Table of Contents

David Seymour

ACT Party Leader

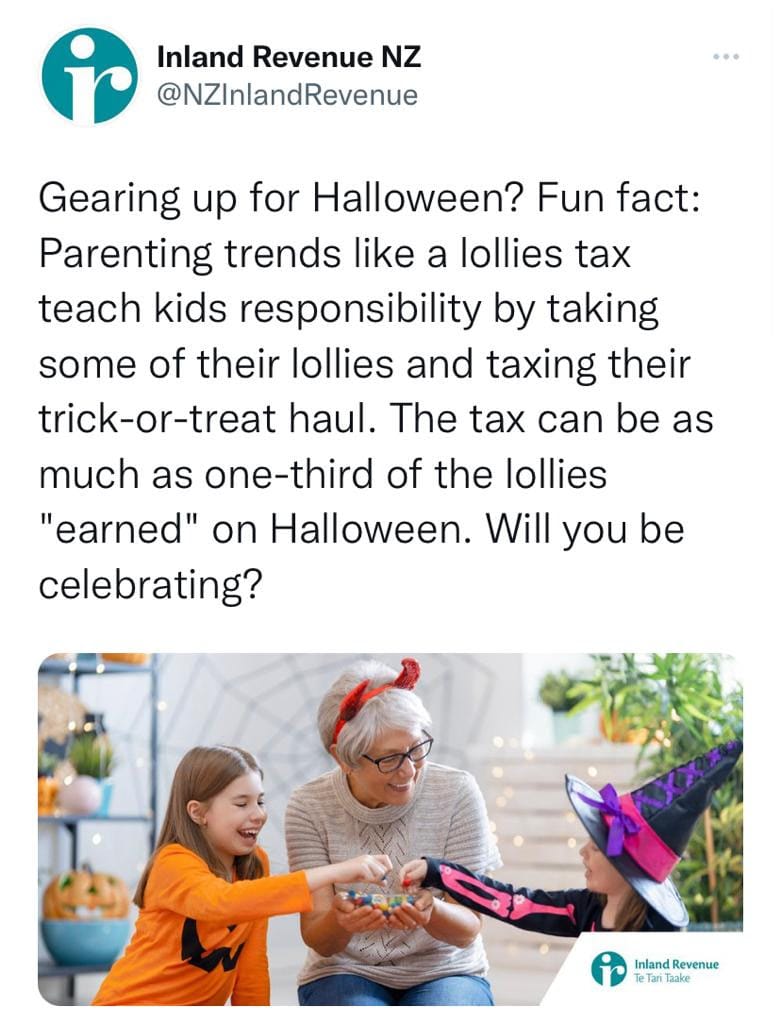

The spookiest thing this Halloween was a glimpse into the mind of an IRD tax collector. In a now deleted social media post, New Zealanders got to see the culture the government is setting for its departments, tax everything you can, even kids’ lollies.

The Tweet from Inland Revenue posted yesterday read “Gearing up for Halloween? Fun Fact: Parenting trends like a lollies tax teach kids responsibility by taking some of their lollies and taxing their trick-or-treat haul. The tax can be as much as one-third of the lollies “earned” on Halloween. Will you be celebrating?”

It might seem like a light-hearted post to some, but it gives us a glimpse into the attitude of this government and the culture that has been set for its departments. Never reward anyone, not even kids on Halloween – just take, take, take.

With the tax-take up 10.7 per cent in the past year, even higher than record inflation on 7.3 per cent. Taking peoples’ stuff might be a fun trick for the IRD but for Kiwis facing a cost of living crisis, grabby Grant and his out of control spending are no joke.

This just shows how incredibly out-of-touch Wellington bureaucrats are. They believe responsibility means New Zealanders paying the taxes they need to survive. Real responsibility happens when people get up every morning to go to work to provide goods and services for their fellow citizens and to create new wealth and opportunities.

Parents can teach their kids about taxes under Labour by taking one-third of the lollies “earned” on Halloween and then throwing half of them in the waste bin.

ACT would let Kiwis keep more of what they earn, whether it’s lollies or dollars.

ACT’s Alternative Budget for Real Change would reduce expenditure by a net $5.7 billion in its first year, and tax by $3.3 billion for a $2.4 billion lower deficit than Labour proposes with its budget.

It introduces more tax cuts when affordable in its second year, delivering a surplus in 2024/25 as forecast by Labour’s budget and $7 billion less debt over the four year forecast period.

ACT’s alternative budget would also deliver someone on a middle income, say a nurse with one child earning $70,000 a tax cut of $2,303 per year in year one. That is the kind of relief New Zealanders need in the face of out of control Government spending.

We would set a culture of rewards for hard work, rather than punishment, which is what this government seems intent on.