Table of Contents

John Ling

wealthmorning.com

John is the Chief Marketing Officer at Wealth Morning. His responsibilities include marketing, customer service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right.

The numbers don’t lie.

2020 was the year of stay-at-home tech stocks, driven by pandemic fears.

But 2021 is now shaping up to be the year of reopening value stocks, courtesy of a world looking ahead.

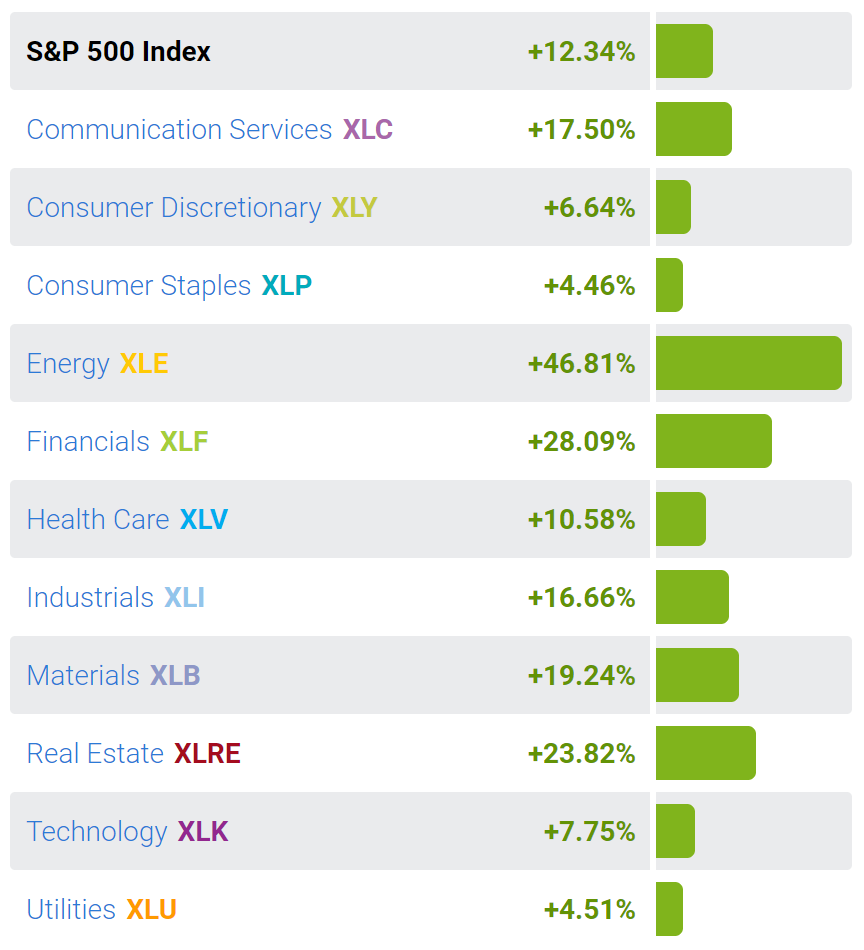

You can see this trend unfolding in the graph below, which breaks down the performance for individual sectors in the S&P 500 so far this year:

Surprise, surprise.

At the time of writing, tech is running out of steam. It’s falling behind, delivering just an average 7% gain for the year.

Meanwhile, energy, financials, and real estate are charging ahead, posting double-digit returns — 46%, 28%, 23%.

The disparity is big. Huge.

So, when exactly did this turning point happen? Well, by my calculation, it would have to be early February. That’s when the most speculative tech stocks appeared to suffer a catastrophic blowout.

ARK Innovation ETF [NYSE:ARKK] — featuring holdings like Tesla [NASDAQ:TESLA] and Zoom [NASDAQ:ZM] — was absolutely hammered.

From peak to trough, it plunged over 36%.

It’s a sharp reversal of fortune. Perhaps the clearest indication yet that a new era of investing might just be upon us.

We’re seeing a rotation out of growth and into value.

So, how is this happening? And why now?

Why Tech Is Being Punished

In Oliver Stone’s biopic of Alexander the Great, there’s a scene where Alexander’s father, King Philip, makes a speech:

‘Fate is cruel. No man or woman can be too powerful or too beautiful without disaster befalling. They laugh when you rise too high. And they crush everything you’ve built with a whim. What glory they give in the end, they take away. They make of us slaves.’

Like most things in Greek mythology, this statement is exaggerated for dramatic effect.

Still, there’s a morsel of truth to be found here.

These past five years have been extraordinarily good for technology. The sector has posted an average return of almost 230%. This is double the performance of its closest competitor, consumer discretionary, which has delivered 119%.

That’s a big gap — a chasm — between first place and second place.

This kind of upward trajectory has encouraged many investors — especially the speculative kind — to pour their money heavily into tech. And why not? The promise of a quick turnaround in terms of ROI (return on investment) has been impossible to ignore.

In fact, for a time, it felt like every speculative investor in town was building a portfolio devoted to tech — to the exclusion of everything else.

The rewards they received were outsized and disproportionate — and so was the greed.

It actually reached a point where basic fundamentals were ignored. It didn’t matter if a tech company was wildly skewed in terms of earnings multiple, book valuation, or debt.

All rational concerns could be easily dismissed with a simple wave of the hand: ‘It doesn’t matter. This company will be the next Apple or Facebook.’

That justification appeared to work for a while.

Well, until it didn’t.

Remember what King Philip said about hubris and complacency.

Why Value Is Set to Outperform

Since February, I’ve seen two kinds of investors posting on social media:

- Speculative growth investors who piled into tech when it was at its peak — then suffered the crash — are anguished by the fact that their portfolios are sharply in the red. ‘How can this be happening?’

- Traditional value investors who humbly took the chance to load up on value stocks are nodding their heads in quiet satisfaction, with all their holdings now up in the green. ‘It’s about time.’

Hindsight may be 20/20, but the signs were already there, for those who knew where to look.

Eric Kuby of North Star Investment Management has said:

‘We’re coming out of a multi-year period of extraordinary outperformance from big cap techs. Value stocks have been so inexpensive. A major rotation is going to take place. When valuations are so out of whack, there has to be a reversion. There is no question value stocks will outperform. It’s time to look for high quality and low volatility.’

Clearly, the moment has come to wipe the slate clean. Solid fundamentals are now back in fashion. Which means value is king. Be prepared to challenge your old assumptions.

Please share this article so that others can discover The BFD.