Table of Contents

Larry Bell

cfact.org

CFACT Advisor Larry Bell heads the graduate program in space architecture at the University of Houston. He founded and directs the Sasakawa International Center for Space Architecture. He is also the author of “Climate of Corruption: Politics and Power Behind the Global Warming Hoax.”

Sure.

So here’s the rationale as I understand it.

First let’s end billions of years of climate change by switching over from the 85% of reliable world energy that comes from fossil sources by increasing from the 3% of seasonal and weather dependent wind and solar systems we buy from China which is building the equivalent of one coal-fired plant weekly to achieve “net-zero” global greenhouse gas emissions.

Then we’ll replace the current 98% of petroleum fueled cars and trucks by government subsidies and mandates that grow the current 2% of electric vehicles (EVs), add them to already overloaded power grids, and purchase the rare earth minerals required for all those intermittent solar, wind and EV batteries from China which controls 85% of the world supply.

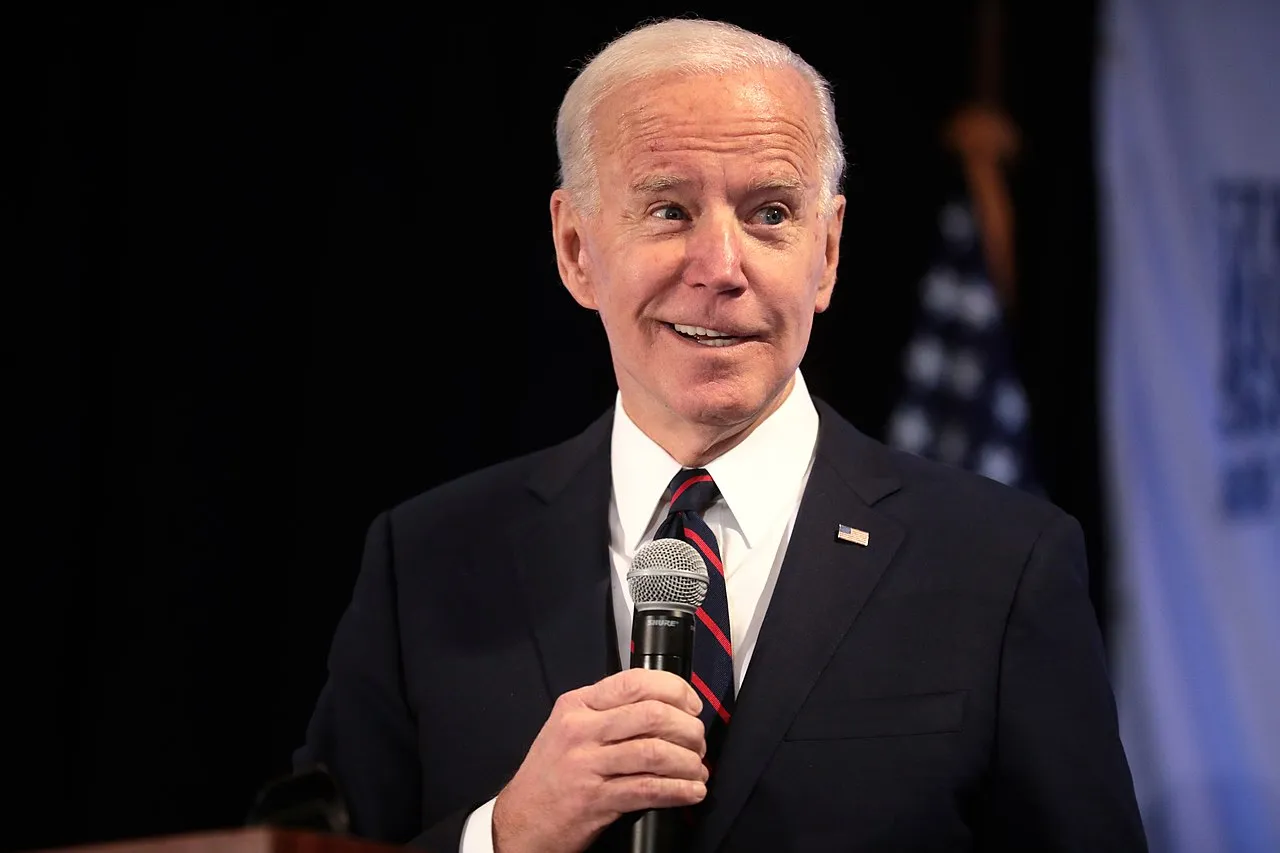

It’s not as if America doesn’t have rare earths of our own … we have plenty. The problem is that environmental activists don’t want us to mine them, and the Biden administration is considering a 20-year delay of new rare earth mining operations in northern Minnesota.

Meanwhile, let’s also regulate those climate ravaging hydrocarbons out of existence.

Like, for example, capping off the Keystone XL pipeline from Canada and drilling permits in the Arctic National Wildlife Refuge (ANWR), while simultaneously giving President Vladimir Putin a pass to complete Russia’s Nord Stream 2 pipeline under the Baltic to sell natural gas to Europe that we could have provided.

