Table of Contents

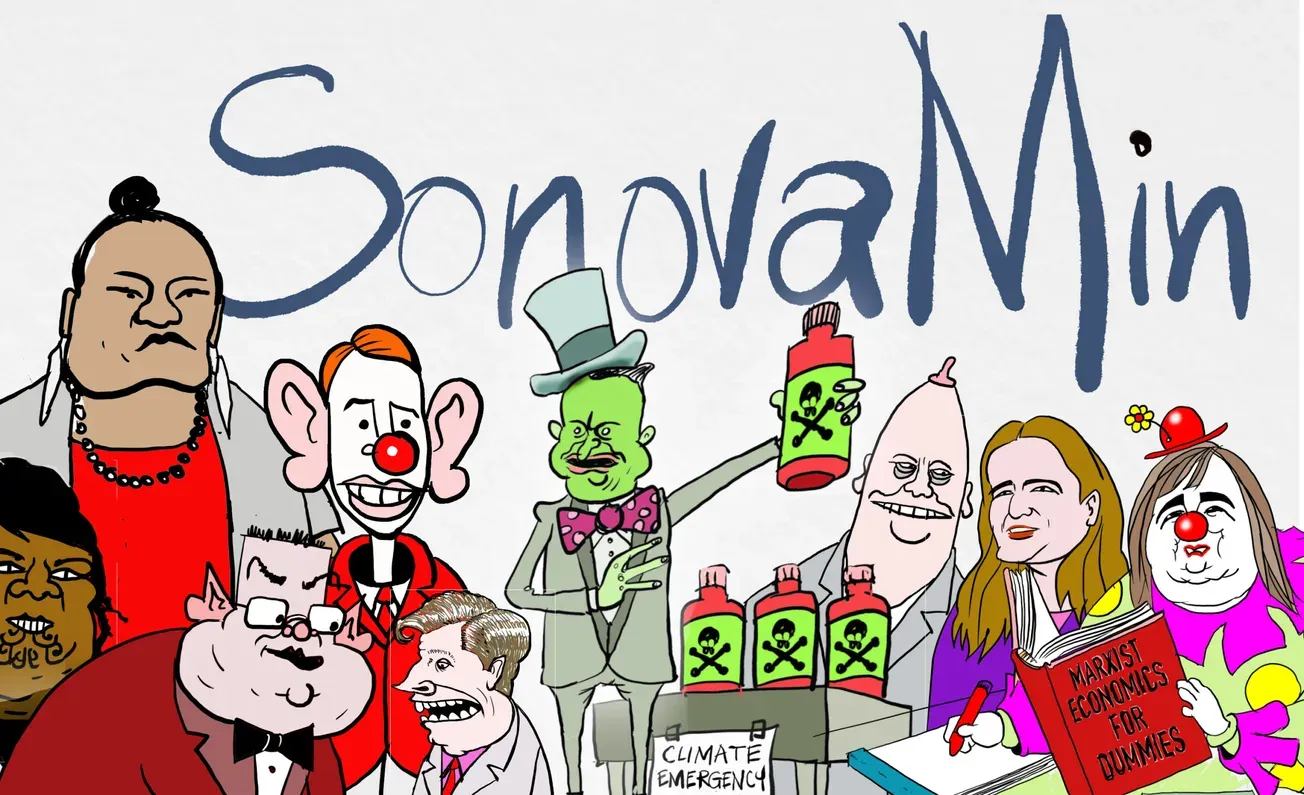

Now that they are not an actual coalition partner in the new government, the Greens are using this opportunity to become unmuzzled. They have decided to go back to the idea of wealth taxes. Perhaps James Shaw is blowing his wealth tax horn because of his massive gaffe over the green school; whatever the reason, the Greens are determined to become the Robin Hood of the 21st century, by robbing from people who work hard and giving to those that can’t be bothered. The difference in Robin Hood’s day was that the poor were really poor, but nevertheless, it was still theft. James Shaw and his Merry Greens want to legalise theft by introducing wealth taxes.

Green Party co-leader James Shaw says the Government needs to use the levers it has to stop further over-heating in the housing market.

