Table of Contents

Sir Bob Jones

nopunchespulled.com

A private Super Fund purveyor, Sam Stubbs, gained ill-deserved headlines when he described the decision by Rob Muldoon to scrub Labour’s 1974 Super Scheme as, “The Worst Decision by a New Zealand politician ever”. Plainly Stubbs knows bugger all about New Zealand history, or possibly anything else.

It was actually a first rate decision by Muldoon. In promoting it, its creator Roger Douglas advanced that one of its great virtues was it could fund propositions commercial banks had declined as too risky. That of course was outrageous for a Super Fund and one of the many silly thing’s Roger said in the 1970s. Ultimately he saw the light and went on in the 1984-7 government to earn the well-deserved mantle of our greatest ever economic reformer.

The Fund actually made a few “investments” before Muldoon was able to kill it. I knew the bloke in charge. His first decision was to buy a newly built, badly designed and poorly located Lower Hutt office building. Today that building would be lucky to fetch even a tenth of its current replacement cost, or, in other words, has been (and will continue to be) a stead-fast money-loser.

Stubbs backed his nonsense assertion with the fiction the scheme was compulsory for all employees over seventeen, this yet further testimony that he had no idea what he was talking about. It was most certainly not, rather it required employees to belong only if not already in a super scheme. Stubbs then claimed that had it not been cancelled it would today be worth $500 billion dollars. Really? That’s $5 million per citizen. Cash up, hand $5 million to every man, woman and child and… oh why do I bother?

Far from being anti-superannuation, Muldoon introduced the only realistic gilt-edge one possible, that is a direct retirement age payout without the risks incumbent on leaving it to private Funds. If Stubbs reads the news he will know that world-wide it’s littered with tragic stories of peoples’ savings disappearing through incompetence or fraud by private operators, such as his own.

There’s no special reason to argue that retirement Funds should be run privately. Why not the same for health, policing, education etc?

It’s no secret I support the market economy, as does the overwhelming evidence. But they’re risky for their participants who have the gumption to have a go. However in a sophisticated society, the basic life requirements of health, education, security etc are proper functions of the state which is the only entity that can guarantee their continuing provision.

In writing this article, Sam can claim to have penned the dumbest and most ignorant comment ever published on this topic.

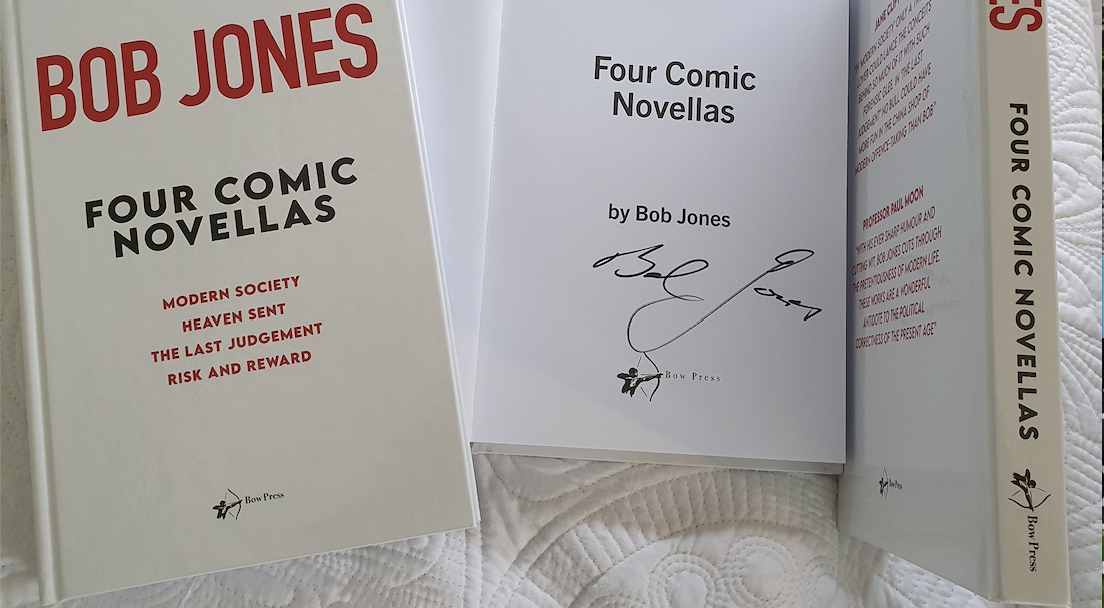

BUY Your Own First Edition Hardcover Signed Copy of Sir Bob’s Latest Book Today.

Please share so others can discover The BFD.