Table of Contents

Rt Hon Winston Peters

The Pre-Election Fiscal Update Changes Everything

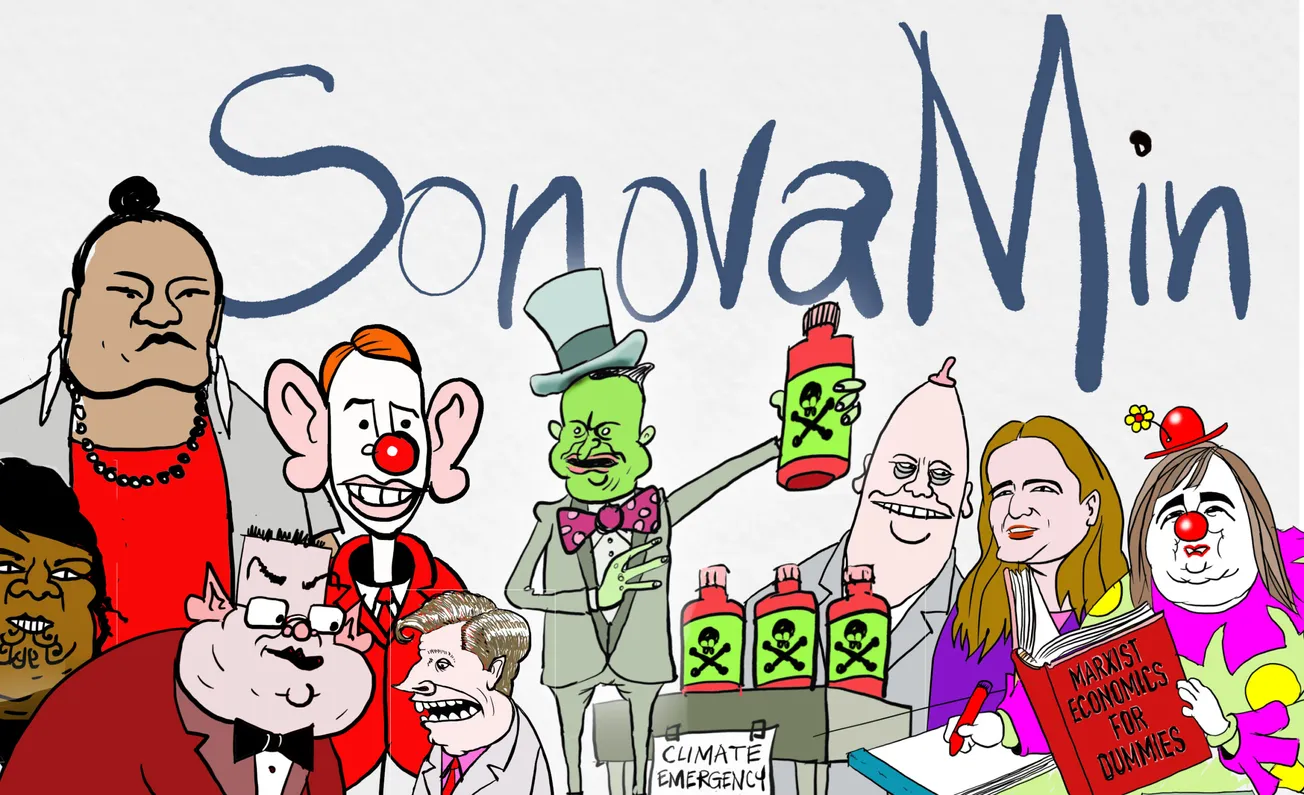

Within an hour of this speech, there is going to be a debate between the political parties that the media, under MMP, still think are the only parties that matter in this campaign. Both of those parties are riddled with inexperience, as evidenced by the promises they have made, before the PREFU of 12 September, and maintain after the 12 September, when their eyes should be wide open.

Before last week’s Pre-election and fiscal update, known as the PREFU (12 September 2023) New Zealand First had planned to announce tax relief for hard working kiwis.

We had planned today, to announce our policy that the first $14,000 earned would become tax-free.

We also promised we would cost our policies to ensure they were affordable – the sensible and responsible thing to do.

Ladies and gentlemen, the appalling mismanagement of Labour, over the three years since the adults in New Zealand First were made to leave the room, was laid bare for all to see in the PREFU.

New Zealand First is fiscally realist. We are committed to making the first $14,000 tax-free but this commitment cannot happen until 1 April 2026, at the earliest, and 1 April 2027 at the latest.

Such is the deteriorated state of the nation’s books, no party can look voters in the eye and seriously say their tax cuts are affordable now.

National’s $14.6 billion tax package is both not credible nor reconcilable with its spending commitments. No nation, nor household, can survive with far less money through the front door but spending rocketing up and out the side door. That is voodoo economics.

Act, meanwhile, wants to reduce government spending by $38bn but do not detail what that means to health, law and order, superannuitants, families, and small businesses. Plus, Act is now going back to the Roger Douglas era of flogging off state owned assets to foreign economies. Seemingly having learnt nothing from countries like Norway, Singapore, Iceland or Ireland – and their nationalistic economic success record.

Labour’s big idea is “10 cents off a turnip”. New Zealand First has looked at GST off fresh foods, but in the present economic climate there is no assurance that such a GST change will go to families and not to Foodstuffs or Woolworths. That’s what Labour’s ill-conceived GST plan would do. Which is why New Zealand First is not proceeding with it now.

The Greens and Maori Party have proven themselves to be economically illiterate.

We know the public want a tax cut after the last three years of hard labour. As a famous Senator Long once said about tax reform “Don’t tax you, don’t tax me, tax that man behind the tree”. But, post-election, when reality sets in, does anyone seriously believe that tax cuts of this nature could be delivered in the next two years?

