Table of Contents

Dr Bryce Edwards

Political Analyst in Residence, Director of the Democracy Project, School of Government, Victoria University of Wellington

Victoria University of Wellington

MPs are supposed to serve the public interest, not their own self-interest. And according to the New Zealand Parliament’s website, democracy and integrity are tarnished whenever politicians seek to enrich themselves or the people they are connected with.

For this reason, the Parliament has a “Register of Pecuniary Interests” in which every MP must declare their financial interests relatively thoroughly. According to Parliament, this is to help the public judge whether MPs are acting appropriately and to help voters know where conflicts of interest occur. The register published on Tuesday contains a summary of the details for 120 MPs – those elected last year, but not including newly elected list MPs from 2024.

There are certainly a lot of financial interests for the current Parliament to declare – the average MP is wealthy, propertied, and has fingers in a few pies. The public can see for themselves, by looking at the latest Register of Pecuniary and Other Specified Interests of Members of Parliament.

The register reveals a fair amount of disturbing MP activity and ownership. Generally, it shows that the New Zealand Parliament contains a rather narrow spectrum of socio-economic interests.

MPs as landlords and property moguls

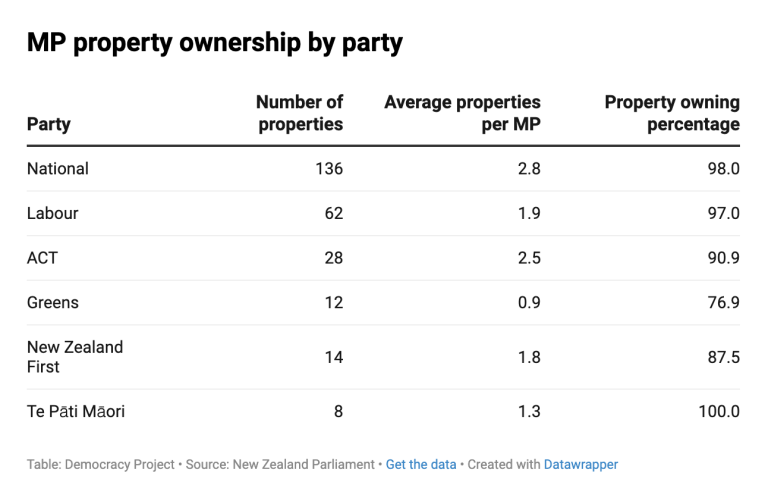

Housing and property should be big areas of interest for the public, especially because MPs own so many homes during a housing crisis – which I wrote about already detailed in another column today – MPs own 2.2 houses on average.

Property ownership is one area in which politicians are clearly out of sync with the public. It raises questions about whether their ownership of houses impacts their preference for implementing policies that impact house prices to go down, stabilise, or up.

Not all the properties MPs own are family homes – although one MP, Simon Court from Act, lists all five of his houses as “family homes”. Many of the properties owned by MPs are investment and rental properties.

The Register of Pecuniary Interests doesn’t clearly state which properties MPs own are rentals. However, a browse of the register shows that it’s not uncommon for MPs to have a rental property in addition to a family home.

The largest landlord appears to be National’s Carlos Cheung, who has five rental properties in Auckland and owns two property investment companies. His leader, Christopher Luxon, owns seven properties, of which four are residential or commercial rentals – one is an office rented to Parliamentary Service for his electoral office (costing taxpayers about $1000/week).

Other National MPs are heavily involved in property. Nicola Grigg, MP for Selwyn, has her own registered property investment firm. Cabinet Minister Matt Doocey part owns the Avonhead Shopping Centre in Christchurch. And Mark Mitchell has three rental properties in Auckland (in addition to two family homes).

Company ownership and investment funds

MPs need to declare all the businesses and investment funds they own more than $500 in. This is supposed to help the public be aware of any conflicts of interest in how politicians vote and operate.

The most startling and interesting declaration is that of MP and Parliamentary Undersecretary Todd Stephenson. The ACT MP recently moved home to New Zealand after a lengthy business career in Australia. He has seven residential properties, two managed investment schemes, and stakes in 11 businesses.

