Table of Contents

Transport Minister Michael Wood needs to urgently clarify who will be exposed to his Car Tax, National’s Transport spokesperson David Bennett says.

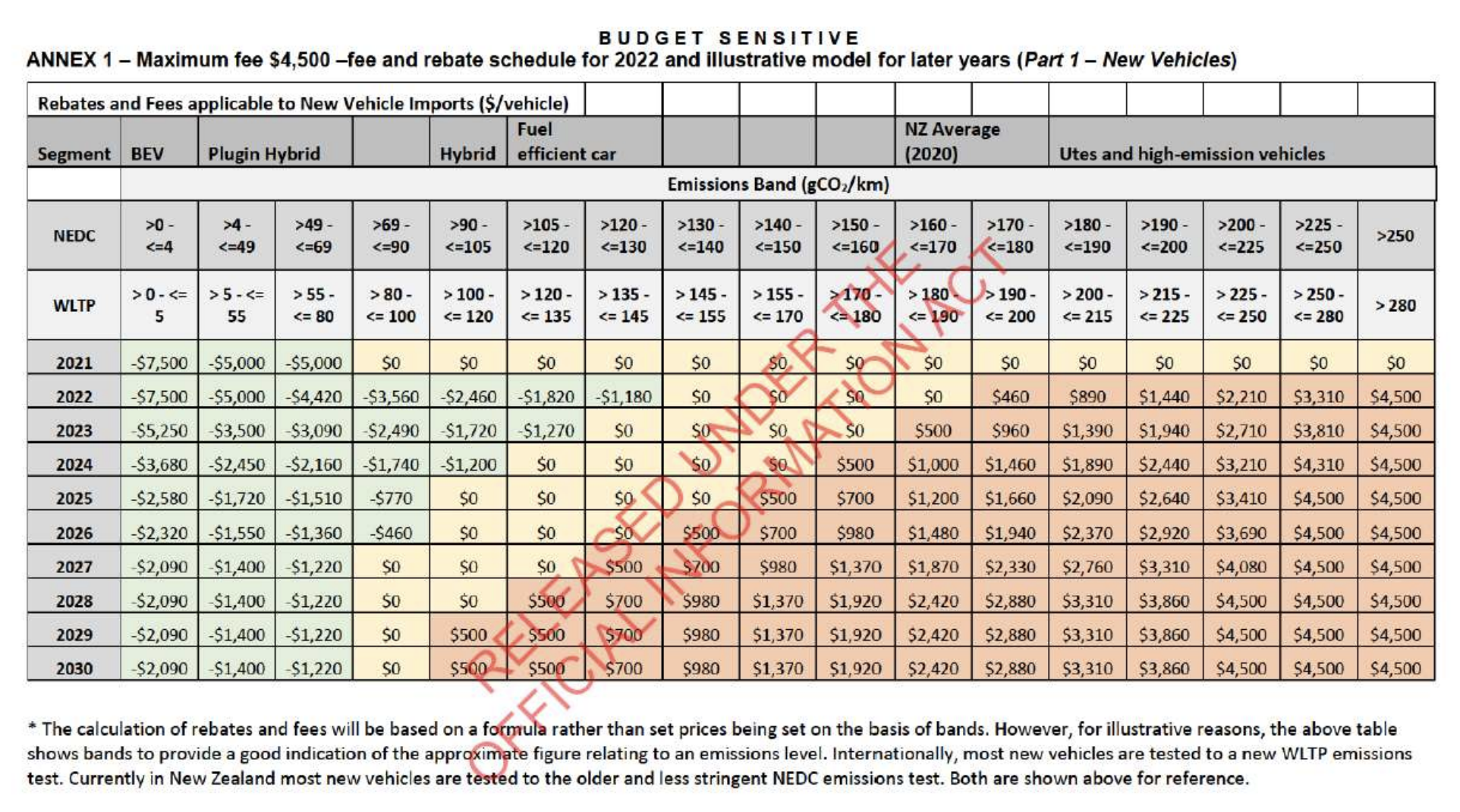

“When Minister Wood launched his Car Tax he said it would focus on the highest emitting vehicles. But he also took a paper to Cabinet showing that he intended to phase the tax in so by 2028 it would apply to a car as efficient as a 2021 Suzuki Swift.

“Answering on his behalf Minister James Shaw said he stood by that decision.

“Mr Wood must come clean to New Zealanders and make it clear that his plan is to tax almost all petrol cars in the country. His tax won’t simply apply to utes and vans.

“Earlier this year the Government released a list of cars that would be taxed under its policy, but clearly that detail is now out of date because the Minister has shifted the method for calculating greenhouse gas emissions on cars.

“Now, just a few months before this tax is supposed to take effect, car importers don’t know how much tax each car will pay.

“It is not good enough for the Minister to say it is consumers not importers who have to pay these fees, importers will still need to tell buyers what taxes they will have to pay.

“The Motor Industry Association estimates that the Minister’s car policies will push up the cost of cars by 15 to 20 per cent.

“New Zealand imports around $5 billion of cars a year, meaning Labour is pushing through a billion dollar tax increase at a time Kiwis can least afford it.

“Labour must axe its punitive Car Tax.”

A table outlining what cars will be taxed and when is attached.

Please share this BFD article so others can discover The BFD.