Table of Contents

JD

When I was a young shaver, I was taught a simple lesson to explain how inflation works. Imagine, if all the goods and services in the country are represented by a box of 100 apples and all the money in circulation is represented by 100 dollars, then each apple is worth one dollar.

Now, if you print another 100 dollars, the number of apples doesn’t just magically double to match. What does happen is the price of an apple simply rises to meet the amount of extra money now in circulation.

Ergo, an apple now costs two dollars. And that, my friends, is inflation in action.

But isn’t that obvious? Well, apparently not to Mr Orr and his esteemed colleagues at the RBNZ judging by his latest speech to the Petersen Institute in Washington on 23 October.

In this speech Orr compares himself and other policymakers to Kupe, the legendary Polynesian explorer as they ‘navigate their own waters’ in pursuit of “clear goals – primarily focused on achieving and maintaining low and stable inflation”.

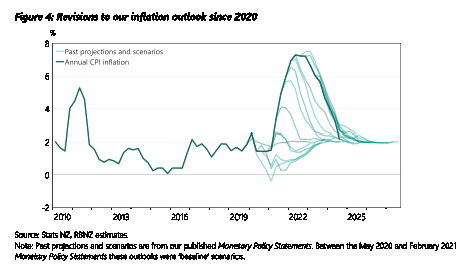

However, as is clearly shown by this graph from Orr’s presentation, the RBNZ under-called their inflation projections. And they did this consistently from the time when, in Orr’s own words, they started issuing “modern ‘quantitative’ monetary instruments [which] in the case of New Zealand had not been used before” (also known as ‘spraying money around like a one-armed paperhanger’) to the time inflation peaked in 2023.

Additionally, in his Washington speech, Orr comments, “On a personal note, I often reflect to early 2020 and ask myself the question: if someone offered me a peak of 7.3 per cent inflation and unemployment around three per cent in two years’ time – would I have accepted it? Yes!”

Which leads to a further inference. If in 2020 an inflation peak of 7.3 per cent was something he would have happily accepted, then, by definition, he was clearly expecting more than this.

This being the case, why, as his own graph shows, did the RBNZ publish seven forecasts between 2020 and 2023 showing inflation projections that were lower than 7.3 per cent?

The conclusion a cynic might come to is that Orr knew inflation was going to be greater than the levels the RBNZ was officially forecasting but political expediency in support of Grant Robertson and the Labour Government which appointed him, forbade him from admitting it.

But did he really know? Well it wasn’t rocket science to determine what inflation was going to be. Harking back to the ‘apples vs dollars’ lesson of my youth, it was easy to work it out, as I said in this letter (published in the NZ Herald in June 2022, before they became terminally woke and stopped printing any opinions that weren’t firmly left of centre).

The long-term trend line for NZ money supply (M3) shows that the current amount in circulation should be NZ$340 billion. The actual amount currently sloshing around in the economy is NZ$390 billion. With NZ$390 billion chasing NZ$340 billion of available goods and services, the price of those goods and services must rise by 15 per cent to soak up the excess cash available.

Fifteen per cent is the amount of domestic inflation that must occur over the next two or three years to make this happen. Throw in another two per cent or three per cent per year of imported inflation, from oil prices, supply chain problems and the Ukraine war effect, and it’s obvious that NZ must expect inflation to average eight per cent or more over the next two years at least.

Adrian Orr will be forced into “doing what was necessary" to bring inflation back into line (Liam Dann NZH May 26) for a lot longer than many people realise.

And the reality? In the three years from the end of 2021 to now, NZ’s inflation is a cumulative 18.43 per cent, pretty much exactly what I predicted.

To believe that I could work this out but that Orr, with his degrees in geography and economics, could not, has to be disingenuous to say the least.

Which brings me to one last anecdote about the family Orr whose surname is carried by the esteemed Adrian.

I once worked for a company with a chairman named Hamish Orr-Ewing, who, when asked at a sales conference why the reps were forced to drive two-door Ford Escorts, famously replied, “Because they don’t make one door Ford Escorts.”

A parsimonious outlook that our own Mr Orr might bear in mind next time the government asks him to print money in defiance of his and the RBNZ directive that they “navigate their own waters” in pursuit of “clear goals – primarily focused on achieving and maintaining low and stable inflation”.

PS. If you think the last two paragraphs offer a very tortuous comparison between my old chairman and our current RBNZ governor, then I simply point to the attempt by the latter to compare himself to Kupe the great navigator. Note that the words sauce, goose and gander come readily to mind and I rest my case.