Political parties cannot proceed damning the fiscal torpedoes no matter what the cost.

They are promising jam where there is no bread.

The Economic Day of Reckoning Has Long Been Here

In 2020 when New Zealand First was at the Cabinet Table, Grant Robertson projected that in 2024, government spending would be $144bn.

Why then, in the 2023 Pre-Election Fiscal Update released only last week, has 2024 spending spiked to $177bn?

That is $33bn more in 1064 days of “hard labour” between the 2020 PREFU and the 2023 PREFU. That means Labour’s planned spending has increased by $22,000, every minute, of every day, once New Zealand First’s ‘handbrake’ and restraint left Cabinet.

And what have they got to show for it? Virtually nothing. Dreamland light rail schemes, mountains of expired COVID-19 kits, hundreds of millions still being spent on COVID-19, and over $1.2bn on consultants – to name just some areas of fiscal irresponsibility.

We know what the result has been. Rampant inflation, the loss of our best to Australia and a Labour Party policy-inflamed, worsening, cost of living crisis. Meanwhile, 60,000 people wait for hip and knee operations, or a specialist’s appointment.

And just to compound the impossibility of their economic thinking working now, every other party agrees to the “sugar hit” of 100,000 immigrants coming to this country, this year, that alone being inflationary. And without the essential basics of houses, health amenities, educational facilities, and infrastructure, to handle such a burden arriving out of such unfocused immigration policy – where needed workers and specialists come second and consumptive numbers come first.

We’re spending $33 billion more but you still cannot even see a GP for months. Billions more, while youth not in school smash up the local dairy as crime explodes. Billions more, yet many kids cannot read, cannot spell, and cannot add, yet somehow, their education is costing individually, thousands of dollars more.

Labour is not working.

Back To Black Responsibly

New Zealand First promises to work with like-minded thinkers to introduce a mini-Budget before Christmas.

We cannot keep spending like this. We’ll end up a south-seas Venezuela.

New Zealand First’s fiscal strategy, instead, is to establish a spending cap for 2024/25 and to focus meanwhile on the essential basics.

For Total Government Expenses this cap would be $165bn while Core Government Expenses would be capped at $133bn.

This is more than the government spend in 2022/23, last year, but a lot less than the kitchen sink Mr Robertson projects for 2024/25, where under Labour, total government spending would soar by over $19bn more.

Using Treasury projections, though the Met Service may be better at forecasting these days, means New Zealand First’s fiscal strategy will begin returning New Zealand to the significant surpluses, we need, to start paying down debt.

Doing this takes the heat off interest rates and inflation and is the single biggest thing responsible government must do to ease the cost-of-living burden.

In 2020 when we were last in government, total public borrowing was $153bn, but under Labour alone that’s grown to a forecast $275bn in 2024/25 – up a staggering $122bn under Labour governing alone. Labour’s debt is almost equal to a third of the New Zealand economy.

It is just not sustainable. That is why we need a mini-Budget before Christmas 2023.

And when we do get to surplus, we can ease the tax burden on hard working Kiwis.

That is being honest and being fiscally responsible.

Where We Will Start First

We will reduce the core public service through redundancy or reassignment packages, not harsh “sackings”, and provision for this. All Ministries will have a focus on productivity.

We will work in government to light a fire under unnecessary regulations to rapidly grow the Kiwi economy and get government out of the way.

We will soon announce the details of an independent and state-owned Infrastructure Body whose purpose will be the provision of public infrastructure. It will not include BlackRock.

We Cannot Keep Going Like This. To Be Green, You Need To Be In The Black

The effects of either Labour’s economic vandalism or tax cuts at any cost will be borne by you. This is why New Zealand First is doing the responsible thing.

We must balance the budget, get the economy growing, start paying down debt and then legislate for overdue tax relief in this term.

New Zealand First voted with a past Labour Government to index tax rates that the John Key government then repealed.

Now, in 2023, this Labour Government opposes indexation while National thinks it is a great idea. One party here is consistent. That party is New Zealand First.

My message to anyone with a mortgage. Anyone with an overdraft and anyone with debt, is this. Your costs must come down, but they can’t if government borrows to fund tax cuts that’ll keep your interest rates high as well as inflation, making food and power more expensive.

In 2020, when we were last at the Cabinet Table, it was projected that by 2024 the annual cost of paying public debt would be $2.4bn. A lot of money but manageable given we were amid Covid-19.

In last week’s Pre-Election and Fiscal Update, the cost of servicing this debt, paying the interest, will be $9.1bn before hitting almost $10bn in 2024/25.

In 1064 days of hard labour between PREFU’s, the cost of just servicing “our” debt has increased by $6.7bn. More than a quarter of what’s spent on hospitals. Over a billion more than what we’ll spend training apprentices, engineers, and doctors.

By 2024/25 Debt Servicing, if it was a Ministry, would be the sixth largest.

Again, the best thing we can do as a Party and in government to solve the cost-of-living crisis, is to make government live within its means.

Experience Also Tells Us There Will Be Nasties When The Books Are Really Open

In 1990, an incoming National Government discovered that the $89m budget surplus was in fact a $3.2bn deficit.

And legislative attempts at fiscal transparency does not allay New Zealand First’s suspicion that billions more in fiscal costs will be found after the next election is over.

Again, within an hour of this speech there is going to be a debate between the political parties that the media, under MMP, still think are the only parties that matter in this campaign. Both of those parties are riddled with inexperience, as evidenced by the promises they have made, before the PREFU of 12 September, and maintain after the 12 September, when their eyes should be wide open.

New Zealand First’s mission and commitment is to bring balance, experience, and common sense into hopefully an “adults in the room economic crisis resolution”.