Table of Contents

Taxpayers Union

This week’s most important story: the Reserve Bank Governor’s move to cut the interest rate from 1.5% to 1.0%.

New Zealand has not seen a cut this large since the Christchurch earthquake. Previous rate cuts of this size were seen during the global financial crisis and after 9/11.

It’s clear that the Reserve Governor is getting nervous about the economy losing steam, but he admits rate cuts alone aren’t enough. So should the government boost spending? What about cutting taxes? Joe and Jordan discuss:

The face that haunts Porirua ratepayers

As important as the Reserve Bank story is, a relatively minor piece of wasteful spending we uncovered seems to have earned plenty of media attention.

The image below is Porirua City Council’s new official “icon”, chosen as part of a rebrand that cost $98,000.

PCC logoWe released the information as a warning against expensive, unnecessary, ego-driven rebranding exercises, thinking it would get a few shares on social media.

Since then, the story has graced the front page of the Dominion Post, led Seven Sharp, and featured on Stuff, the Herald (twice), Newstalk ZB, and Newshub, with brand specialists, mayoral contenders, and the local Chamber of Commerce all weighing in.

One Porirua ratepayer sent us their personal reaction to the rebrand:

We’re glad the council is copping flack for this, but it’s also a shame that the media seem more interested in ‘quirky’ stories that make good TV than the systematic waste we expose through our research.

Revealed: The cost of missed specialist appointments

Continuing on from last week’s report on health productivity, on Tuesday we launched the first of three papers on healthcare revealing that DHBs lose around $29 million a year due to missed specialist appointments.

We say DHBs could also do a lot more to remind patients of appointments, and even simply track and set targets for appointment attendance.

These basic improvements in efficiency are necessary to balance the costs created by our aging population.

Should DHBs go even further and charge patients who fail to show up to their appointments?

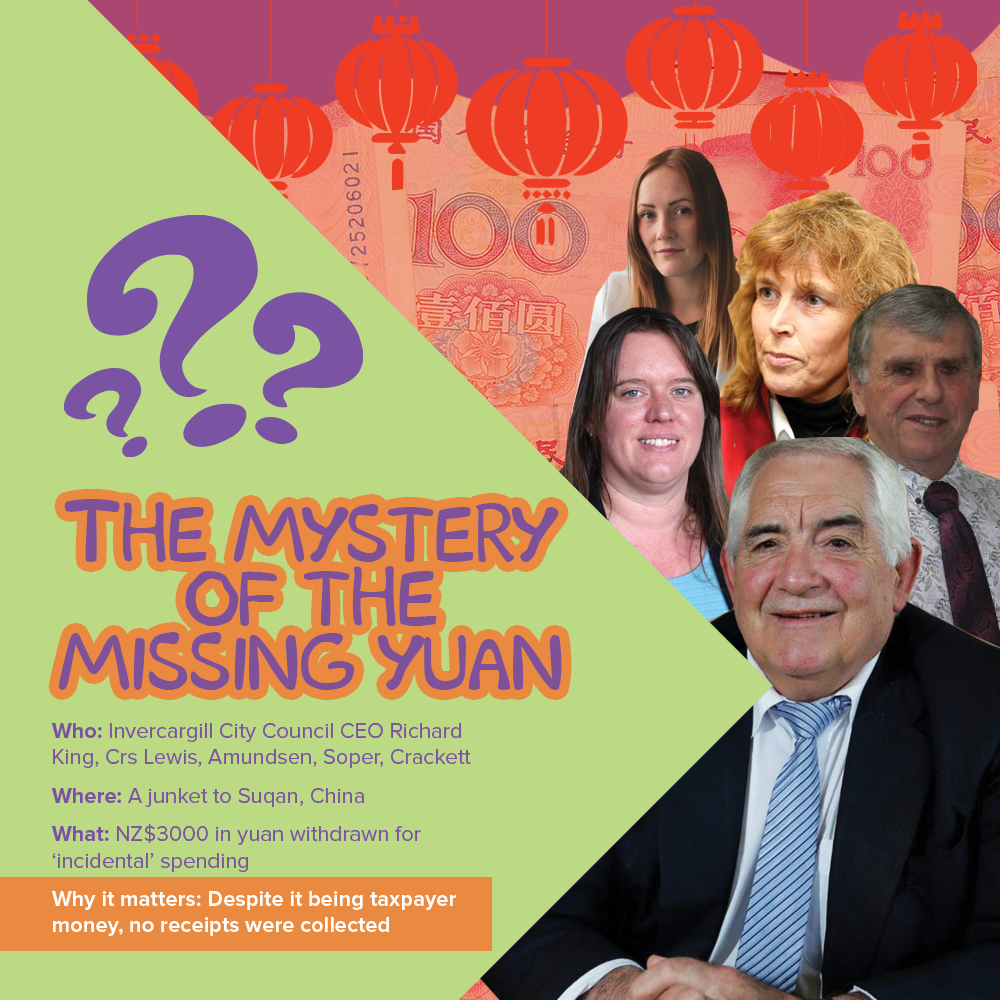

What did Invercargill councillors spend ratepayer money on in China?

Overseas junkets, especially ‘sister city’ visits for local councils, tend to involve generous spending on sightseeing, dinners, and booze. Fortunately, receipts are kept to ensure some degree of accountability to ratepayers.

We are astounded to learn that this is not the case at Invercargill City Council.

In 2017, four Invercargill City Councillors visited Suqan, China, with the CEO who withdrew $3,000 worth of Chinese Yuan for expenses. When the money was returned, the wad of cash was $1,200 lighter, with the council admitting to us that no receipts were collected. Not even one.

This arrogant failure of transparency ought to dog the council in this year’s elections.

Dropping consumer confidence shows need for tax relief

The latest ANZ consumer confidence survey shows consumer confidence dropping across the country – but not in Wellington.

It’s telling that the capital is a lonely bright spot for consumer confidence. Bureaucrats and lobbyists on Lambton Quay are doing well but at the expense of productive job-creating New Zealanders facing higher fuel taxes and tax brackets that don’t keep pace with living costs.

Improving consumer confidence isn’t complicated. Let people keep more of their hard-earned money to spend or save as they see fit. A good start would be cuts to income tax, along with the indexation of tax brackets to inflation.