In addition, Biden has put 1.87 million acres of federal Utah land off limits to oil and gas production as a “national monument,” and his administration is reportedly considering the shutdown of another major pipeline, the Embridge 5 line that currently delivers a half-million barrels of light oil through Canada and Michigan.

On top of that, why not task the U.S. Labor Department to direct and enlist influential global asset managers into the regulatory process with anti-fossil Environmental, Social, and Governance (ESG) investment score determinations? Such woke considerations should penalize assessments of negative impacts on climate change, and reward investments in sanctioned “green” energy projects.

BlackRock, for example — the world’s largest asset manager — screens out investments in companies with bad ESG ratings for supporting coal and oil, although their huge funding in Chinese enterprises that violate every ESG standard imaginable don’t seem to warrant any scrutiny.

And now, as America’s recent energy independence from Middle East oil fades from memory, fuel and electricity prices skyrocket, and we brace ourselves for a brutally expensive winter heating season, we know exactly whom to blame.

It’s of course those greedy OPEC opportunists and Russians who refuse to pump more of that dastardly climate polluting stuff, along with our own Big Oil companies that are driving up those politically painful pump prices.

Or maybe not.

The real surprise shouldn’t be that oil prices are highest in a decade with natural gas now up about double year-to-date, but rather that deliberate Democrat actions to accomplish American energy poverty have been so effective so fast.

Nor so entirely clueless.

Adding idiotic irony to colossal lack of self-awareness, White House officials recently asked oil and gas industry executives how best to moderate price increases.

The next step was to deflect blame for consequences of his own policies.

On Nov. 17, Biden sent a letter to Federal Trade Commission Chair Lina Khan asserting that there is “mounting evidence of anti-consumer behavior by oil-and-gas companies.” He urged her — as if she needed his prodding — to investigate illegal conduct and “bring all of the commission’s tools to bear if you uncover any wrongdoing.”

During a Nov. 5 interview, Energy Secretary Jennifer Granholm, a former Michigan governor, declared it “hilarious” to think the White House could bring down energy prices. “Would that I had a magic wand,” she mused.

Nevertheless, even without that wonderous wand, waving a little virtue-signaling flag might at least make it appear that he was doing something to bandage the self-inflicted energy inflation wounds.

So on Nov. 23, the Biden Energy Department announced that in December it will begin releasing a paltry 50 million barrels of oil from the U.S. strategic petroleum reserve (SPR), amounting to about three days-worth at our nation’s current consumption rate.

The result?

Instead of lowering prices, the announcement immediately triggered wholesale crude prices to rise as market analysts doubted the releases were big enough to cover surging demand amid the highest inflation in more than three decades.

This occurred after the administration had been hinting at a coordinated global release in previous weeks, causing traders to overbake exaggerated benefits into the pricing. This reportedly influenced oil stocks to rise significantly; according to Continental Resources by 8.3%.

The White House had been pleading with OPEC and its allies to increase outputs for months, contending that there wasn’t enough global oil to meet demands as the global economy rebounds from the pandemic.

By early November, OPEC and Russia-led producers correctly told White House officials that it wasn’t their problem, leaving them no symbolic action option other than a small raid on U.S. reserves.

Despite ironic Biden administration harping that they aren’t pumping enough of the evil brew, the OPEC+ cartel has steadily been raising supply by about 400,000 barrels per day each month. Saudis are comfortable with current oil prices at about a break-even $8 per barrel revenue budget level.

The Kingdom also reportedly worries that a negotiation-desperate Biden administration will lift oil sanctions against Iran in exchange for a renewed nuclear deal.

In the meantime, the Democrat climate of war on fossil energy supply continues unabated as the Biden administration has recently asked the Fifth Circuit Court of Appeals to reverse a lower judge’s injunction on its ban on oil and gas leases on federal land.

Biden’s nominee for the Treasury Department’s Comptroller of the Currency, Saule Omarova, has gone on record saying: “A lot of the smaller players in that [fossil fuel] industry are going to, probably, go bankrupt in short order — at least, we want them to go bankrupt if we want to tackle climate change.”

All such policies to penalize production and raise costs are particularly chilling during a season when drillers fill storage tanks and caverns to prepare for frigid temperatures that drive heating demands.

The U.S. Energy Information Administration (EIA) estimates that the volume of natural gas in storage is currently 16.5% less than a year ago, and U.S. power plant coal inventories are expected to fall to the lowest figures since at least 1997.

As a result, analysts predict it might not have to get extraordinarily cold this winter for prices to reach heights unknown during the shale era which transformed the U.S. from a gas importer to supplier to the world.

All these policies to curtail American oil, gas and coal production empower adversaries, especially China, Russia, and Iran.

Don’t let anyone fool you that climate and white supremacists are our greatest threats.

Keep the truly most dangerous home-grown culprits in mind this winter when your lights go out, your politically correct plug-in EV won’t recharge, and your water pipes freeze.

This article originally appeared at NewsMax

Please share this article so that others can discover The BFD.