Table of Contents

16th August 2021

The disastrous American extraction from Afghanistan has major geopolitical implications for the region. The manner of the pull-out sends a message to its allies, and NATO and the UK are especially brassed off with the USA. Russia and China have responded speedily, saying that they will recognise the new regime and look forward to building relationships with it. Oddly enough, Afghanistan is home to some of the world’s most highly desirable minerals.

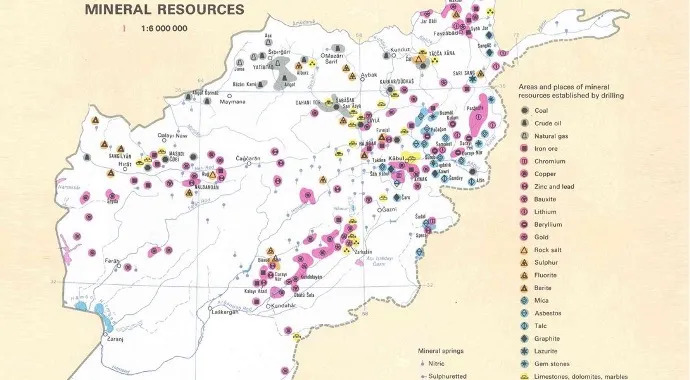

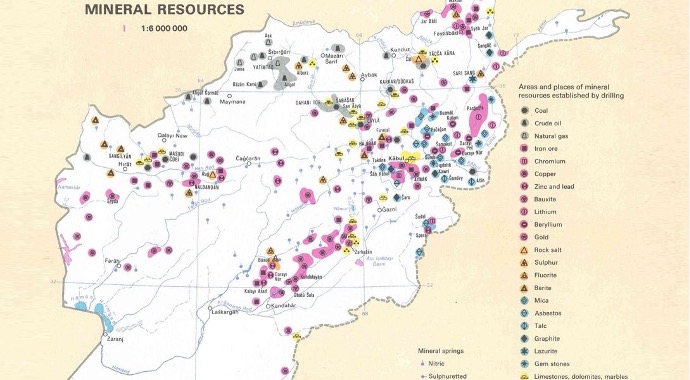

Afghanistan has vast reserves of gold, platinum, silver, copper, iron, chromite, lithium, uranium, and aluminium. The country’s high-quality emeralds, rubies, sapphires, turquoise, and lapis lazuli have long charmed the gemstone market.

The United States Geological Survey (USGS), through its extensive scientific research of minerals, concluded that Afghanistan may hold 60 million metric tons of copper, 2.2 billion tons of iron ore, 1.4 million tons of rare earth elements (REEs) such as lanthanum, cerium, neodymium, and veins of aluminium, gold, silver, zinc, mercury, and lithium.

According to Pentagon officials, their initial analysis at one location in Ghazni province showed the potential for lithium deposits as large as those of Bolivia, which has the world’s largest known lithium reserves. The USGS estimates the Khanneshin deposits in Helmand province will yield 1.1.-1.4 million metric tons of REEs. Some reports estimate Afghanistan REE resources are among the largest on earth.

Source The Diplomat February 2020.

Coming back to Myanmar, the two countries giving major support to the Junta are, (yes, you’ve guessed it), Russia and China.

The coup and resulting state of emergency quickly resulted in concerns in China over metal and mineral supplies from its neighbour.

- Myanmar is the world’s third-biggest miner of tin and in 2020 accounted for more than 95% of China’s imports of tin concentrate, used by smelters to make refined tin for circuit-board soldering. China’s overall import reliance is 30-35%.

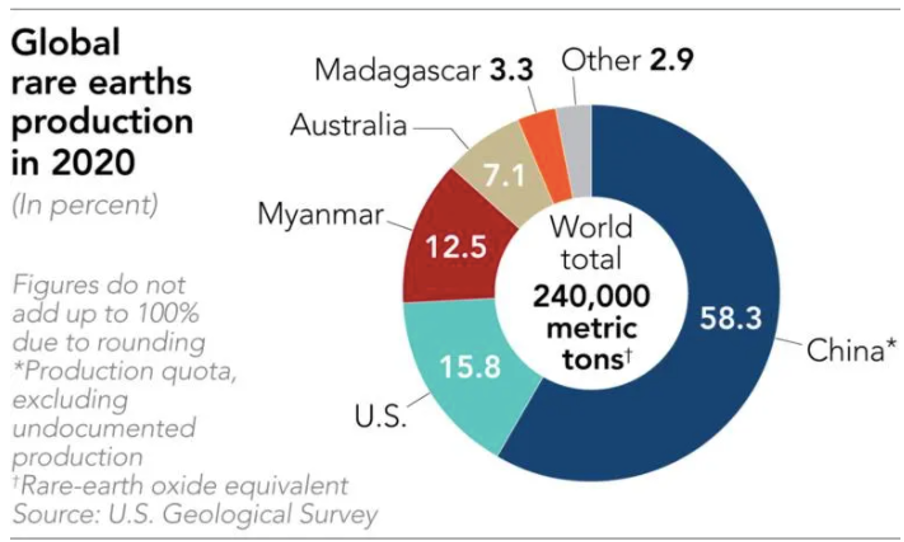

- While China is the world’s dominant producer of rare earths, it relied on Myanmar for about half its heavy rare earth concentrates in 2020.

- Myanmar was the world’s 18th-biggest copper producer in 2019, with all output coming from two projects led by China’s Wanbao Mining, a unit of military supplier Norinco. Refined copper cathode shipments to China from Myanmar were 108,584 tonnes in 2020—a negligible part of record imports of 4.5 million tonnes from all countries.

- As reported by Roskill on 25 March, all ionic adsorption clay (IAC) mining operations in China, including those who had operated throughout in 2020, asked to be suspended in late February, and there are no signs of any re-start yet. The proposed introduction of ammonia-free in-situ leaching technology at various IAC projects in China has not materialized over continued concerns regarding pollutants, recovery rate and social impacts.

- This means that there are very few operational alternatives to Myanmar-derived production of heavy rare earth elements (HREEs) such as dysprosium and terbium, with viable sources either only in pilot scale production or producing mixed HREE products as a by-product of Nd-Pr, the Roskill analysts said.

- In 2020, Myanmar accounted for 39% of global HREE mine production, with China itself the only other major producer of HREE mined products at 48% of global supply. In comparison, the next largest producer of HREE mined products was Lynas Corporation at roughly 5.5% global supply. There are reported to be stockpiles of refined HREEs, including dysprosium and terbium compounds, held by both private and public inventories, which could be drawn down in China, though without primary production these inventories would soon become depleted.

*Source: Green Car Congress April 2nd, 2021.

Can anyone see a pattern emerging here? The USA (and consequently the West) has lost access to valuable mineral resources in Afghanistan, having lost influence to Russia and China.

The USA and the West are having difficulties in deciding on a policy towards the Junta in Myanmar. First off the rank to support the Junta were Russia and China who will probably gain favourable access to Myanmar’s mineral resources.

One big loser in both cases is India, and China will exploit any opportunity it has to irritate the Indian government.

What will this do for Oceania? Well, it will impact the production of chips and modern technology, whether increasing prices or potentially limiting access to the latest technology, much of which is made in China.

It makes me wonder who the geopolitics expert in the USA administration is and what their strategy is.

Please share this article so that others can discover The BFD