Table of Contents

Last week Sean Plunket had on his show a couple of self-styled “investment advisors”. Taking a look at their website, they appear to be life insurance salesmen who also peddle KiwiSaver (hardly Warren Buffett). Another red flag casting doubt upon their usefulness was some of the things they said to listeners and viewers, dressed up in stentorian tones to pretend it’s sage advice. It isn’t: they’re just repeating a few catchphrases they’ve picked up along the way, probably from other dubious life insurance salesmen at various conferences they’ve attended.

What I have a problem with is the following:

1. They are charging a $1500 fee for advice. This is no doubt to imply that by paying all this money the advice must be both important and the advisor knows his stuff. Please don’t fall for it. If you’re really ignorant about investments, you can either read my essays on this website about investing or simply trot along to your bank where they have people to assist you for free.

2. The querying on whether KiwiSaver could be a person’s entire retirement portfolio: notwithstanding the answer to this question in the video at 4 minutes 25 seconds, once again done to pretend you’re dealing with some sage advice givers and really smart cookies, the more money you have in your KiwiSaver account, the greater the income it will generate (e.g., $2 million in Kiwisaver generates more money than $350,000). Fairly simple logic I would have thought.

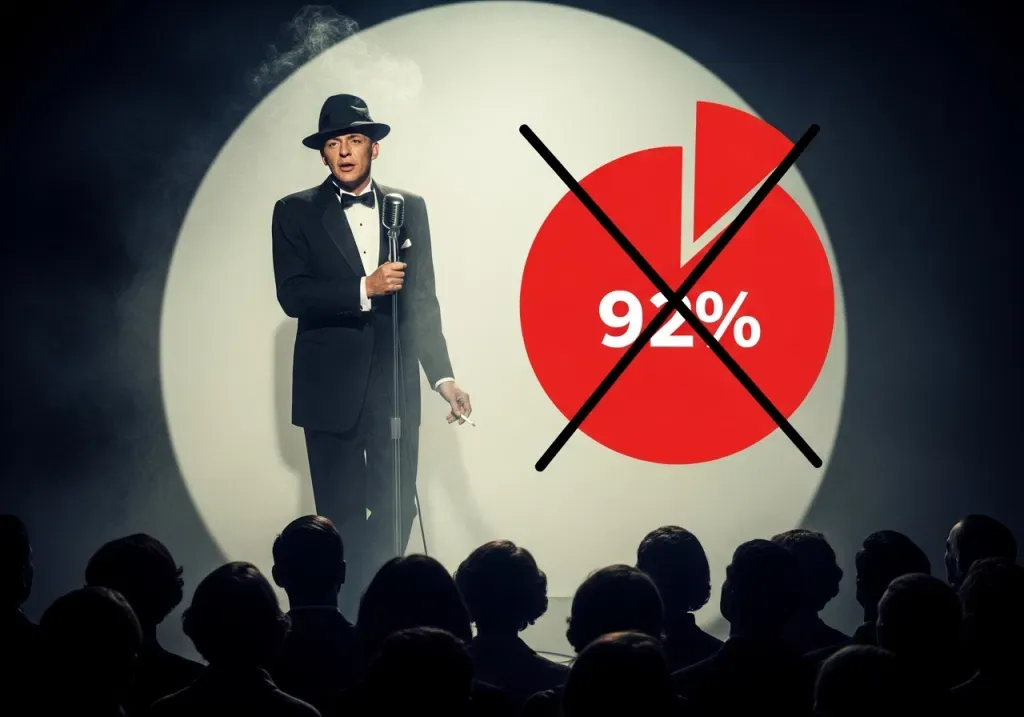

3. Claims made at 6 minutes 41 seconds “...the only way you lose money is if the world ends…”: without even delving into whether he’s taken leave of his senses, this claim is a very dangerous one to make. Presumably these “investment advisors” are peddling “Index Funds” – something I’ve previously written about, urging enormous caution, due to their not really adding up.

4. The use of jargon and of easily obtainable information and dressing it up as appearing all rather esoteric and magical (‘so pay us $1500’) is, frankly, pathetic. Nothing that was said during this video constitutes ‘financial advice’ – due to their own ignorance of financial matters – Plunket didn’t need to make disclaimers!

There is an old saying: ‘Only people who don’t know what they’re doing talk about diversification.’ Any investor who’s made a lot of money from investments will tell you that is manifestly true. If you want to be successful, wealthy and have a good income later in life, what you need to do is pick a small number of good investments. Three or four are sufficient and they will see you right.

The trick is to select the right ones. For example, I have also previously written about discovering an Australian mining company a couple of years back when it was on life support and buying large dollops of shares for four and five cents each. After sorting their internal problems out the share price is now 32 cents as I write this. It’s not supernatural, folks! There are also bank term deposits and government bonds for those who want to ‘set and forget’.

You don’t need to pay good money for so-called ‘investment advice’ that is a lot of twaddle. Let’s follow the logic and see where we end up. If someone charging a fee was any good, they’d be investing for themselves and making a killing, so they probably wouldn’t be, well, working as life insurance salesmen peddling buzz words on an online radio station that has 140 viewers on YouTube. If they’re no good, why pay them a fee?