Table of Contents

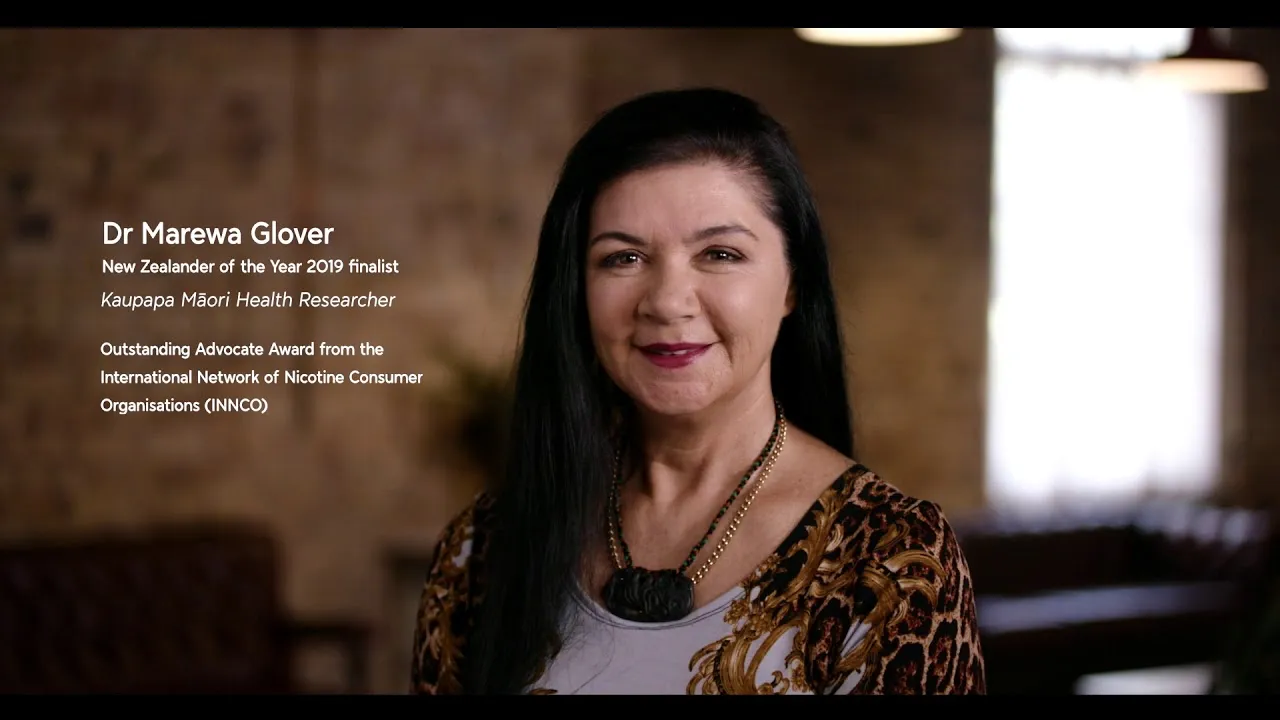

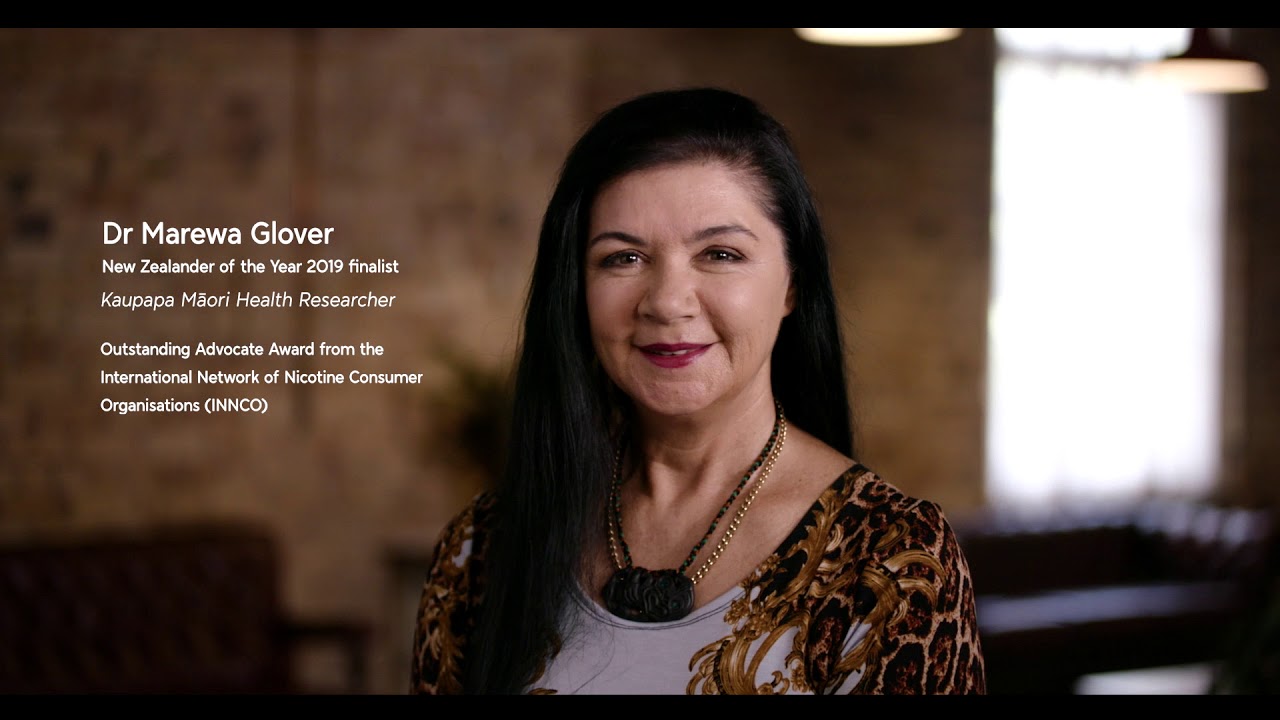

Researcher Dr Marewa Glover has calculated the tax take from Maori and has found that Maori paid $723 million in tobacco taxes, $264 million in alcohol taxes and $161 million in gambling taxes. She wants it all given back to Maori.

Quote.“Smoking rates for European New Zealanders and Maori have slowly reduced over the last four decades in tandem, which people think is equal and fair, but this is not what equity is about.End quote.

“No Government over that time has done anything effective to reduce the disparity between Maori and non-Maori smoking.”

And why is this issue of personal responsibility the role of government?

Quote.European New Zealander smoking rates were at 13.2 per cent, whereas for Maori it was 33.5 per cent.”End quote.

Glover said the findings were a “kick in the guts” for those working to improve Maori wellbeing.

“If you’re working to improve Maori economic and social wellbeing, these figures are a kick in the guts.

And the government is responsible for forcing Maori to smoke, drink and gamble, is it?

Quote.“The amount of revenue that Government is siphoning off Maori each year just in taxes on tobacco, alcohol and gambling is way more than the 8.5 per cent return post-settlement tribal entities are earning on their $9 billion asset base.” […]End quote.

“Imagine how much faster the Maori economy could grow, and how many Maori families could be lifted out of poverty, if spending on these behaviours could be positively redirected.”

Glover said the $1.1b in taxes could pay for almost 1700 KiwiBuild homes.

“In the hands of iwi, $1.1b could be used to build many more homes than that.”

