Table of Contents

A standing ovation for National for proposing the concept that we should keep more of our hard-earned cash. While National’s tax policy stands alone for being sensible compared with others (with the exception of ACT), we are nailed every time and the average citizen is crucified by taxation no matter which way they look. Personal taxation is a very small part of it (remember Ardern’s promise of no new taxes?). Look at how much she’s taken by stealth under a different name.

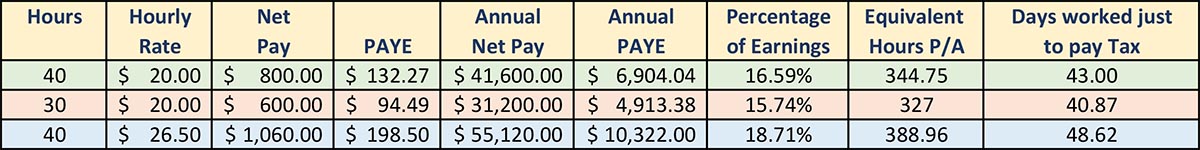

Governments have for years cunningly added to their tax take in various ways without calling it tax, and we in the suckersphere have politely and mildly accepted it. And the list is endless. From PAYE (which makes us slaves to the government for pretty much one day of each week as we work for no pay so it can go directly into the government coffers) to GST, tariffs, assorted levies, land transport fees and of course speeding fees, which are not strictly speaking ‘taxes’ but in reality they actually are. You know it, I know it, the cops know it, the politicians know it. Yet all of them deny it. Speeding isn’t anything like the problem they make it out to be. It is government revenue gathering and therefore a form of penalty tax – a fee for going faster than they said we should. No problem for the well off but crucifixion for the poor (as usual).

I’m no expert on taxation and I’m mindful of a time many years ago when Sir Bob Jones referred to it as “legalized theft”. I agreed with him then and I agree with him even more now. Last week I wrote about how useless democracy really is and how it throws up many issues in an anything but democratic way. We can happily add taxation to the list.

The concept that all citizens pay a ‘what one can afford’ tax in the better interests of our society, looks like a very reasonable, even sensible position. Except that our much-lauded democracy doesn’t provide us with any say in how much, how often, how it’s spent or what the priorities might be.

It’s all well and good to say we get to choose every three years. Unfortunately, with a few notable exceptions, the talent pool is bereft of talent and we’re too often left to choose between dumb and dumber – spend a lot or spend even more.

Nowhere do I see anybody suggesting we need to cut back on the ‘feelgood’ spending and focus on the ‘essential’.

When will a political leader set a budget before an election and promise to live within their means?

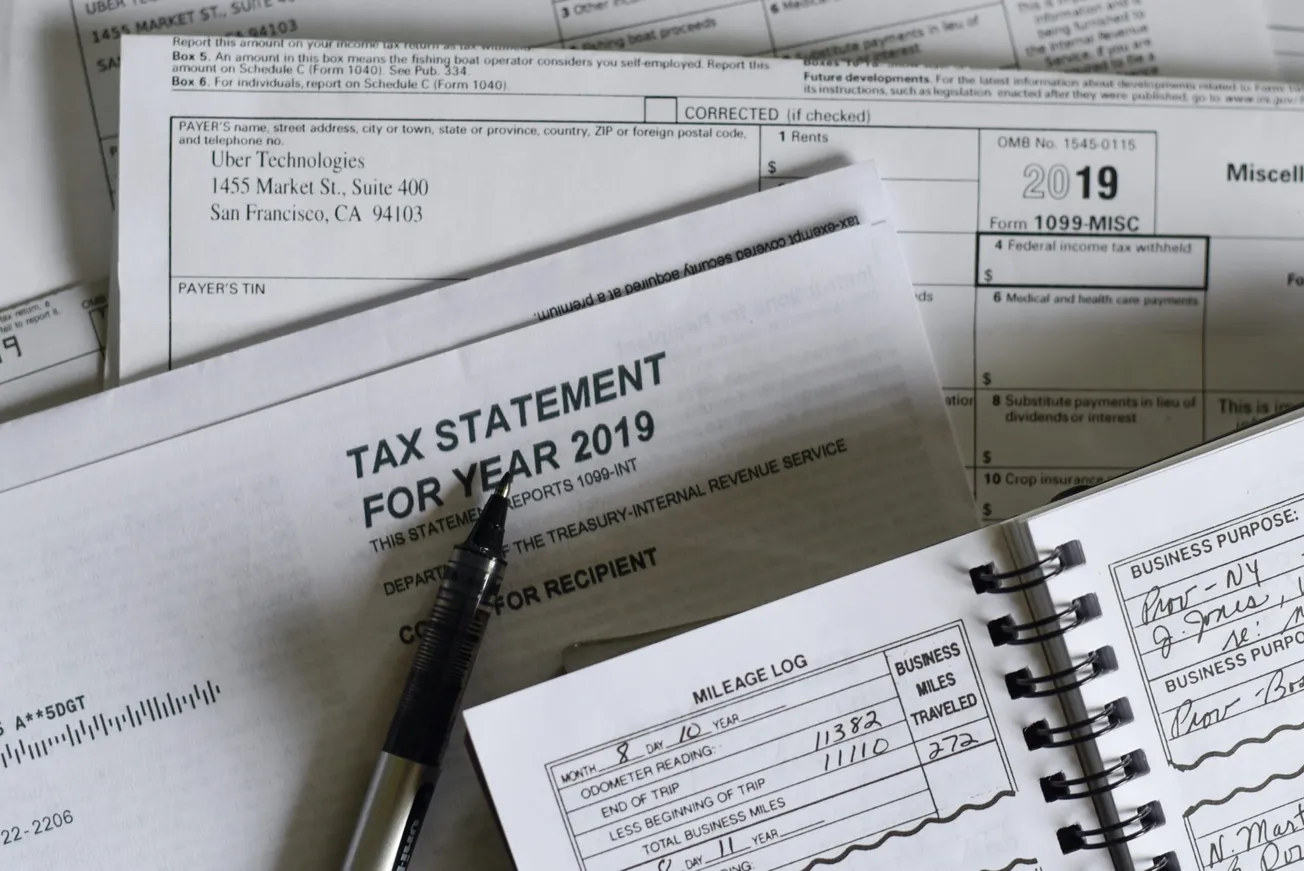

I said above, I’m no tax expert. Let me add to that, I’m no mathematician either but I have tried to calculate what an average lower salary earner might earn and pay in tax and as a result, how many hours/days a year that person spends working to pay their personal tax:

I’m sure this will be a revelation for many. And by the way – none of the other assorted taxes and levies and tariffs mentioned above are included – you’ll have to add those on yourself.

How many days a year are you working as a slave for no pay?

If you enjoyed this BFD article please share it.