Table of Contents

Information

Opinion

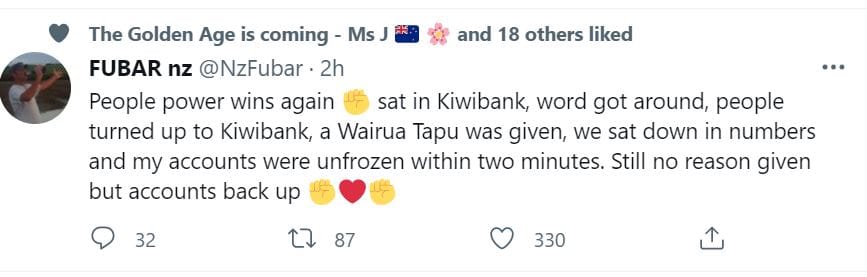

Some of you will have heard about a protester at the Wellington anti-mandates campaign having his bank accounts frozen by Kiwibank without explanation. Here is the tweet that I saw Friday.

We all know that the tyrant Justin Trudeau is doing this to the Canadian truckers, but you must remember that he gave himself special emergency powers to do so. Unless I have been living in a cave, no such powers have been granted here in New Zealand.

Yet…

So what the hell is going on?

There are certain circumstances in which a bank account can be frozen. Primarily, those circumstances are as follows:

- to comply with a court order

- when you have been declared bankrupt

- when there isn’t enough money in your account

- when it has been notified of a dispute over either who owns the money in the account or who has use of the account

- to protect either one or all parties to the account, the bank or a third party with a reasonable claim to an interest in the account.

Bank accounts are sometimes frozen during a dispute, for example, a matrimonial dispute, but normally, that would only apply to any joint accounts. Money can also be seized by the police as proceeds of crime, but a conviction is required before this can be done.

The only other circumstance where bank accounts can be frozen is if the bank suspects that you are a party to money laundering and are falling foul of the AML rules introduced in 2018. So, if you get a letter from your bank asking about your residency status, best to answer it correctly or your accounts might be frozen.

The Anti Money Laundering (AML) rules are extremely far-reaching and are imposed globally. For example, accountants and lawyers are required to report any activity that they consider may be ‘suspicious’ on the part of their clients. This does not just include the transfer of large sums of money; someone who has saved $20 cash per week and wants to buy a $4,000 car might find themselves under scrutiny as well and if for some reason, you do end up with a large amount of cash, it is very difficult to dispose of it. The bank won’t touch it, lawyers will report it and in general, you will find it difficult to spend it.

These rules, as usual, only disrupt the lives of honest people, as it is quite clear that somehow, the gangs get around these rules quite successfully.

So the next question is this:

Can the bank just freeze your accounts because you are exercising your right to protest and have been delivered a trespass notice?

No. The bank cannot do that. There is no dispute, there are no proceeds of crime and there are no circumstances that can possibly justify such action.

Contrary to popular belief, the IRD cannot just access your bank accounts either, even if you owe money. Normally, IRD will try to organise an arrangement to pay off taxes, of which you are a ‘willing’ party. If that fails, they normally then approach your employer and make an order on your wages, which the employer is required to observe. The same thing happens with court fines, but again, you will know about such orders as you will normally have been a party to the negotiations or processes that brought you to this place.

IRD can approach your bank and ask for funds to be withdrawn, but they are required to inform you of any such action. In any case, none of these actions results in accounts being frozen; it is simply the recovery of money owed in tax or fines.

But what do we think happened in Fubar’s case?

I think the clue might be in the word – Donations. It seems that people are making donations into Fubar’s account (or one that he operates on behalf of the protesters possibly). If there are large amounts of money being deposited or irregular activity, the bank is required, under the AML rules, to take action. In this case, they have the right to freeze the account(s) and ask for an explanation as to the source of the funds deposited.

I am speculating, of course, but I think this may be what has happened in this case. Here is another tweet, posted about an hour after the first one.

Kiwibank has backed down and unfrozen the bank accounts. It may have been that Kiwibank simply needed clarification as to the source of the funds, and once they were assured of their legitimacy, the accounts were unfrozen and all’s well that ends well.

I have to say that I do not think Kiwibank handled this well, as they should have made an effort to contact Fubar and let him know what was happening. This matter could have been resolved by a simple phone call but that call was not made.

As I said, this is speculation, but I am not aware of the government giving itself emergency powers to freeze the bank accounts of individuals. With the tyranny and treachery going on in the world at the moment though, I wouldn’t be surprised if our government takes steps to give themselves such powers fairly soon. Then that would be yet another indelible right that we have lost. But no. It hasn’t happened yet.

All of this makes the argument for using more cash fairly strong… but we are in a circular argument here. If you have too much cash, you may find yourself under scrutiny for breaching the AML rules… and on it goes. We may be losing freedoms hand over fist at the moment, but to be fair, as the AML rules show, a lot of our freedoms have already been taken away. And none of us has seen it coming.