Table of Contents

For reasons I have never been able to figure out, this government is determined to destroy private landlords, even though the outcome will be to make life even harder for renters. The latest measures for property investors are the most far-reaching ever. First of all, Grant Robertson has increased the Bright Line Test from 5 years to 10 years, breaking a promise he made before the election that, apart from a new top tax rate of 39%, there would be no new taxes. Then, with a broad sweep, he has cancelled the deductibility of mortgage interest for property investors, starting immediately for properties bought after 27 March, and phased in from 1st October for all other investors.

Please understand that property investment is the only area of business where losses and now interest costs cannot be deducted in the normal way.

If you have a small hobby business, selling stuff on Trademe or selling houseplants, you can offset any interest costs, and offset losses against other income. Only property investors are affected by these new rules.

So let’s just clarify the new interest deductibility rules, or lack of them, from today.

If an investment property is bought after 27 March 2021, there is no loan interest deductibility whatsoever.

If an investment property was bought prior to March 27 2021, interest is fully deductible for the 2021 tax year, through to 30 September 2021.

From 1 October 2021 to 31 March 2023, interest is 75% deductible.

From 1 April 2023 to 31 March 2024, interest is 50% deductible.

From April 1 2024 to 31 March 2025, interest is 25% deductible.

From 1 April 2025, there is no deduction for interest on an investment property.

I understand that the object of this exercise is to try to assist first time buyers into the property market, but in doing so, the government is likely to make life even harder for those who rent. Let’s not pretend for one second that driving out landlords will mean everyone will be able to own their own home. That has never happened in the past, and it won’t happen now. A proportion of the populace, usually about 25% to 30% at the best of times, will always need rental accommodation, and some will simply never own their own homes.

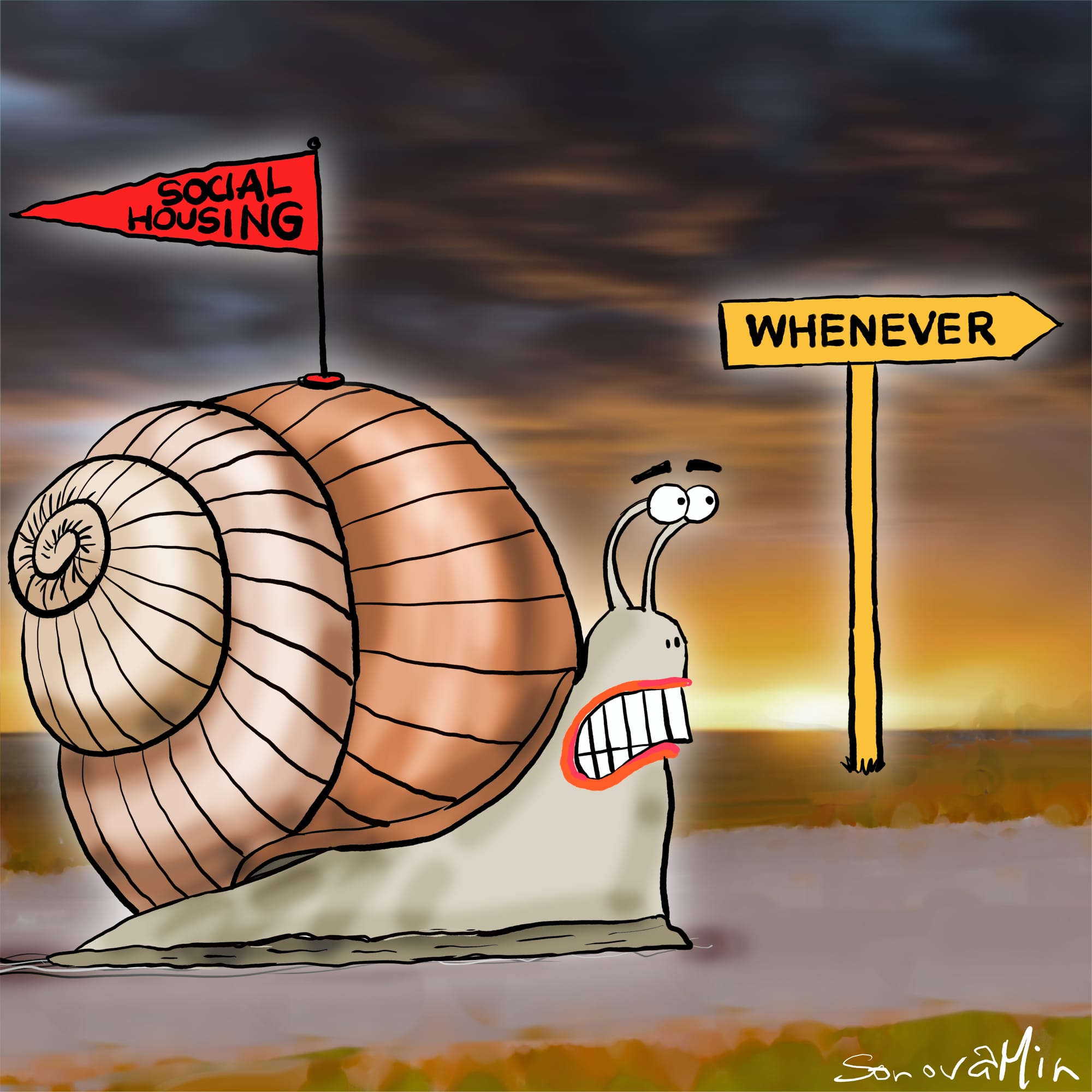

To do this to the private rental market at a time when there are so few rentals and even fewer state houses available, might help a few first-time buyers, but it will cause huge problems for renters and overall will almost certainly increase the homelessness problem. And yes, the government is ramping up its social housing building programme, but even they admitted that this programme is set to be rolled out over the next 20 years. Good luck to those in temporary accommodation in the meantime.

This is not going to fix the housing crisis. This is just another case of the government wanting to be seen to be doing something, rather than actually doing something. Small-time landlords or those who were thinking of selling anyway may exit the market, and their rental houses may be snapped up by first time buyers, but serious landlords, who have been in the game for 10 years or more, know that all that will happen is that rents will increase. Why would they want to exit now?

Don’t forget that if you already own an investment property, you are not affected by the new Bright Line Test. It only affects property bought after 27 March 2021. If you have owned that property for more than 5 years, your capital gain is still tax-free. A lot of landlords will be in that position.

The only way to solve the housing crisis is to increase supply. That means we need more builders. Where are we going to get those from with the entire industry at full capacity and the borders closed? And even if we brought some builders in from overseas, first they have to find a place in MIQ and then they will need somewhere to live.

And on it goes. But hey, let’s tax landlords more. That’ll fix it.

Please share this article with others so they can discover The BFD