Stephenson categorises three of the businesses listed in the register as “healthcare” – Johnson & Johnson, Chimeric Therapeutics, and CSL Limited. These are, in fact, pharmaceutical and biotech companies. This fits with Stephenson’s background, as for 17 years, his jobs in Australia were in the pharmaceutical industry, working for companies such as Roche, Janssen, and Medicines Australia.

The problem is that Stephenson’s ACT party is now in government, and he’s been appointed by the Prime Minister to be a Parliamentary Undersecretary with a special responsibility for advising Associate Health Minister David Seymour on Pharmac. This was all covered yesterday in David Fisher’s Herald story, David Seymour’s special medicines envoy has investments in Big Pharma (paywalled).

Fisher reports that Stephenson has previously been a critic of Pharmac and has defended the costs charged to Pharmac by pharmaceutical companies. His involvement in the industry continues, with Fisher outlining his recent interactions with pharmaceutical companies, including accepting a trip this week to Australia to attend a drugs conference.

In his role in assisting the Government on Pharmac, Stephenson has an official role in advising Seymour on pharmaceuticals and was involved in the appointment of Paula Bennett as the new chair of Pharmac. Although these roles make his continued involvement and ownership of pharmaceutical companies problematic, his office has explained to David Fisher that his Parliamentary Undersecretary role isn’t formally part of the Executive. So he’s not subject to the Cabinet Manual rules on conflicts of interest.

Plenty of other MPs hold shares and ownership of companies. Many do this through “managed investment shares”. MPs seem to own plenty of shares in energy companies and electricity retailers.

However, some MPs own shares in renewable and environmentally friendly energy businesses. For example, Green Party co-leader Chloe Swarbrick has obviously become an enthusiast for “green capitalism” – her investment fund has shares in 23 companies, many of which have names like “Devon Artesian Green and Sustainable Bond Fund.”

The MP with the most managed investment fund disclosures is National’s Kaikoura MP Stuart Smith, with 44 funds, including companies such as Contact Energy, Genesis Energy, Ebos Group, and Delegat wines. Other big investing MPs are Mark Patterson (12 funds) and Andrew Hoggard (5).

Trusts

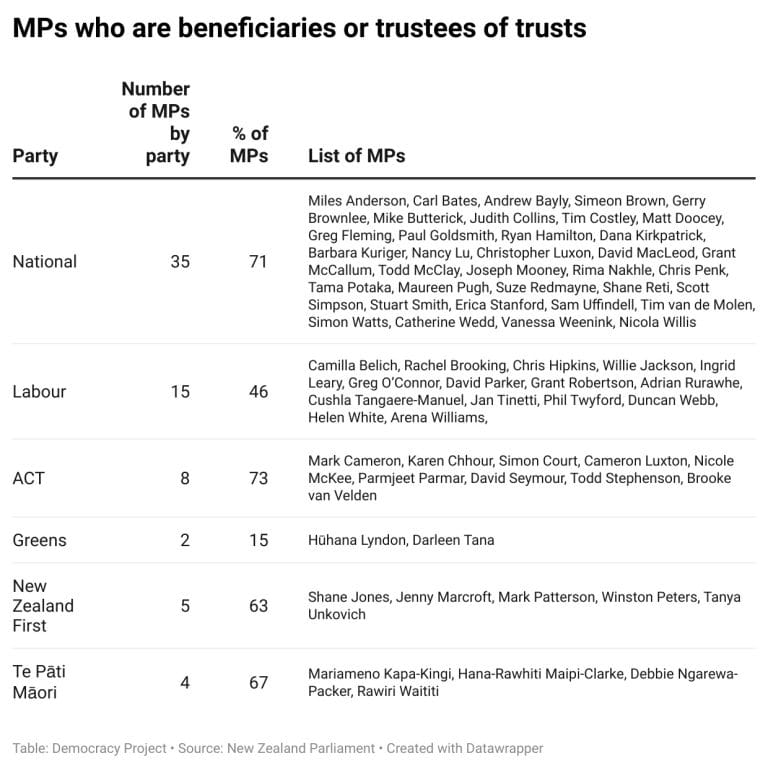

Collectively, MPs are involved in more trusts than there are members of Parliament – about 130. Trusts have become particularly fashionable in New Zealand. They are a legal device for holding finances and assets. Although there are many good reasons for the public and politicians to keep assets in trusts, they are also associated with tax avoidance, asset protection, and transparency avoidance.

