Table of Contents

We face an economic disaster, the likes of which most have never experienced in their lifetime. The financial blowout is the result of Jacinda Ardern’s decision to lock down healthy people and businesses, as well as the policies of her socialist Labour Government’s out-of-control spending and borrowing. The debt is eye-watering and embarrassing.

Jacinda’s Labour Government loves to tax hardworking Kiwis. There are other governments who have decided to help their people through the pain of a looming recession.

Some countries are lowering taxes.

They are reducing taxes to help sectors of their economies hit hardest by the Coronavirus Pandemic. KPMG, a UK accounting firm, on 13 July 2020, reported a temporarily reduced rate of VAT (value added tax) for hospitality in the UK.

The UK will introduce a temporary reduced rate of 5% for certain supplies, aiming at helping the hospitality and tourism sectors.

KPMG also states,

Germany cuts VAT from 19% – 16% temporarily, at a cost of €20 billion. “This is the first major global attempt at fiscal easement to stimulate consumer demand. It signals policy moving into a new phase as governments attempt to deal with the rapidly moving health and resulting economic crisis.

BBC on 15 July 2020 reported VAT cuts in Scotland.

Scotland is reducing VAT from 20% to 5% designed to help sectors of the economy hit hardest by the pandemic. This reduction applies to a lot of supplies including food and non-alcoholic drinks, in restaurants, pubs, hotels, campsites and admission to tourist attractions.

New Zealand

New Zealand has a 15% flat GST (Goods and Service Tax). Kiwis live in the highest taxed country in the OECD (Organisation for Economic Co-operation and Development) in terms of sales tax as a proportion of GDP. Therefore, all food is expensive.

Grocery costs

Kiwis realise that grocery shopping in New Zealand is very expensive. It seems unfair to find some foods are much cheaper in Australia. The GST in Australia has a tax of 10% on most goods and services sales. However, there is no GST for certain foods.

Likewise, some foods in the UK do not have any VAT added to the cost. This makes basic food items a reasonable cost for every shopper.

What would really help New Zealanders would be the removal of GST from all unprocessed food.

The UK does not tax unprocessed food, such as fruit and vegetables, fish, meat, poultry, and eggs, but other items are also zero rated for VAT, such as:

- Biscuits (not chocolate covered)

- Bread, rolls, baps & pitta bread

- Cakes (including Chocolate teacake, Jaffa Cakes)

- Canned & frozen food (not ice cream)

- Cereals

- Chilled/frozen ready meals, convenience foods

- Cooking oil

- Milk, butter, cheese

- Nuts & pulses (raw for human consumption)

- Salt (culinary)

- Sandwiches (cold)

- Tea, coffee & cocoa

- Water (household)

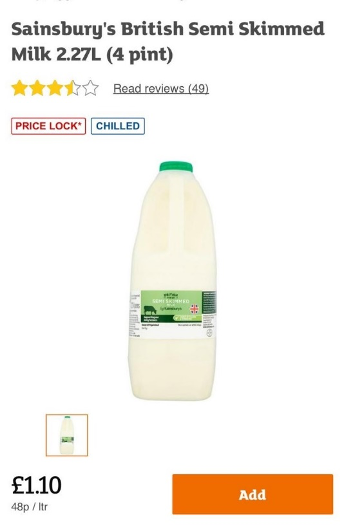

We live in the land of milk and honey, but look at what they pay for milk in the UK. (Sainsbury is not a budget supermarket).

That is about 97 NZ cents a litre. Kiwis deserve a prime minister and team who are fiscally savvy and, as Judith Collins states, “have real-world experience”. We need responsible professional leaders for both sides of the economy

If you enjoyed this article please consider sharing it with a friend.