Table of Contents

For all the vast arsenals, proxy wars and Cuban Missile Crises, in the end the Cold War was won, not by bullets but by dollars. Brute economics brought down the Soviet Union in the end. Mostly because, especially in the Reagan era, the Soviets locked themselves into a ruinously expensive arms race put on steroids by the Strategic Defense Initiative. Moscow went broke first.

A history lesson Beijing might want to consider. As I’ve been reporting, more economists are suspecting that the official economic growth figures are grossly inflated, not to mention its claimed GDP. Youth unemployment is shockingly high. At the same time, its president is pursuing his monomaniacal dream of conquering Taiwan – which would require a seaborne invasion to dwarf even D-Day – via a massive military build up.

At the same time that it’s running out of two vital commodities: people and oil.

With regards to the former, not only is China locked into a seemingly unstoppable demographic decline, there’s some suggestions that its existing population is as inflated as its GDP.

With regard to the latter, China, which has been engaged in economic larceny on a staggering scale for decades, mostly intellectual property theft, is copping a taste of its own medicine.

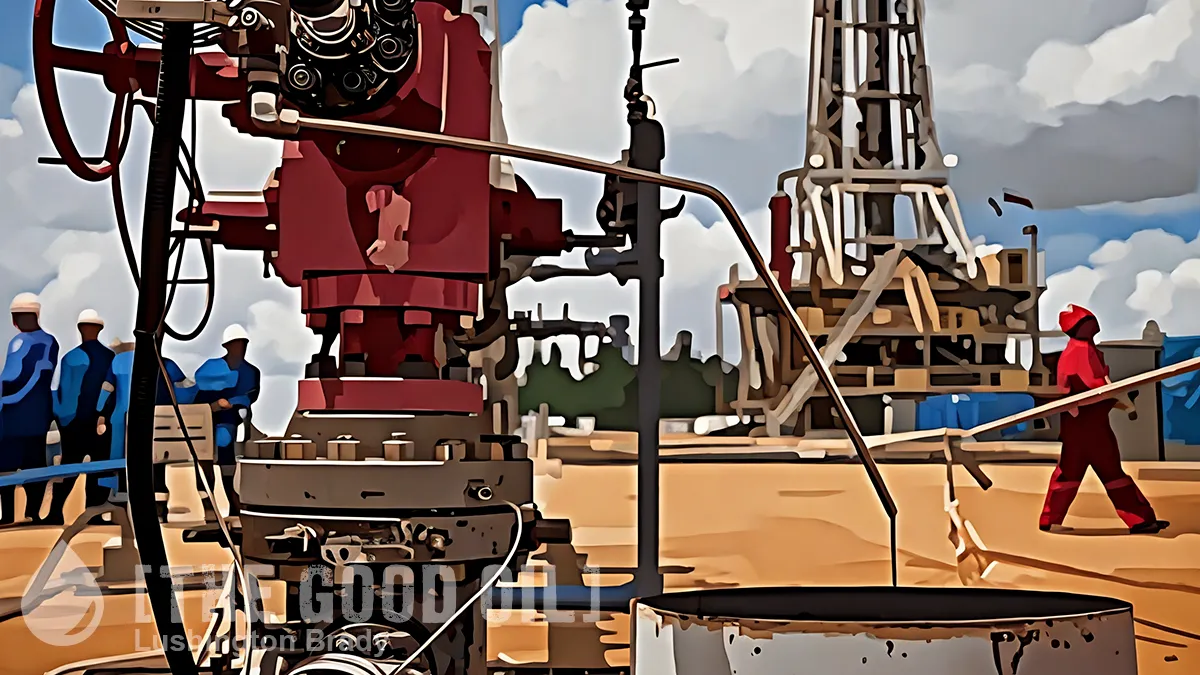

When Venezuela booted out American oil companies in a nationalization campaign nearly two decades ago, China stepped in. Now, Beijing’s foothold there is in doubt as the US asserts new power over Venezuela’s oil patch.

Venezuela’s ‘nationalisation’ campaign in reality amounted to wholesale theft of American assets. China joined in the plunder with its communist dictator buddy.

The Chinese producers expanded their claims in the aftermath of a 2007 Venezuelan nationalization drive that pushed out Exxon Mobil and ConocoPhillips. China quickly emerged as a financier, equipment supplier and political partner in what Caracas called an “iron brotherhood” that until now insulated it from US pressure.

China can still buy Venezuelan oil, US President Donald Trump has announced – but they have to pay market prices.

Nearly all of the country’s paltry output in recent years had ultimately flowed there in largely black-market purchases, at a steep discount to global prices […]

China’s embassy in Washington said its assets in Venezuela are governed by international law and benefit both nations. “China will take all necessary measures to protect its legitimate rights and interests in Venezuela,” a spokesman said.

This is, yet again, China treating international law as exactly what it is: a convenient fiction to be employed solely when it suits the whims of the powerful. The US will almost certainly reply in kind.

In speaking about China’s presence in Venezuela this month, Secretary of State Marco Rubio echoed the administration’s national-security strategy to “deny non-Hemispheric competitors” control of the region’s vital assets. “You cannot continue to have the largest oil reserves in the world under the control of adversaries of the United States,” Rubio told NBC’s Meet the Press on Jan 4.

For all the delusional fantasies of the Climate Cult, the Oil Age is very far from over. Oil will continue to be a vital strategic resource for decades to come, probably the rest of the century. A strategic resource China badly needs.

China was desperate for oil when the late Venezuelan leader Hugo Chávez in 2007 stood under a banner that read “Full Oil Sovereignty, the Road to Socialism.” As ConocoPhillips and Exxon refused to cede control of fields they had developed, Beijing jumped at the chance to buy in.

The Chinese economy at the time was blisteringly hot and on its way to topping the world in energy consumption, and Beijing was frantic to lock in what it called energy security.

Its list of sympathetic suppliers is growing thin. China was also buying embargoed Iranian oil, in turn keeping the Islamic dictatorship from completely starving – until its major port and oil export terminal blew up last year, which realistically leaves just Russia as a China-sympathetic energy exporter. Saudi Arabia also supplies China, but is moving increasingly closer to the US.

The blow to China is also a massive economic one. Venezuela was yet another pawn in China’s debt-dependence drive of recent decades. Suddenly, America is in the position to dictate where Venezuela’s money goes.

What could be problematic for Beijing is Trump’s assertion of US control on the money generated by Venezuelan exports, particularly if whatever new sales mechanism Washington might approve unravels an oil-for-debt-relief arrangement that has for years governed China-Venezuelan trade. Venezuela owes at least $10 billion to China, its largest creditor.

Which is $10 billion China is going to need very badly.