Surely it is way better to cut out the middleman and the bureaucracy involved in collecting the taxes, working out who is Maori and siphoning off their contribution into another pot to redistribute to Maori?

If you want to get out of poverty, why not keep the money in your pocket? Absolutely ensure that “spending on these behaviours [is] positively redirected” by not buying ciggies, six-packs and lotto in the first place?

Quote.The disproportionately higher rates of smoking among Maori meant Maori were disproportionately hurt by punitive taxes and fines aimed at curbing smoking, Glover said.End quote.

“It is not necessary for the Government to keep increasing the tax, for example on tobacco – it’s a choice they make.

It is not necessary for Maori to keep paying the tax, for example on tobacco – it’s a choice they make.

Quote.“The choice they’re making is to stunt Maori advancement by keeping the poorest groups who have the highest rates of smoking locked in poverty.”End quote.

Glover said the excess tobacco tax – the extra amount Maori disproportionately pay – should be distributed to iwi to reduce smoking prevalence. […]

A Newspaper

Is this not a bit back-to-front? If Maori reduced their smoking prevalence (took control of their own future rather than expecting a tax redistribution) then there would not be this ‘extra amount of tax paid’ and the money would not need to be distributed to iwi. It would stay in their pockets.

Who is to say that the ‘poor’, the smokers, the drinkers and the gamblers would get any more benefit from this new tax redistribution scheme than they have got from the Treaty Settlement tax redistribution scheme.

The Treaty settlement money does not seem to be having any great trickle down effect as yet. Why would this scheme be any better?