Politicians must list their involvement with trusts – including if they are the beneficiary or trustee of a trust and if their properties are in trusts. In total, 69 MPs use at least one trust. National has the most MPs with trusts – 35 MPs (or 71 per cent of the caucus). All but one of the ACT MPs have at least one trust, and the same is true for NZ First. And the Cabinet has an exceptionally high proportion of ministers using trusts – 75 per cent.

Retirement schemes

MPs have access to particularly favourable retirement conditions – the taxpayer contributes $2.50 to their retirement fund for every dollar that an MP saves (up to $20,000). Hence, many MPs receive an annual contribution of $50,000 from the taxpayer into their retirement schemes.

The Register of Pecuniary Interests lists all the retirement schemes owned by each MP. Seven MPs don’t have a retirement scheme, but many other MPs have multiple schemes. The Spinoff’s Gabi Lardies has looked into this: “Twenty-four of them have two retirement schemes, three have three, Christopher Luxon has four, and Jenny Salesa has five” – see: What I learned about money from scrutinising where MPs hold theirs.

Lardies finds that although most MPs use standard KiwiSaver schemes, there are some other interesting ones: “like Salesa’s Kaha’u Superannuation Fund, Kieran McAnulty’s Go the Bush private superannuation scheme and Gerry Brownlee’s Bradnor Superannuation Scheme.”

In addition, she found that “at least 10 MPs have these Schedule 3 super schemes, which are single-person affairs that allow you to invest your money where you choose. While theoretically anyone can open one, in reality they’re the preserve of mainly MPs, judges, and the like.”

For more on the various retirement schemes chosen by the politicians, see Stacey Rangitonga’s article in The Post: The KiwiSaver schemes popular with MPs (paywalled).

Side hustles

MPs must also declare any other employment they are involved in while working as an MP. There’s already been a lot of attention put on NZ First MP Jamie Arbuckle for working as a Marlborough District councillor, and he’s declared that in the register.

But there are other surprising employment being declared. The Minister of Health, Shane Reti, lists himself as “self-employed” in “medical consulting”. National MP Paulo Garcia says he runs Paulo Garcia Barristers & Solicitors Limited. National’s Grant McCallum is in charge of “Grant McCallum Limited”, which he listed as “agriculture/farming”. Te Pati Maori MP Mariameno Kapa-Kingi is the CEO of Te Runanga Nui o te Aupouri, which is the “post-settlement governance entity” for her iwi.

Gabi Lardies has also delved into some of what MPs are declaring payments for: “Paul Goldsmith is getting paid book royalties from Penguin Random House (he’s written a bunch), and also received payment for doing some writing for retirement village rich-lister Cliff Cook… Catherine Wedd is collecting an apiary management fee for, I presume, looking after some bees.”

Gifts

MPs also need to list any gifts they’ve received in the last year with a value of over $500. For details on these, see Adam Pearse’s Herald article, Former PM Chris Hipkins was gifted a bike by Chinese Premier Li Qiang during a 2023 trip to China.

Stuff’s Bridie Witton has also covered these gifts, but also some of the director’s fees received by MPs serving on various boards – see: MP freebies: Tickets to major sporting events, concerts, jet boat rides.

While the latest register gives the public a glimpse of politicians’ assets and finances, it shouldn’t be taken as absolutely accurate and thorough. The existence of trusts means that much is hidden.

It should also be noted that some gifts don’t seem to make it onto the register – such as the Koru Club access that Air New Zealand gives all MPs. The Herald’s Thomas Coughlan covered this in November – see: Air New Zealand Koru Club membership – the gift every MP gets, but none declares

And finally, can we trust politicians to declare their various assets and gifts properly? Not necessarily, according to a study recently published in the International Journal of Drug Policy about New Zealand MPs – see Kristie Boland’s NZ politicians might under-estimate the influence of gifts, research finds.