He said these levers could be taxes on capital gains and wealth.

Shaw’s remarks came after the Reserve Bank’s announcement on Wednesday of a scheme to offer banks cheap funding, which they will use to further lower lending rates. It’s expected this will add more heat to an already overheated housing market.

In a previous life, James Shaw was involved in an accounting firm which no doubt did some tax work. Maybe he didn’t do any tax work himself, but it might be reasonable to expect him to have a smattering of tax knowledge, given his pre-politics background. That being the case, I find this approach completely unforgivable on the part of James Shaw. He pretends that he doesn’t realise that capital gains taxes and wealth taxes will do nothing to help the overheated housing market. In fact, if taxes have to be factored into a property sale, surely that is likely to increase prices, not reduce them.

People like Shaw, clamouring for taxes on property sales, always seem to completely ignore the Bright Line test. Here is a reminder of how it works. Any property that is not the family home that is sold within five years of purchase is subject to tax on the profit on sale. It is a mini capital gains tax, which has a fixed term of 5 years. This includes holiday homes, baches, rental properties, land, farmlets (farms are governed by different tax rules)… everything except the house you live in is covered. It is so tight that I had a case where a client owned a beach property but rented a house in town to be closer to work and there was tax payable on the sale of the beach house. As it was the only house she actually owned, I had thought she might have got away with it, but no. It was not her principal place of residence, so the profit on sale was taxable.

So as you can see, the Bright Line test takes the sting out of any CGT that is introduced because for the first few years, there will be little change, in the property sector anyway. In fact, there is considerable evidence that any CGT introduced will not be fiscally effective for 10 to 15 years. Again, Shaw conveniently ignores this unfortunate piece of statistical data, preferring to persuade his supporters that the housing market woes are all the fault of those mean nasty landlords, and they must be stopped in their tracks.

Landlords provide an important public service. Yes, they are rewarded handsomely for their effort these days, but that is not the fault of the landlords themselves. It is the fault of governments interfering in the private housing market and local councils refusing to release land for housing, and also for making the building and consenting process hideously expensive. We simply cannot build enough houses to meet the current demand, and with estimates that another half a million kiwis are likely to return home in the next 5 years, things will not get better any time soon. As night follows day in this particular scenario (or as Economics 101 will tell you), the price goes up. It is a fairly simple equation that politicians like Shaw with a particular agenda choose to ignore.

The problem with CGT is, as I have said, a form of taxation that has a long lead time, but no modern government ever takes that into account. Think about the Tax Working Group’s proposal for CGT, estimating that it would gather approximately $100 million in its first year. Needless to say, the government immediately spent those funds, even though they were very unlikely to get it, even if they had introduced the tax. CGT is easy to avoid in the short term; asset owners simply bring forward their decisions to sell, thus circumventing the tax. Any government that wants to introduce a CGT is doing it for future governments, and that is not a generally accepted practice in the here-and-now attitude of today’s government.

As for wealth taxes, they are so dreadfully inequitable that Jacinda was wise to dismiss the idea out of hand. There is another name for wealth taxes. They are also known as political suicide.

In his search for ‘fairness’ in the tax system, Shaw seems to lose sight of the concept of fairness altogether. While the family home was exempted from the proposed CGT, this was not true of the Green Party’s proposed wealth tax, where the threshold was set at $1 million – the price of an average Auckland house. As house prices continue to rocket ahead, it is foreseeable that average houses in every city and large town would be subject to a wealth tax before long. How exactly this increases ‘fairness’, while penalising elderly people who have scrimped all their lives and live in a modest home is beyond me. But this is not particularly surprising, as just about everything that comes out of Green Party HQ is well and truly beyond me anyway. It is the politics of envy, pure and simple.

Capital gains tax and wealth taxes will not fix the housing market. Look no further than Australia for proof of that. James Shaw knows full well that they won’t, but in his world where fairness is putting little old ladies into poverty, he pretends that they will. This is a politician who used to work in an accounting firm. Terrifying, don’t you think?

If you enjoyed this BFD article please share it so that others can discover The BFD.