderful for politicians, but not so good when one considers the Cantillon effect and the fun little fact that this enables, as Milton Friedman puts it, “Taxation without representation”.

Yes, I know, there are other drivers that push consumer prices up. Economic sanctions for example always have an impact on the supply of products or services.

In New Zealand, we saw sanctions, at a local level in a way we have never before seen in our lifetimes.

Many businesses, mine included, were told to simply stop. I couldn’t even get to my office without attempting a run at a police checkpoint. This happened with little regard to the downstream consequences, the withheld production that would see the demand for many products outpace the supply; the demand already overly stimulated by unbacked capital flows from central banks.

Will this tiny handout help us in the long run? No, no it won’t. An economy cannot spend itself into prosperity. It is simply not possible to consume before we have produced, and the world’s economies have been getting fat, consuming unbacked wealth for decades.

For a short while this deposit will ever so slightly appease our personal addictions to consumerism, bringing back a temporary high, so to speak. It will feel good for a moment. But once the high fades the cold sweats of withdrawal will set in again soon.

But for only three easy payments of $116 the Government will keep us believing that it’s doing something to help! And like the spending addicts that we are, we’ll buy it.