Table of Contents

Information

Opinion

Nothing contained in this opinion piece constitutes a solicitation, recommendation, or endorsement. It should not be taken as professional and/or financial advice.

Just over a week ago a small event occurred that I didn’t pick up on until earlier today when it was drawn to my attention. It amounts to the final piece of the puzzle which leads me to conclude that 2022 is looking remarkably like 2008 (and 1974); time to ensure you are not chopped up and spat out, folks.

What occurred was interest rates on Kiwi Bonds (the retail version of NZ government bonds) increased to the level whereby you really should start to panic. I always said 3% was “time to panic” and it was increased to 2.9% (so, ‘close enough’). The interest rate (the “yield”, as it’s known) on wholesale government bonds (i.e. if you buy the bonds on the market) is up to 3.75%. Bear in mind these interest rates were basically zero not too long ago.

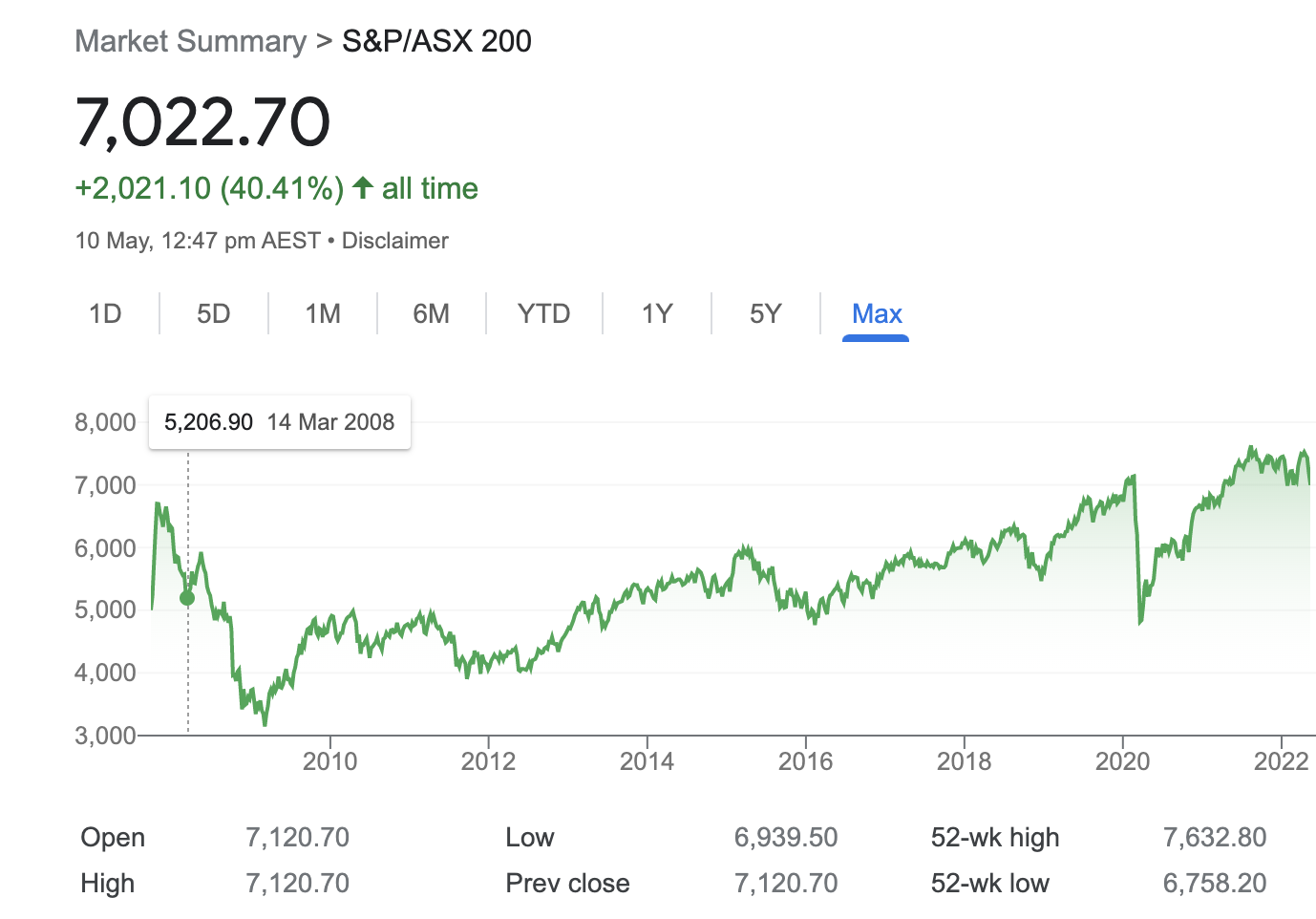

There are quite a number of other matters which are occurring and data which are very troubling, reminiscent of 2008 and the crash that followed. It also happened back in 1974 (but who can recall that?). Of particular concern in this part of the world has been the bizarre situation whereby the Australian sharemarket (where vast sums of your Kiwisaver money are invested) is at levels which bear little relation to the Australian economy and other problems across the Tasman.

In early 2008 the Australian sharemarket index fell, and then something quite odd began to happen; the market stabilised (and actually started to rise in March and April) before a collapse did occur. Similarly in the last year or so the ASX index hasn’t fallen the way you would have expected.

My point is simple: governments and central banks have been pumping money into the system, propping up markets, and eventually, the end of the rope is reached and the free market’s inviolate ‘laws’ prevail.

We have reached that point now and the crash hasn’t even got warmed up yet. I have been around a while, I have seen this sort of thing before and it seems it’s happening again.

Why mention the Kiwi Bonds interest rate? What it means is this – why take risks to earn, say, 8% to 10% in (for instance) a managed fund when you can take no risk whatsoever and earn 3%? (or 3.75% wholesale). Is it really worth risking a sharemarket crash for what amounts to an extra 5%? When interest on government bonds was 0.5% and your fund manager was getting you 12% then it was worth the risk but that is not the case today.

Even if your fund manager managed to get you any return at all (i.e. 0%; almost all have experienced negative returns so far this year) you are still better off buying government bonds simply because there is no risk involved. I should also note that interest rates on government bonds are going to rise even further. If the rate was, say, 5% (and don’t be surprised if that happens by July) or 7%, why would you take all the risk by making other investments in falling markets? It doesn’t make any sense.

My advice, dear reader, is to move into cash and government bonds to ride out the storm that is about to hit. If you don’t have enough cash in the bank today to cover your overhead from now until the end of next year (I am being serious: an entire year and a half!) then start selling [falsely inflated] assets until you do. Personally, I have been in cash and out of the markets for over a month as the house of cards is about to collapse.

Sources:

- https://debtmanagement.treasury.govt.nz/individual-investors/kiwi-bonds/kiwi-bond-interest-rates

- https://tradingeconomics.com/new-zealand/government-bond-yield

Look at the ASX 200 index. You can see in March/April 2008 the market rallied before going tits up. Compare that with March/April this year. It is kinda chilling for everybody’s super money.