Table of Contents

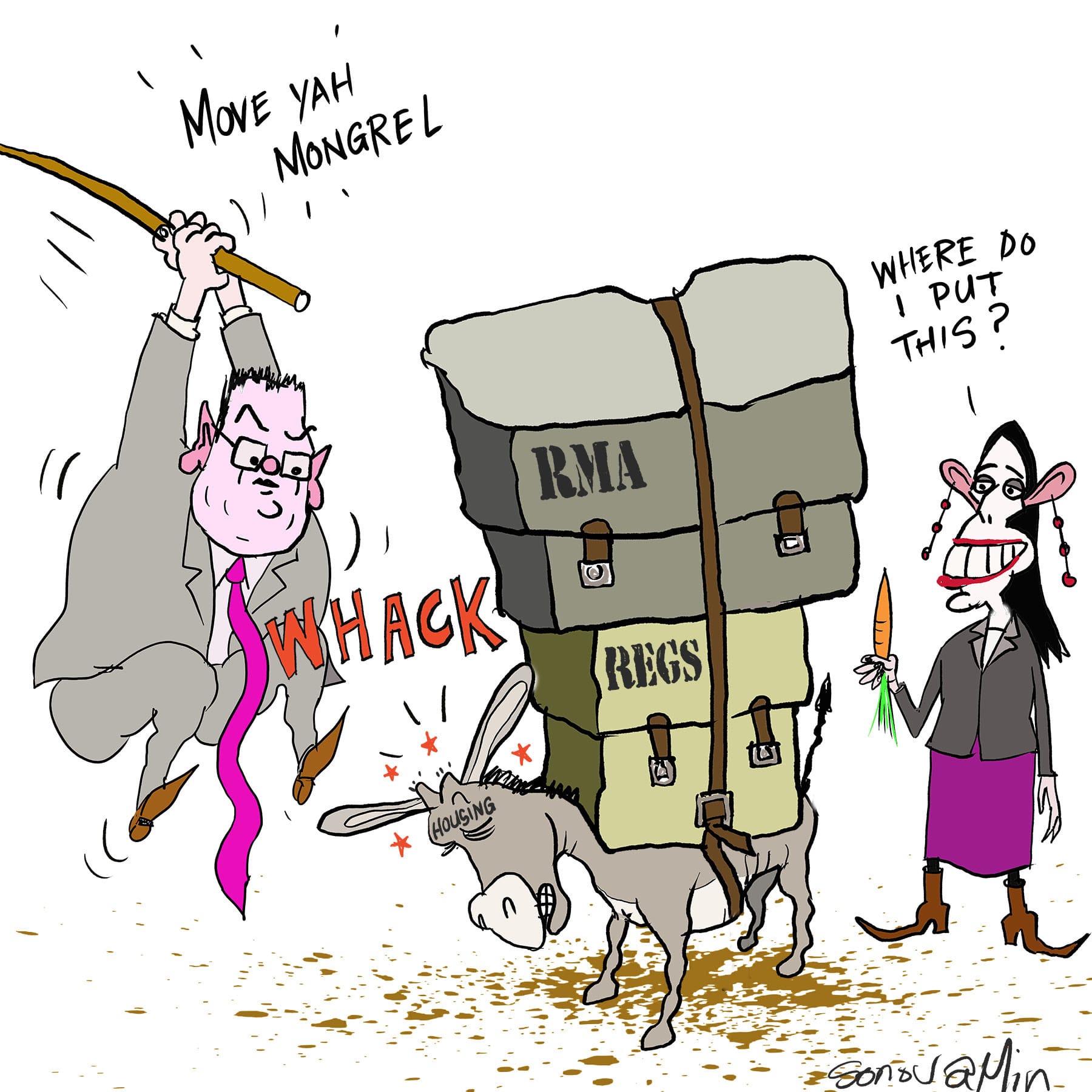

Brooke van Velden

ACT Housing spokesperson and Deputy Leader

Four years in, the Ardern Government couldn’t be failing harder at ‘fixing’ housing.

The Real Estate Institute of NZ’s (REINZ) House Price Index (HPI) figures out today show 29.8 per cent growth in the House Price Index nationwide is a record. But it hides a 32.7 per cent increase outside of Auckland.

Jacinda has failed. She promised to ‘tilt the balance more towards first home buyers,’ but today’s data continues to dash the dreams she stoked.

As Acting REINZ Chief Executive Wendy Alexander has said: “Median prices haven’t significantly eased yet as many had hoped would be the case, and things are certainly not getting any more affordable for first time buyers.”

Not only have the Government’s policies failed at their stated aims, they have done enormous damage to property investors at the same time. We’ve seen the announcement on mortgage interest deductibility has not only failed to help first home buyers, it has scapegoated and vilified property investors.

Through ACT’s campaign against the change, we have heard harrowing stories of people affected by the removal of interest deductibility. For example, a parent who bought self-contained units for their two disabled sons, are faced with selling them because they will be caught in the Government’s tax changes.

Of course, the real problem is supply. ACT says the current generation of first home buyers do not need new taxes, but to build like the Boomers. We need major reform in infrastructure funding and planning, resource consenting, and building consents.

Without supply-side reform, the Government’s policy is just an attempt to choose who gets to miss out in a supply-constrained market. And the Government can’t even get that right.

Please share so others can discover The BFD.