This is edition 2025/117 of the Ten@10 newsletter.

Welcome back. It's 2025 and 20 years since I started writing about politics and anything else that took my fancy. Thank to my VIP members for making this site what it is today. In July we will be having a 20th birthday celebration. Stay tuned for more announcements.

Last Day before the event!

This is the Ten@10, where I collate and summarise ten news items you generally won't see in the mainstream media.

Enjoy!

1. Uber’s influence empire in New Zealand – A tax dodger’s political playbook

Bryce Edwards

- 🚗 Uber’s Tax Avoidance: Uber avoids taxes in NZ by misclassifying drivers as contractors and under-reporting its revenue. This leads to lower local tax payments and significant profit offshoring.

- 💸 Misclassification Strategy: Uber mislabels drivers and its revenue, making the company appear smaller and avoiding tax obligations. In 2023, NZ reported only 42% of its earnings locally, siphoning millions to tax havens.

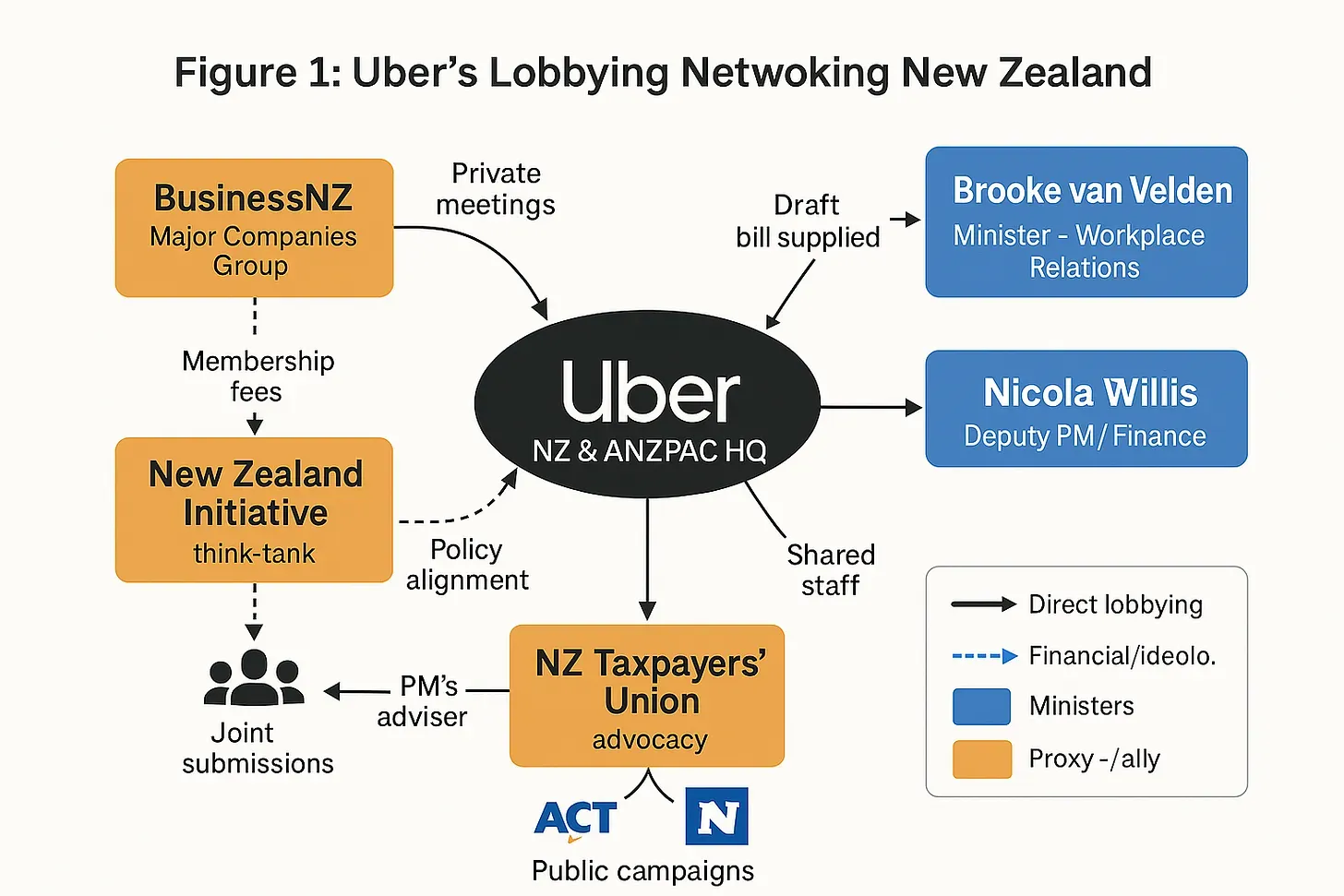

- 🏛️ Political Influence: Uber’s political lobbying in NZ has shaped laws in its favor. It influenced recent changes to employment legislation, including the introduction of a "gateway test" to classify workers as contractors.

- 📝 Government Cooperation: The NZ government, particularly the Act Party, seems to have adopted Uber’s policy suggestions directly, with allegations that Uber wrote its own regulatory framework, bypassing normal democratic processes.

- 📉 Impact on NZ: Uber’s practices deprive NZ of significant tax revenue, estimated at $56 million for 2023. This undermines public services, like healthcare and education, while benefiting a multinational corporation.

- 🔄 Revolving Door: The close relationship between Uber and NZ lawmakers raises concerns about policy capture, with the government accused of prioritizing Uber’s interests over the public’s.